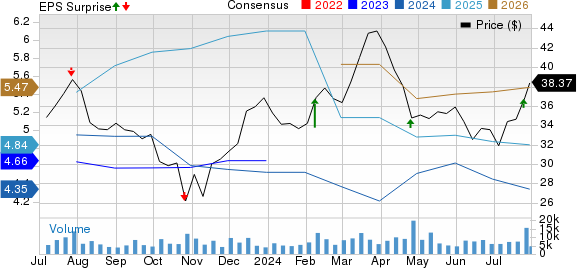

Harley-Davidson, Inc. (HOG) has kickstarted a roaring 13.3% ascent since the company flexed its financial muscle on Jul 25. Propelled by stellar earnings that overachieved expectations, the stock has catapulted skyward, leaving investors beaming with joy. The company’s top and bottom lines notched up remarkable year-over-year growth. To add fuel to the rally, Harley-Davidson also announced a $1 billion share repurchase program stretching out until 2026.

HOG delivered a turbocharged performance in the second quarter of 2024, with adjusted earnings per share hitting $1.63. This remarkable feat not only eclipsed the Zacks Consensus Estimate of $1.43 but also surged a striking 34% from the previous year. The Motorcycles & Related Products segment played a pivotal role in driving this triumph, with higher revenues and operating income stealing the show. Consolidated revenues, including motorcycle sales and financial services revenues, rang in at a resonant $1.62 billion, marking a praiseworthy 12% surge from the comparative quarter.

Surpassing Expectations: The Financial Front

Harley-Davidson Motor Company posted a stellar performance, with total revenues from the Motorcycle and Related Products segment soaring 13% year-over-year to $1.35 billion – a figure that outstripped projections. Global motorcycle shipments revved up by 16% to 49,700 units, outshining estimates, while revenues surged by 20% to $1.07 billion. Operating income for the segment, up 2% to $198 million, outpaced the Zacks Consensus Estimate.

On the flip side, Harley-Davidson Financial Services revved up revenues to $264 million, a noteworthy 10% jump from the prior year. Although operating income climbed 21%, surpassing $71 million, it fell short of expectations.

LiveWire, a key focus for the company, saw a spectacular surge with total shipments hitting 158 units – a staggering 379% leap over the same period last year. Despite a dip in revenues, the operating loss narrowed, hinting at a brighter road ahead.

Bolstering Financial Fortitude

In the financial realm, Harley-Davidson showcased impressive resilience, with improved selling, general, and administrative expenses and shareholder-friendly dividends. Cash and cash equivalents witnessed a robust uptick to $1.85 billion by Jun 30, 2024. Simultaneously, long-term debt embarked on a downward trajectory, shrinking to $4.94 million compared to the preceding year.

Navigating the Road Ahead: 2024 Guidance

Harley-Davidson anticipates a 5-9% dip in revenues from the HDMC segment for 2024. Operating income margin for motorcycles is projected to hover between 10.6% and 11.6%. Financial Services are expected to maintain a steady course, with operating income likely to remain flat or register a moderate 5% increase compared to 2023.