Strategic Expansion Continues to Propel Hyatt (H) Performance

Hyatt Hotels Corporation has strategically positioned itself for growth through an asset-light business model and aggressive expansion plans in both established and emerging markets. The company’s recent focus on forming key partnerships has further enhanced its market presence and profitability.

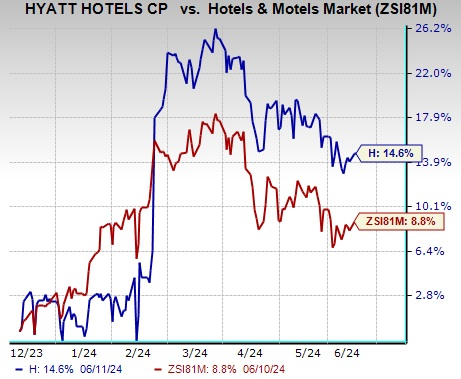

Market Performance and Positive Outlook

Hyatt’s stock has shown commendable performance over the past six months, outperforming the industry average. This success can be attributed to increasing demand in both leisure and business travel sectors, particularly from Greater China. Analysts remain bullish on Hyatt’s future prospects, with an expected earnings growth rate of 17.1% year over year for the second quarter of 2024.

Driving Forces Behind Hyatt’s Success

Asset-Light Business Model: A significant shift towards an asset-light strategy has proven fruitful for Hyatt. By selling off owned properties and focusing on management agreements, the company has significantly boosted its earnings and reduced risks associated with real estate ownership.

Footprint Expansion Plans: Hyatt’s aggressive expansion initiatives in key global markets continue to support its growth trajectory. The addition of new properties and strategic collaborations have solidified the company’s market presence, leading to increased market share and improved business performance.

Accretive Partnerships: In addition to organic growth, Hyatt is actively engaging in partnerships to diversify its portfolio and explore new avenues for revenue generation. Recent collaborations, such as the joint venture with Kiraku, demonstrate Hyatt’s commitment to enhancing its offerings and market reach.

Economic Factors and Challenges

Despite its positive outlook, Hyatt faces challenges such as rising costs and macroeconomic uncertainties. Inflationary pressures and geopolitical disruptions pose risks to the company’s profitability, requiring careful navigation in an unpredictable market environment.

Key Recommendations for Investors

Investors seeking opportunities in the consumer discretionary sector may consider potential market movers such as Strategic Education, Inc., Netflix, Inc., and Royal Caribbean Cruises Ltd. These companies exhibit strong growth potential and are well-positioned to capitalize on evolving market trends.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Revolutionizing Portfolios: Profiling Unprecedented Stock Performances

Everything was so different in 2006. The distinctive ringtone of a flip phone, the frenzied songs of JibJab’s political parodies, perhaps even a smattering of synchronized dance moves courtesy of the young, vibrant performers emerging from shows like “So You Think You Can Dance.” Amidst this era of transition and possibility, who would have forecasted just how profoundly the landscape of stocks and investing would evolve? Fast forward to today, where revolutionary feats are being achieved by companies that stand proudly against the backdrop of a similarly transformative era.

Medical Marvels: A Growth Beyond Compare

From the ashes of tumultuous market fluctuations emerged a titan of medical manufacturing, astonishingly delivering returns that defy conventional wisdom. Over the span of 15 years, this entity has managed to accrue an unprecedented surge of +11,000%, a feat that echoes through the corridors of Wall Street history with resounding significance. Such unmatched growth stands as a testament to the enduring vigor and adaptability inherent in the heart of the stock market.

Thriving Amidst Turmoil: The Rental Revolution

Amidst the ebb and flow of market values, one company in the realm of rentals stands as a stalwart victor, claiming the mantle of excellence in its sector. As competitors falter and trends shift, this entity charts a course of unparalleled success, positioning itself as a beacon of prosperity amidst the tumultuous seas of financial uncertainty.

Powering Growth: The Energy Dynamo

In a bid to cement its dominance in the realm of energy, a veritable powerhouse has set its sights on an ambitious trajectory. With plans to elevate its already generous dividend by an awe-inspiring 25%, this entity showcases a remarkable commitment to growth and prosperity, setting the stage for a future steeped in promise and potential.

Reaching New Heights: The Aerospace Innovator

Breaking through the stratosphere of traditional expectations, an aerospace and defense juggernaut recently secured a monumental contract potentially worth $80 billion. This colossal achievement underscores the resilience and vision of a company standing at the vanguard of innovation, pushing boundaries and redefining the very essence of success within its sector.

Championing Innovation: The Chipmaking Giant

Steering the course of progress toward uncharted horizons, a giant chipmaker has initiated bold moves by establishing expansive plants within the heart of the United States. These grand endeavors reflect a commitment to innovation, growth, and economic revitalization, underscoring the enduring impact of forward-thinking strategies in a rapidly evolving market landscape.