Microsoft’s Dominance in AI Space

As artificial intelligence (AI) takes center stage on Wall Street, Microsoft (MSFT) emerges as a standout player. Referred to as the “Magnificent 7,” Microsoft has solidified its position in the AI software realm, garnering attention from financial experts at Morgan Stanley.

Morgan Stanley’s analysts, led by Keith Weiss, recently upped Microsoft’s price target to $520, forecasting a remarkable 26% upside potential. This move underscores the faith in Microsoft’s ability to capitalize on AI growth, especially in infrastructure and applications.

A Glimpse at Microsoft Stock

Based in Redmond, Washington, Microsoft is a tech behemoth with a market cap of $3.1 trillion. It is renowned for its dominance in the PC software market and its comprehensive suite of cloud-based solutions through Azure.

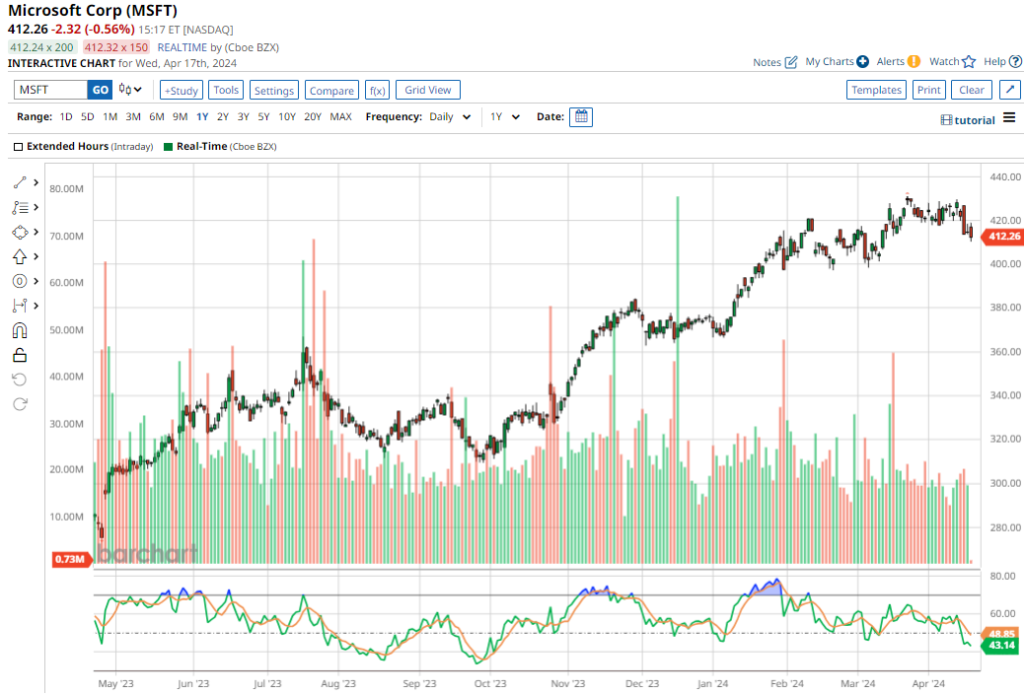

Over the past year, Microsoft shares have surged by 42.6%, outperforming the S&P 500 Index’s return. The company’s track record of paying dividends for 19 consecutive years further solidifies its position in the market.

Microsoft’s Recent Financial Performance

In its fiscal Q2 earnings report, Microsoft revealed earnings of $21.9 billion, surpassing Wall Street estimates by 6.2%. The company’s revenue also grew by 18% year over year to $62 billion, slightly exceeding analysts’ predictions.

Looking ahead, Microsoft anticipates continued growth across various segments, including Azure and Office 365, which are expected to drive revenue in the upcoming quarters.

Analysts’ Outlook on Microsoft Stock

Analysts are bullish on Microsoft stock, with a consensus “Strong Buy” rating. While the average price target suggests a modest upside potential, some analysts are more optimistic, with a street-high target of $600 projected by Truist Securities, indicating a potential rally of up to 45.7% in the long term.