Following the recent earnings reports from major tech companies, it is evident that Apple (NASDAQ: AAPL) stands as the outlier in the group. A key reason for this is Apple’s apparent reluctance to adopt and introduce AI-centric products.

Instead, Apple seems to be sticking to its traditional sales-focused strategy. But the question remains, is this approach viable in an era dominated by artificial intelligence, or should shareholders start to worry?

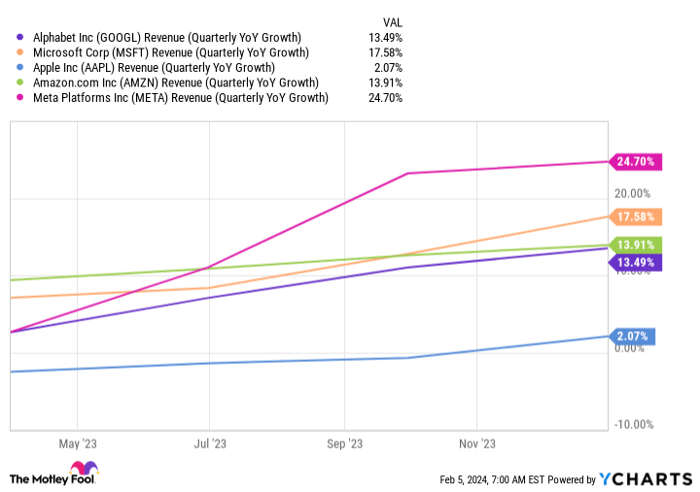

Apple’s Lagging Growth Compared to Peers

Apple’s revenue growth has consistently trailed behind its counterparts in the big tech industry. In its most recent quarter, the company reported a mere 2% increment in revenue, signifying a sluggish expansion. Although there was a slight improvement from its negative growth in previous quarters, the 5.9% rise in iPhone sales, which constitute nearly 60% of Apple’s total revenue, is insufficient for a company aiming to beat the market.

However, Apple’s services segment, encompassing advertising, cloud services, digital content, and the App Store, exhibited more promising performance, with revenue growth at 11% and a gross margin of 73% compared to the hardware division’s 0.05% revenue growth and 39% gross margin.

With its higher-margin services business advancing faster than its other sectors and negligible increases in operating expenses, Apple recorded a 16% growth in earnings per share, although it continues to lag behind several other companies, Amazon being a notable one.

The Absence of AI in Apple’s Current Investment Strategy

As other tech companies begin to witness the impact of AI on their financials, it’s becoming increasingly clear that AI integration holds profound significance in the evolving investment landscape. Apple, however, is yet to incorporate AI into its core business model, relying primarily on three factors to drive growth: continual product upgrades, a burgeoning services division, and the potential success of the Apple Vision Pro headset.

While not inherently a flawed strategy, setbacks in product upgrades, coupled with the considerable entry price of the Apple Vision Pro headset, pose challenges. Incorporating AI into its products could potentially revive Apple’s standing as a top-tier tech company, yet the current absence of this initiative places Apple at a disadvantage.

However, dismissing Apple as complacent would be imprudent; the company’s track record of delivering meticulously developed products suggests that Apple may already be formulating its AI integration strategy, keeping investors in suspense.

Nonetheless, the current state of affairs renders Apple an overpriced stock, trading at 29 times earnings with comparably slower growth and an absence of a robust AI strategy. With other companies exhibiting superior growth, a more robust AI approach, and more attractive stock prices, the allure of investing in those companies overshadows Apple’s current position. Nevertheless, this narrative could swiftly change with innovative product announcements or a resurgence in its core business activities.

Despite the present scenario, it’s crucial for investors to monitor Apple’s strategy closely, as well as any potential developments, before drawing definitive conclusions about its future prospects.

*Stock Advisor returns as of February 6, 2024