Nvidia (NASDAQ: NVDA) has been riding a golden wave in the past year. Its stock has skyrocketed, climbing threefold on the back of soaring demand for its artificial intelligence (AI) chips. These remarkable figures have placed Nvidia’s stock at around $680, exceeding the consensus median price target of $650 for the next 12 months, as projected by 53 analysts. However, the Street-high price target for Nvidia stands at a lofty $1,100, suggesting a potential upside of 61% from current levels. Considering the enormity of the milestone and the current trajectory, the question arises: Can Nvidia hit the $1,000 mark, signifying a 47% appreciation? And if so, how soon will it reach that landmark?

High-tech Heavyweights Fuel Insatiable Appetite for Nvidia’s AI Chips

Enormous industry players have been queuing up to acquire Nvidia’s graphics processing units (GPUs) to train large language models (LLMs). Discovering a scarcity of the company’s flagship H100 data center GPU, a wide array of customers, including Meta Platforms, Amazon, Microsoft, and Alphabet, are facing lead times ranging between 36 and 52 weeks for delivery. The surge in demand for AI hardware among tech giants was distinctly communicated during their recent earnings calls and financial outcomes. Meta Platforms, for instance, revised its 2024 capital expenditure forecast upward by $2 billion to a range of $30 billion to $37 billion. Consequently, the magnified investment will be dedicated to servers, encompassing both AI and non-AI hardware, the management disclosed during the earnings conference call. Similarly, Microsoft indicated on its latest earnings call that it anticipates a substantial hike in capital expenditures, driven by investments in cloud and AI infrastructure. Amazon’s management also echoed a forecast of increased infrastructure capex, underscoring additional investments in generative AI and large language models.

Nonetheless, the colossal technology juggernauts are not the sole contestants vying for Nvidia’s AI chips. Nvidia’s CEO Jensen Huang remarked in a Bloomberg Television interview that numerous countries, including Japan, Canada, France, and India, are eyeing investments in AI infrastructure. Furthermore, Nvidia is strategizing to cater to the demand for its chips in China while remaining compliant with U.S. regulatory restrictions. The enterprise is reportedly accepting preorders for the H20 AI processor and other chips tailored for the Chinese market. With all indicators pointing to a sustained uptick in demand for Nvidia’s AI processors in 2024, the company is fervently working towards significantly bolstering the supply of its flagship processor. This concerted effort is anticipated to yield an estimated revenue of $50 billion from the sales of this chip in 2024, underscoring analysts’ sanguine outlook for robust revenue growth in the fiscal year 2025.

Pathway to $1,000: Anticipated Revenue Surge

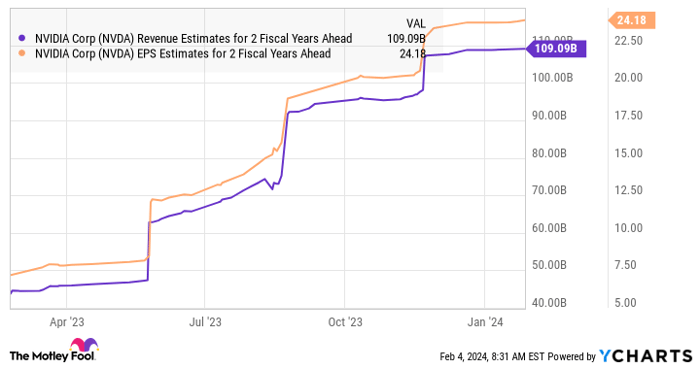

Analysts foresee a 58% revenue surge for Nvidia in fiscal 2025, carrying the estimated revenue to $93.4 billion. The company’s earnings are projected to leap from $12.30 per share in the previous fiscal year to $20.80 in the current fiscal period. Strikingly, Nvidia is poised to maintain its robust growth trajectory in fiscal 2026, based on the consensus forecast.

NVDA Revenue Estimates for 2 Fiscal Years Ahead data by YCharts

Nvidia is currently trading at 37 times sales and 90 times trailing earnings. However, if it is assumed that Nvidia would trade at a discounted 25 times sales by the end of fiscal 2026, enabled by its robust top-line growth to attain $109 billion in revenue, the company’s market capitalization could escalate to $2.72 trillion. This would represent a remarkable 67% surge from current levels. Given Nvidia’s current stock price hovering around $660 and the potential upside it could furnish on the back of its staggering growth trajectory, its shares could command a value of $1,000 apiece in the next couple of years. With such a tantalizing prospect, interested investors should contemplate seizing this AI stock, particularly given its attractive forward multiples.

Is it opportune to invest $1,000 in Nvidia at this juncture?

Before embracing Nvidia’s stock, it is prudent to weigh in:

The Motley Fool Stock Advisor analyst team has recently pinpointed what they consider the

Bypassing the 10 Best Stocks for Now

Investors Scramble for Top-Performing Stocks

Investors are always on the lookout for the next winning stock, and the investment landscape is evolving just as quickly. Amidst the fervor, Stock Advisor has identified 10 potential gems, all primed to deliver stratospheric returns—a prospect that might make even seasoned investors drool with anticipation.

A New-Type of Investment Blueprint

They say hindsight is 20/20, but could there be a crystal-clear strategy for the future? Stock Advisor offers a straightforward way for investors to navigate the complexities of the market. The service features a comprehensible investment roadmap, regular insights from analysts, and two fresh stock recommendations every month. Remarkably, Stock Advisor has outperformed the venerable S&P 500 by over 200% since 2002, a testament to its foresight and acumen.

The Outliers and Ringleaders

Nvidia, a perennial favorite, didn’t make the cut, causing consternation among some seasoned investors. Nevertheless, the selections that did pass muster are shaping up to be true trailblazers in the years to come, hinting at the possibility of a new hierarchy emerging in the boreal forest of the stock market.

The Motley Figures Behind the Scenes

Interestingly, a few illustrious personalities stand behind Stock Advisor—undeniable proof that the service knows a thing or two about snagging the right stock. Suzanne Frey of Alphabet, Randi Zuckerberg formerly of Facebook, and John Mackey, the ex-CEO of Whole Foods Market, are among the composition of the influential members on The Motley Fool’s board. Their presence seems to suggest that Stock Advisor has some substantial weight and the backing of seasoned heavyweights in the corporate arena.

Harsh Chauhan, a notable figure, has abjured any stake in the stocks mentioned. Meanwhile, The Motley Fool has not just endorsed but also positioned itself in favor of Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The publication also maintains a clear-decision policy.