Earnings season is slowly coming to a close, with a significant number of S&P 500 companies already disclosing their quarterly outcomes. The latest addition to this list is the home improvement behemoth, Home Depot (HD), stirring up bullish sentiments in the market. As investors eagerly await the quarterly results of Home Depot’s peer, Lowe’s (LOW), scheduled for August 20th, let’s dissect the current financial narrative.

Examining Home Depot’s Resilient Performance

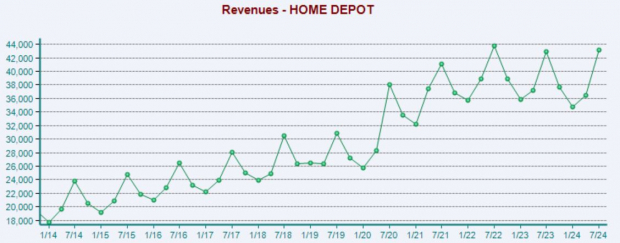

Home Depot (HD) managed to surpass the Zacks Consensus EPS estimate by 2.9% and reported sales that were 1.4% above the consensus numbers. While earnings saw a slight dip compared to the previous year, sales exhibited a modest uptick of 0.6%. The company’s sales growth trajectory has plateaued post-pandemic, signifying a sharp reversal from the initial surge fueled by home improvement projects during the COVID era.

The CEO, Ted Decker, noted the slowdown in project demand but maintained an optimistic stance by emphasizing, ‘The underlying long-term fundamentals supporting home improvement demand are resilient,’

Despite facing margin pressures that impacted profitability, recent trends indicate a gradual shift in the tide, as depicted in the trailing twelve-month chart.

Assessing Lowe’s Projected Deceleration

Expectations for Lowe’s (LOW) earnings have slightly dwindled in recent months but stabilized following Home Depot’s quarterly disclosure. The company is projected to experience a growth slowdown, with earnings anticipated to decline by 13% alongside a 4% reduction in sales.

Like its counterpart HD, Lowe’s has encountered a pullback in demand, with comparable store sales witnessing a 4% drop year-over-year, primarily in big-ticket discretionary items. Given Home Depot’s insights, it is plausible that Lowe’s faced a similar deceleration in big-ticket purchases during the period.

Currently, Lowe’s holds a Zacks Rank #4 (Sell), with a downward shift in earnings expectations over recent months. Investors are advised to remain cautious until positive earnings revisions materialize, potentially triggered by favorable guidance and better-than-expected quarterly figures.

Collating the Insights

Home Depot (HD) recently unveiled its quarterly performance, prompting a mildly positive market reaction. While no significant alarms were raised in the announcement, the slowdown in big-ticket discretionary items poses a notable challenge for the company.

Anticipations are aligned for Lowe’s (LOW) impending revelation on August 20th, as a parallel dip in big-ticket spending is envisaged. Forecasts signal a downtrend for both earnings and revenues vis-a-vis the previous year.