The Journey of AMD Over the Last Decade

For nearly 50 years, the trajectory of Advanced Micro Devices (NASDAQ: AMD) was akin to a sluggish stream, overshadowed by the behemoth Intel. Investors who braved the storm through the years finally saw hope take shape in 2014 when Lisa Su stepped in as CEO. Under her guidance, AMD transformed into a force to be reckoned with, leaving Intel struggling in its wake. Su’s focus on CPUs and GPUs propelled AMD to the forefront of the semiconductor industry.

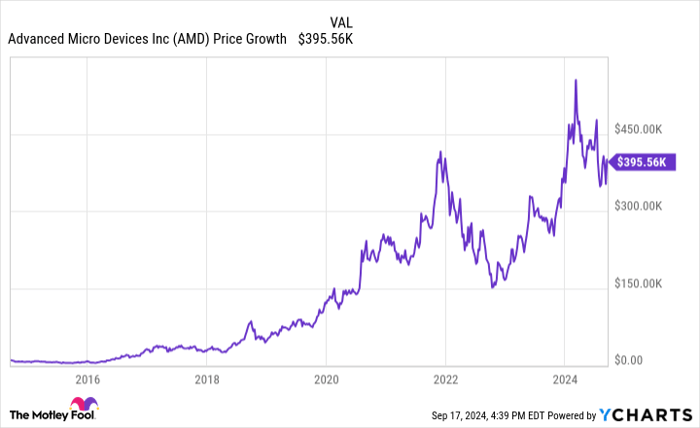

Those who dared to invest $10,000 in AMD a decade ago would now be sitting on a staggering $395,000. A decision that once seemed precarious blossomed into a tale of resilience and reward.

Back in the day when AMD shares were a modest $3.80 each, that $10,000 investment would have secured 2,631 shares. However, the road to riches was not a smooth one. Investor optimism was tested as the stock nosedived below $2, a nerve-racking experience for those who embarked on this journey. The long wait for Epyc and Ryzen chips to hit the market felt endless.

Yet, as the release date drew near, a glimmer of hope emerged in 2017. Investors who had shown faith back in 2014 started reaping the rewards, marking a turning point in AMD’s fortunes.

With a foray into gaming consoles, PC markets, and a strategic acquisition of Xilinx, AMD’s popularity surged among customers and investors alike. The stock’s ascendancy became a beacon of success, weathering occasional setbacks with unwavering resilience.

Today, as AMD sets its sights on the AI accelerator market, the future looks even more promising. Considering the projected 38% compound annual growth rate in the AI chip market until 2032, the horizon seems boundless for AMD investors.

Is Now the Time to Invest in Advanced Micro Devices?

Contemplating an investment in Advanced Micro Devices warrants caution and consideration. While the Motley Fool Stock Advisor team has unearthed the 10 best stocks poised for substantial returns, AMD did not make the cut. These selected stocks hold the potential to yield substantial profits in the years to come.

Reflecting on history, when Nvidia found a place on this esteemed list in April 2005, those who heeded the call saw a mere $1,000 grow to an astounding $694,743. Stock Advisor offers a roadmap to prosperity, featuring expert insights, portfolio-building strategies, and two new stock picks monthly. The service has outperformed the S&P 500 by a significant margin since its inception in 2002.

If the past is any indication, potential investors must tread carefully. While past performance does not guarantee future results, the saga of AMD bears testimony to the unpredictable yet rewarding nature of the stock market.