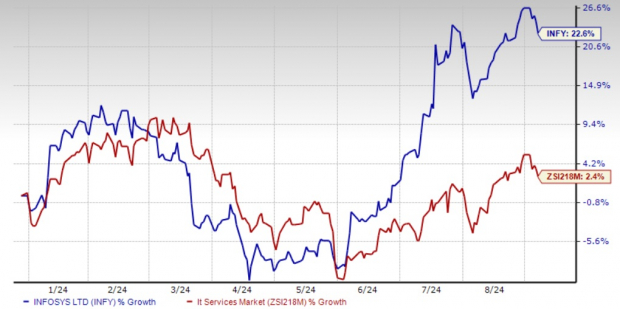

Infosys INFY has seen a remarkable return of 22.6% year-to-date, surpassing the Computer IT Services industry’s growth of 2.4%. This substantial outperformance is a testament to investors’ unwavering faith in the company, a confidence bolstered by a consistent inflow of projects.

Infosys recently unveiled the FT Money Machine app in partnership with the Financial Times. The app pays homage to the Monetary National Income Analogue Computer, an iconic hydraulic analog computer from 1949.

Backed by the London School of Economics and Cambridge University, FT Money Machine will be accessible in Apple AAPL Stores, offering users an immersive experience in extended reality through Apple Vision Pro.

With the Apple Vision Pro, users can simulate economic scenarios using gestures, eye tracking, and voice commands in a free play mode. Collaborating with WongDoody, Infosys and FT have endeavored to breathe life into the world of economics with this innovative application.

Infosys Year-to-Date Performance

Image Source: Zacks Investment Research

Client Expansion Propels INFY’s Growth Trajectory

In fiscal 2025, Infosys has forged strategic alliances with industry leaders like NVIDIA NVDA, ServiceNow NOW, Nihon Chouzai, and Telstra, to provide cutting-edge solutions across AI, healthcare, and telecommunications sectors.

Collaborating with NVIDIA, Infosys integrated INFY’s Topaz with NVDA’s NIMs to introduce TOSCA Network Service Design, an AI-powered networking center that leverages generative AI and Infosys Cortex. Additionally, the partnership with ServiceNow led to the creation of a solution combining the Now Platform and Infosys Enterprise Service Management café to enhance enterprise business services.

In the first quarter of fiscal 2025, INFY inked deals for 34 major projects totaling $4.1 billion. These deals span retail, communication, EURS, Financial Services, Manufacturing, Hi-Tech, and Life Sciences sectors, showcasing Infosys’ robust digital business, now constituting around 62% of its revenues.

Final Thoughts

INFY’s consistent project wins and expanding partner network set the stage for significant top-line growth. With a Zacks Rank #2 (Buy) rating, current market conditions suggest it may be an opportune time to consider investing in Infosys stock.

7 Top Stocks for the Upcoming Month

Recently revealed: Seasoned experts have curated a list featuring the 7 best stocks from a pool of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.”

Since 1988, this exclusive lineup has outperformed the market by over 2 times, boasting an average yearly gain of +23.7%. Don’t miss out on these prime opportunities.