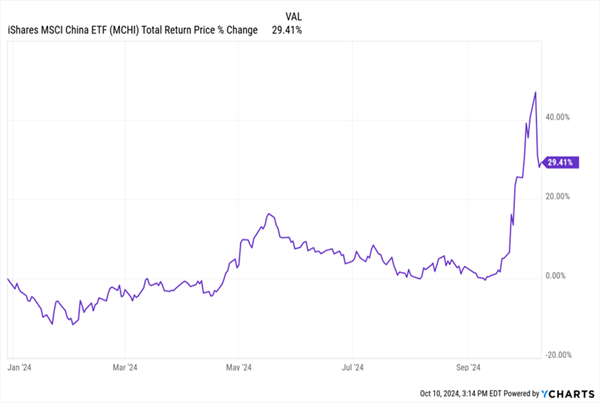

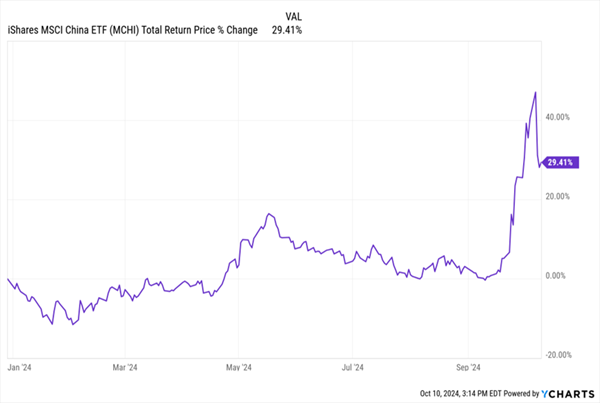

As we gaze upon the chart displayed below, the initial assumption might sway towards the recent performance of a tech titan like NVIDIA or a biopharmaceutical entity basking in the glory of a ground-breaking treatment:

A Non-Tech Narrative—The “Bland” Index Fund Saga

But reality betrays the assumption. The chart in focus is that of the iShares MSCI China ETF, meticulously tracking the ebbs and flows of the Chinese stock market, soaring to its zenith early last week.

The meteoric rise owes its existence to the unveiled stimulus package by the Chinese Communist Party.

The lucrative gains have captivated not only the interest of Chinese day traders and speculators but also the attention of Western counterparts. However, as is custom with China’s economic maneuvers, a fog of uncertainty looms large, with the Chinese government divulging scant details about the forthcoming actions. This lack of transparency culminated in a late-week reversal that merely dented, not obliterated, the bullish sentiment.

So how can us amateurs exploit this scenario? The seemingly straightforward approach involves investing in Chinese stocks. Alas! A substantial risk lurks amidst this play, given that foreign investors are restricted from a direct foray.

Alternative routes exist, such as purchasing shares in US-listed entities like Alibaba. But, this maneuver amplifies the risk quotient, considering that such stocks merely offer a mirage of ownership in Chinese establishments.

This revelation might seem bewildering to those aloof from the Chinese stock market realm. Interestingly, Alibaba and its US-listed Chinese peers are intricately linked to entities termed “variable interest entities,” domiciled in the Cayman Islands. Hence, acquiring shares in Alibaba isn’t just a wager on Chinese stimulus but also on the likelihood of Chinese regulators esteeming international law and acknowledging the legitimate rights of foreign investors in Chinese enterprises.

Another portal to venture into this arena is through an ETF like MCHI. An investment in such ETFs delivers a broad exposure to Chinese assets, with the hope of exiting the tumult before the evanescent frenzy dissipates. Nevertheless, MCHI and its ETF brethren are not the sole avenues, nor are they the most viable.

CEF: The Conduit to Navigate China’s Stimulus Charade

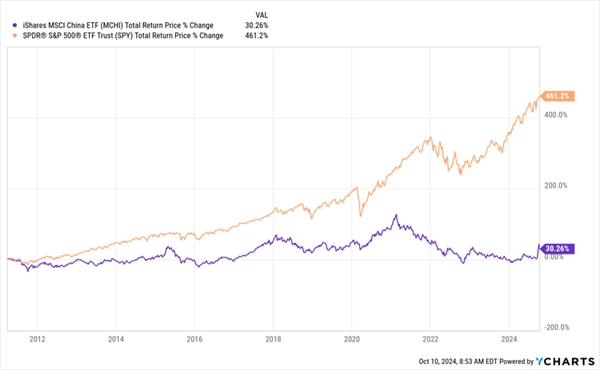

The fundamental snag with Chinese equities unfurls when the short-term bonanzas are juxtaposed against the abysmal long-term performance of the Chinese market. Simply put, it’s been lackluster.

China, the Lagging Contender Against the US Behemoth

Where the US markets yield handsome returns, Chinese stocks pale in comparison, with the former triumphantly overshadowing the latter by a vast margin. An investor plunging $10,000 into US equities in 2011 would relish a whopping $56,120 today, whereas a parallel investment in Chinese stocks would barely scrape past $13,026, leaving a tantalizing $40,000 on the table.

The pivotal lesson emanates loud and clear—if you covet a piece of this whirlwind, make a swift exit, else you risk forsaking hefty gains in other pastures.

