The technological landscape has ushered in the era of artificial intelligence (AI), capturing investors’ attention with tech giants like Nvidia, Super Micro Computer, and Amazon dominating the market.

However, amidst the frenzy, lesser-known growth stocks are emerging as beacons of promise for patient investors, offering substantial returns in due time.

The Resilience of Costco Wholesale

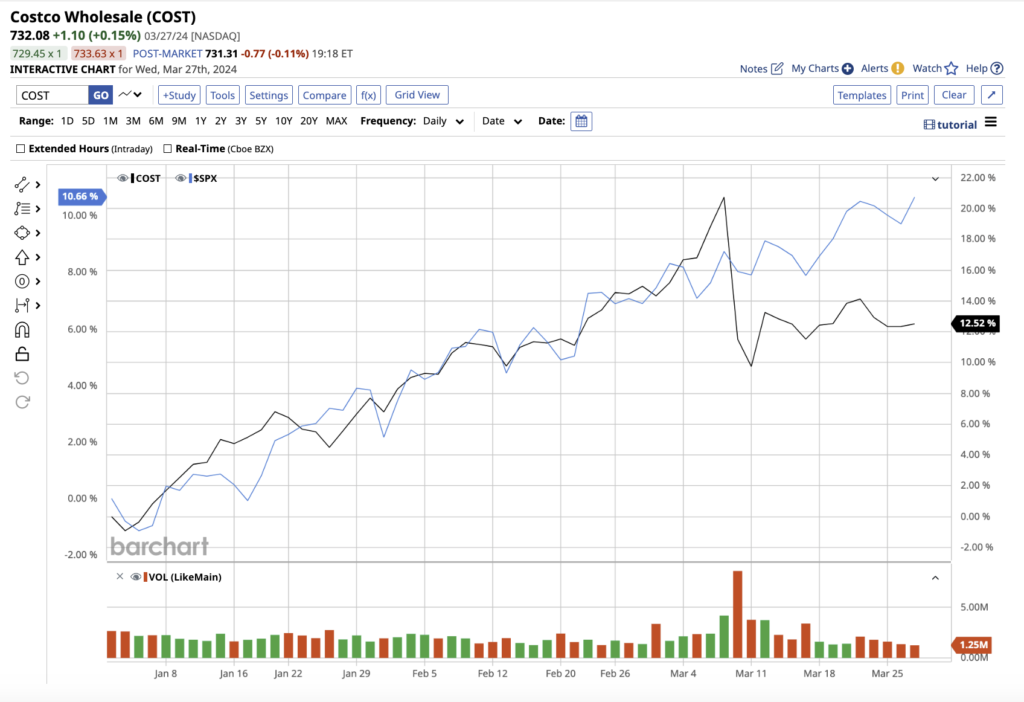

Costco Wholesale (COST), a membership-only retailer, might not shine as brightly as AI stocks, but it has proven to be a stalwart in the face of economic challenges. Over the past decade, Costco’s stock has surged by an impressive 556%, overshadowing the S&P 500’s 180.6% return by a wide margin.

Year-to-date, COST stock has climbed 11%, a testament to the company’s resilience and strategic positioning in the market.

Costco’s membership-based business model has been a key driver of its success, offering bulk products at discounted rates to members while generating steady revenue through membership fees. In the second quarter of fiscal 2024, Costco reported a membership revenue of $1.1 billion, marking an 8.8% increase from the previous year.

With a global presence spanning 875 warehouses and e-commerce platforms worldwide, Costco has diversified its revenue streams and minimized market-specific risks.

Moreover, as a dividend stock boasting a 0.56% yield, Costco stands out with sustainable dividend payments supported by its modest forward payout ratio of 23.5%.

Analysts project Costco’s revenue to grow by 4.9% to $254 billion in fiscal 2024, with earnings expected to rise by 12.4%. Looking ahead to fiscal 2025, further growth of 7.2% in revenue and 9.3% in earnings is anticipated.

While Costco’s forward price-to-earnings ratio might seem steep at 42x compared to Walmart’s 23x, the company’s resilience and diversified revenue streams position it as a stable long-term investment option.

What Analysts Are Saying

Wall Street unanimously backs Costco, rating it a “strong buy.” Of the 19 analysts covering COST, 19 advocate a “strong buy,” with three suggesting a “moderate buy” and seven opting for a “hold.”

The mean price target of $774.58 signals a potential 5.7% upside, while the high target of $905 foreshadows a substantial 23.5% increase over the next 12 months.

Marvell Technology: Riding the Semiconductor Wave

As AI technologies propel the semiconductor industry forward, Marvell Technology (MRVL) stands at the forefront, catering to the increasing demand for AI-related products. From high-performance networking solutions to advanced storage technologies powering cloud computing and 5G connectivity, Marvell’s products play an integral role in shaping the digital landscape.

With a market value of $62 billion, Marvell has surged by 17.5% year-to-date, outperforming the broader market indices.

The Rise and Fall: A Deep Dive into Marvell’s Financial Performance

Marvell’s Meteoric Revenue Climb

Marvell’s total revenue for the fourth quarter of fiscal 2024 surged 1% year-on-year to $1.43 billion, outstripping even the company’s mid-point guidance. This robust performance not only beat Wall Street’s projections but also set a tone of optimism in the volatile financial markets.

The AI Propels Marvell Forward

CEO Matt Murphy illuminated the company’s success by attributing it to the strong growth in the data center end market revenue, which saw a remarkable increase of 38% sequentially and an astonishing 54% year-over-year. The strategic focus on AI technologies bore fruit, propelling Marvell forward in an otherwise challenging landscape.

Forecasting the Future Amidst Uncertainty

Anticipating continued sequential growth in the data center segment, Marvell’s management projects a rocky road ahead. Soft demand in consumer, carrier infrastructure, and enterprise networking sectors might create obstacles in the first quarter of fiscal 2025. However, a turnaround is expected in the latter part of that fiscal year, instilling hope in investors.

Analysts’ Crystal Ball: Glimpse into Marvell’s Stock

Analysts foresee a hazy outlook for fiscal 2025, predicting a slight 3.4% drop in revenue and a more significant 4.9% decline in earnings. Nevertheless, a light shines at the end of the tunnel as Marvell anticipates a substantial 31.9% revenue surge and a staggering 72.5% earnings leap in fiscal 2026. These projections paint a picture of resilience and adaptability in the face of adversity.

The Echoes of Wall Street

Wall Street has been abuzz with praise for Marvell’s stock following its exceptional Q4 results. Stifel Nicolaus analyst Tore Svanberg maintained a bullish “buy” rating on the stock, setting a price target of $86. The overall sentiment on the Street echoes this positivity, with a whopping 25 out of 28 analysts giving MRVL stock a “strong buy” rating, underscoring confidence in Marvell’s future prospects.

The average price target for MRVL stock sits at $87.78, hinting at a significant 23.8% potential upside from current levels. With a high target price set at $100, investors are eyeing a lucrative 41.1% upside in the coming year, beckoning them with promises of greener pastures in the realm of semiconductor investments.