The Era of Apple’s Growth: A Fading Memory?

Once upon a time, owning shares of Apple (NASDAQ: AAPL) was akin to having a golden goose laying eggs of growth and value. Investors basked in the glory of a stock that outshone the S&P 500 with a stellar 300% surge in the past five years.

Apple’s Near-Term Woes Cast a Shadow of Doubt

The lush garden of Apple’s growth is now overshadowed by looming clouds of stagnation. The glory days of the iPhone, once the company’s beacon of light, now face a darkened path. With iPhone sales plummeting by nearly 11% in the second quarter of fiscal year 2024, a sense of foreboding hangs heavy in the air.

The pandemic-fueled surge in laptop and tablet upgrades fizzled out, leaving Apple’s Mac and iPad sales withering. The only glimmer of hope shines from Apple’s services division, yet it remains insufficient to salvage the sinking revenue ship.

Valuation Woes: Apple’s Past Haunts its Present

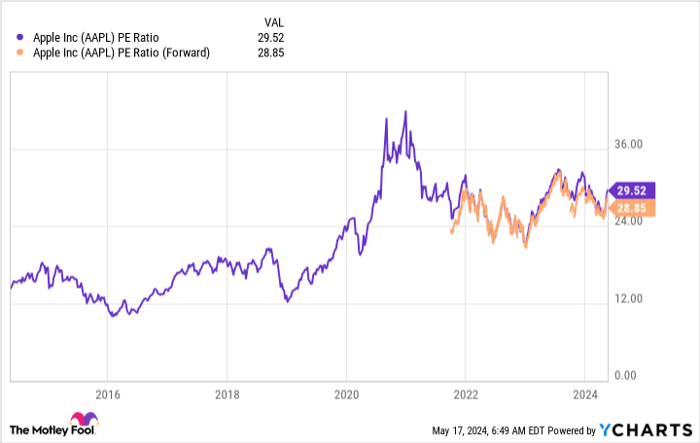

The albatross of a mature company bears down upon Apple, reflected in its price-to-earnings (P/E) ratio mirroring little hope of future growth. Trading at the upper limits of its historical valuation, Apple’s stock defies logic in a landscape where the S&P 500 offers a more favorable valuation.

Investors grapple with a conundrum as they ponder whether the hefty premium demanded by Apple’s stock is justified, given its lackluster growth prospects.

A Bleak Outlook for Apple Stock

Apple, once a darling of growth and value investors, now stands at a crossroads. Its trajectory paints a grim picture, with Wall Street analysts forecasting meager revenue growth ahead. The days of Apple’s glory seem like a distant memory in a market that demands innovation and resilience.

With uncertainty looming over the horizon like a storm cloud, the rationale for investing in Apple appears to be fading like a distant echo.