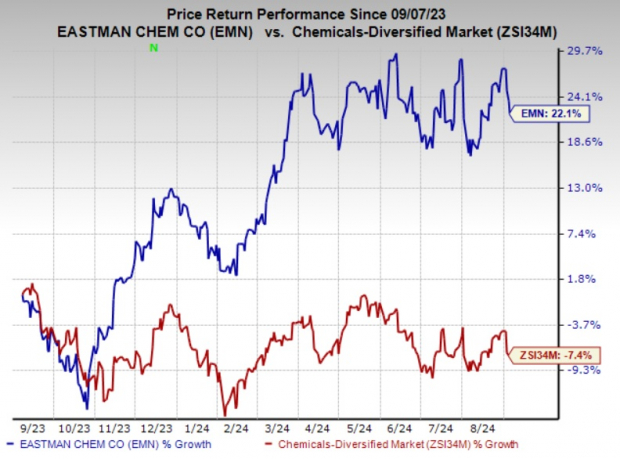

Eastman Chemical Company EMN is making significant strides amidst challenging market dynamics. The company’s sharp focus on cost-cutting initiatives and innovation has paved the way for growth, propelling its stock up by 22.1% over the past year while its industry faced a 7.4% decline.

Image Source: Zacks Investment Research

Let’s delve deeper into why holding onto this Zacks Rank #3 (Hold) stock could be a prudent move in the current landscape.

Cost-Cutting Initiatives & Growth Through Innovation

Eastman’s strategic focus on managing costs is proving fruitful. The company is on track to yield lower operating costs through its operational transformation program, with 2024 poised for enhanced efficiencies.

Not resting on its laurels, EMN continues to keep manufacturing and administrative expenses in check. Achieving $200 million in cost savings in 2023, net of inflation, the company remains committed to sustaining its bottom line through pricing strategies and prudent cost management.

Moreover, Eastman is steering towards new business growth by leveraging its innovation-driven approach. Market development and a robust focus on innovation are expected to drive sales volume across key sectors such as consumer durables, building & construction, and transportation.

Anticipating a further boost in earnings from its Kingsport methanolysis facility in 2024, Eastman is set to enjoy a $50 million incremental EBITDA contribution from this site.

Notably, the company maintains a disciplined capital allocation strategy, with a key focus on reducing debt. In 2023, it returned $526 million to shareholders through dividends and share repurchases, marking the 14th consecutive year of dividend hikes. Eastman plans to repurchase shares worth around $300 million in the current year.

Market Challenges & Future Outlook

Despite its growth trajectory, Eastman Chemical faces headwinds from soft demand in certain sectors. The company is witnessing sluggish demand in building & construction, coupled with restrained consumer behavior in durables and electronics segments. This demand weakness poses a challenge, particularly in the third quarter of 2024.

While navigating through the end of customer inventory de-stocking across most markets, Eastman anticipates continued softness in medical applications in the latter half of 2024. Such softer demand dynamics could impact the company’s performance in the short term.

Exploring Better-Ranked Options

Investors seeking alternatives in the Basic Materials sector may consider exploring better-ranked stocks such as Newmont Corporation NEM, Element Solutions Inc ESI, and Eldorado Gold Corporation EGO, each boasting a Zacks Rank #1 (Strong Buy).

These alternative picks present compelling growth opportunities. For instance, Newmont Corporation’s current-year earnings estimate showcases a substantial rise of 75.2% from the previous year, positioning it as a promising investment prospect.

Similarly, Element Solutions Inc has demonstrated consistent performance, beating earnings estimates while maintaining an upward trajectory. Eldorado Gold Corporation also presents an attractive investment proposition with a strong earnings outlook and notable stock performance.