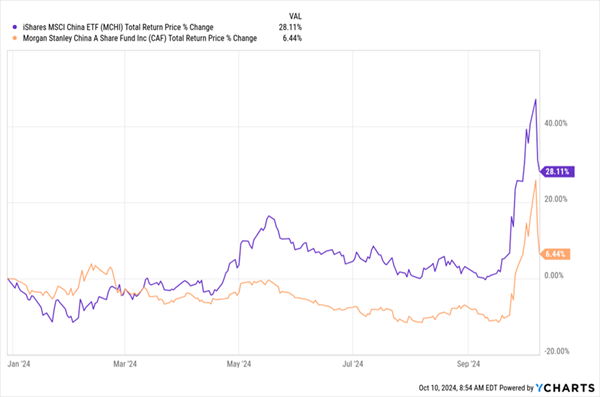

However, if the ardor to partake persists, MCHI isn’t the optimal conduit. To dissect this anomaly, let’s delve into the world of the Morgan Stanley China A Share Fund, a closed-end fund (CEF) analogous to MCHI, nestled within the realm of Chinese companies.

CAF: Trailing the Laggards (Presently)

Evidently, CAF is underperforming MCHI in the ongoing year, accentuated by the significant downturn following the zenith discussed at the outset, a downturn more pronounced for CAF vis-a-vis the ETF. The question that naturally arises is—why should an investor seeking to capitalize on the Chinese stimulus package opt for CAF?

The answer is embedded in the question itself. While the frenzy propelled MCHI, the premier ETF by market cap shadowing the Chinese stock market, its ripples are yet to touch smaller, lesser-known Chinese funds. Considering CAF, with a mere market cap of $275 million, approximately one-twentieth of MCHI’s size, it will likely remain hidden amidst the fervor of the Chinese stock market for a considerable duration.

Such a notion might appear speculative. But beyond its sluggish performance, the discount to net asset value (NAV, i.e., the worth of CAF’s underlying portfolio) alludes to:

A Deep Seated Bargain Elevates CAF Above its ETF Kin

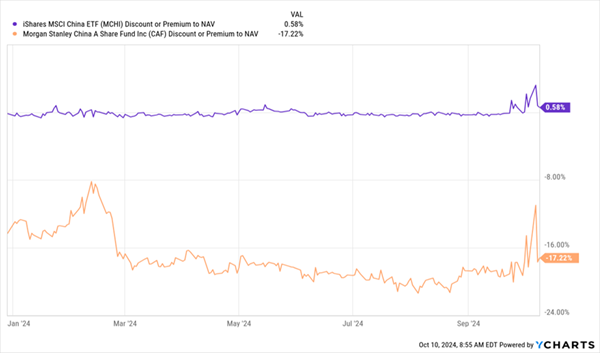

Commencing with the purple trajectory displayed above: MCHI is trading at a 0.6% premium to NAV at the current juncture, a deviation that shouldn’t normally endure. Typically, market mavens gravitate towards selling an ETF commanding a premium and acquiring the underlying assets posthaste, maneuvering an instantaneous profit. Ergo, colossal index funds such as S&P 500 ETFs consistently hover near par.

This premium unearths the arduousness of acquiring bona fide shares in Chinese enterprises, rendering this arbitrage opportunity accessible solely to established investors.

This arbiter should sway more speculators towards CAF, emboldened by its 17.2% discount (disparities to NAV are innate with CEFs, given that their shares remain fixed in number, whilst the asset value they epitomize wavers during trading hours).

Moreover, CAF is presently trading at a comparable discount to its pre-frenzy era. This infers that CAF doesn’t encapsulate the resuscitation driven by the monumental Chinese stimulus, a facet already reflected in MCHI’s pricing.

Embrace the reality that procuring CAF mandates a proactive stance, an unwavering vigilance, and a readiness to vend at the drop of a hat. Such are the tenets of day trading.

The rationale behind favoring a longer-term, dividend-oriented stratagem at my CEF Insider service (alongside downplaying or evading Chinese equities) is evident. Amidst a plethora of CEFs across diverse sectors (and geographies) yield an average of 8%+, abandoning the turbulence and toil of day trading becomes a prudent choice.

Abandoning Chinese Market Timing Hocus-Pocus. Opt for 9.8% Steady Payouts Instead.

CEFs stand as the quintessential cornerstone for erecting a diverse portfolio and an income cascade indispensable to nurture a tranquil lifestyle, whether amidst the throes of retirement or striving towards it.

Enter the fray 4 other CEFs I’m championing today. These stalwarts concoct an outsized 9.8% dividend on average, with a vista of ample upside as their undeserved discounts fade into oblivion.

Embark on a captivating journey through a bespoke investor bulletin unraveling the nuances of CEF investing, spotlighting the colossal yields CEFs proffer, hand in hand with the trajectory of procuring a discounted CEF forging a path towards groundbreaking upside.

This marks a stride towards an untroubled, high-dividend odyssey we covet during these tumultuous (to understate it!) epochs.

Disclosure: Brett Owens and Michael Foster are iconoclastic income investors scouring the undervalued terrains of stocks/funds within the US markets. Embrace the strategies culminating in profits through a recent report, “7 Great Dividend Growth Stocks for a Secure Retirement.”