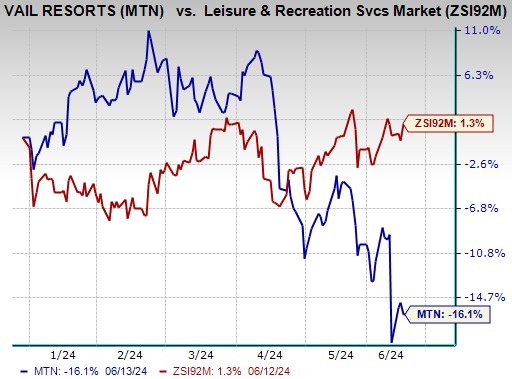

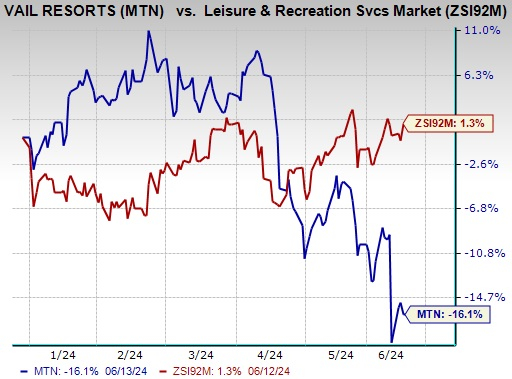

Vail Resorts, Inc. MTN is currently facing a mixed bag of market sentiments. On one end, the company is thriving due to a successful season pass program and strategic business maneuvers aimed at enhancing ski resorts and digital platforms. However, the stock has seen a decline of 16.1% year-to-date, in contrast to the Leisure and Recreation Services industry’s growth of 1.3%.

Despite its proactive strategies, Vail Resorts is grappling with reduced skier visitation patterns, escalating costs, and weather-related impediments. The seasonality of its business places heavy reliance on winter activities, yet the recent fiscal quarter of 2024 failed to yield favorable results.

Image Source: Zacks Investment Research

Let’s take a closer look.

Factors Fueling Growth

Strength in Season Pass Program: Vail Resorts boasts a dynamic season pass program offering a range of products across mountain resorts and urban ski areas in various markets. The company celebrated a significant upsurge in pass product sales for the 2023/2024 North American ski season, marking a 62% increase in units and a 43% rise in sales revenues over the past three years. It also announced a 25% hike in pass product pricing leading up to spring 2024.

Furthermore, the company disclosed positive season pass sales figures for the upcoming 2024/25 North American ski season, showing a 1% increase in sales revenues compared to the same period the previous year.

Strategic Business Moves: Vail Resorts is actively investing in revitalizing its resorts and digital offerings to attract more customers. The company is progressing with planned upgrades at ski resorts, such as new high-speed lifts at various locations to improve guest experience. Additionally, digital advancements like the My Epic app have been introduced to provide guests with personalized statistics, real-time updates, and interactive maps, contributing to an enhanced user experience.

Challenges Affecting Outlook

Declining Visitation Trends: Unfavorable conditions at Vail Resorts’ North American properties have led to dwindling visitor numbers over an extended period. Skier visitation during the 2023/2024 ski season fell by 7.7% compared to the previous year due to a combination of unfavorable conditions and market normalization post-COVID. Notably, lift ticket guest visitation saw a substantial 17% drop year-over-year.

Risks of Weather Dependencies: Vail Resorts faces significant exposure to weather-related uncertainties, especially during the winter season. The company reported a 28% decrease in snowfall across its Western North American resorts for the full winter season, along with inconsistent snowfall and temperature variations at Eastern U.S. resorts.

This weather-related volatility had a direct impact on skier visits and subsequently affected the company’s revenue generation during the period.

Escalating Costs: In response to weather challenges and other operational issues, Vail Resorts has embarked on strategic investments to upgrade its ski properties. These investments include new lift installations, expanded snowmaking systems, and enhancements to digital platforms like the My Epic app. However, these ventures have led to a rise in the company’s operating expenses.

Top Recommendations

For investors seeking alternatives in the Consumer Discretionary sector, here are some top picks:

Strategic Education, Inc. STRA currently holds a Zacks Rank #1 (Strong Buy) with significant earnings surprises and a promising growth trajectory.

Netflix, Inc. NFLX, also carrying a Zacks Rank of 1, is demonstrating notable earnings surprises and remarkable stock performance.

Royal Caribbean Cruises Ltd. RCL, another Zacks Rank 1 stock, has been delivering consistent earnings surprises and substantial market gains.

Presidential election years have traditionally favored market growth. As the market gears up for the upcoming election cycle, investors may find potential opportunities in carefully selected stocks.