The stock market has seen a steady rise in 2024, with the S&P 500 index already up by close to 8%, setting new highs. This upward trend is fueled by a robust U.S. economy and decreasing inflation, creating a favorable environment for investors seeking growth opportunities.

Twilio’s Tale of Turbulence

Cloud communications specialist Twilio (NYSE: TWLO) may not appear as an obvious choice considering its recent underperformance, shedding 18% of its value over the last year. Despite positive fourth-quarter results that saw a 9% increase in annual revenue to $4.15 billion, Twilio’s lack of full-year guidance for 2024 has left investors apprehensive.

Twilio forecasts challenging times ahead with a meager 2% to 3% revenue growth expected in the current quarter, coupled with a 23% rise in adjusted earnings. While this year may present hurdles, Twilio’s strategic position in the communications-platform-as-a-service industry remains strong.

Currently trading at 2.7 times sales, well below its historical average, Twilio presents an attractive opportunity for long-term investors. The company’s innovative API technology continues to drive its dominance in the CPaaS market, set to expand significantly in the coming years amidst optimistic projections of industry growth.

The Nvidia Narrative

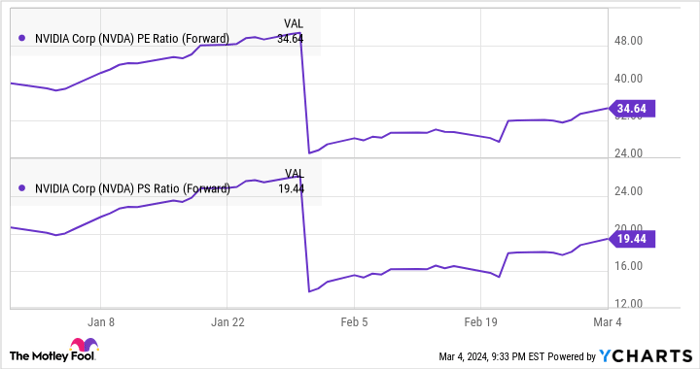

Nvidia (NASDAQ: NVDA), known for its monumental 244% stock surge over the past year, appears expensive at first glance with high multiples. However, closer examination reveals a different story as forward earnings and sales multiples show a downward trend, aligning with the company’s projected strong financial performance.

Analysts anticipate substantial earnings growth for Nvidia, with projections indicating a significant rise in both top and bottom lines in fiscal 2025. The company’s focus on AI chips is expected to catapult it to new revenue heights, with estimates reaching as high as $300 billion by 2027.

With Nvidia’s commanding position in the global AI chip market, holding approximately 90% market share, the prospects for continued expansion remain promising. Coupled with the sector’s overall optimism and AMD’s bullish market forecasts, Nvidia stands poised for remarkable growth in the years to come.

The Rise of Nvidia: A Promising Investment Opportunity in 2024

Nvidia’s Potential Growth in the AI Chip Market

Recent developments suggest Nvidia could be on the cusp of capturing additional niches in the AI chip market, fueling its pursuit of the ambitious revenue target set by Mizuho. This trajectory positions Nvidia as a top growth stock not only for 2024 but also for the foreseeable future. The company’s low forward multiples further sweeten the deal for astute investors.

Nvidia’s Valuation and Earnings Performance

Nvidia’s remarkable earnings growth over the past year has outstripped the rise in its price-to-earnings ratio, underscoring the company’s ability to justify its valuation. The data on Nvidia’s forward P/E ratio chart reinforces the narrative, portraying the stock as a compelling investment opportunity. Savvy investors are urged to consider buying into Nvidia before its value ascends further.

The Case for Investing in Nvidia

While contemplating an investment in Nvidia, it is crucial to heed the counsel of the Motley Fool Stock Advisor team. Their exclusion of Nvidia from the list of top 10 stocks earmarked for substantial future returns underscores the competitive landscape. Nevertheless, Nvidia remains a standout contender, poised to deliver promising gains in the coming years.

The Stock Advisor service not only spells out a roadmap to success for investors but also offers insights into portfolio construction, regular analyst updates, and bi-monthly stock recommendations. With a track record of tripling the returns of the S&P 500 since 2002, the Stock Advisor service embodies a pathway to unparalleled growth potential.