One cannot escape the prominence of artificial intelligence (AI) in modern tech realms, akin to the omnipresent tunes of a summer hit. The trend has ushered in a wave of eager investors looking to ride the AI wave, propelling the stocks of numerous companies entrenched in the AI landscape to unprecedented highs.

While tech juggernauts like Nvidia, Microsoft, and CrowdStrike have basked in the limelight, a silent powerhouse lingers in the shadows, awaiting its deserved acclaim: Taiwan Semiconductor Manufacturing (TSM). Despite a remarkable 65% surge in its stock value this year, TSM is a hidden gem waiting to be unearthed, harboring substantial long-term promise yet to be fully realized.

TSMC: The Keystone of the AI Supply Chain

Standing as the globe’s largest semiconductor foundry, TSMC holds a commanding 61% share of the worldwide semiconductor foundry market as of 2023’s closure. By adopting a foundry model, TSMC customizes semiconductors (chips) to suit individual client specifications rather than mass-producing for generic distribution.

Tracing TSMC’s significance within the AI pipeline necessitates a reverse analysis through a simplified sequence of events. Elaborate AI models, pivotal for operations like natural language processing (e.g., OpenAI’s ChatGPT, Netflix recommendations, and Amazon’s Alexa), rely on copious data volumes to deliver optimal performance. This data payload necessitates storage and processing in data centers, underpinned by cutting-edge AI chips and graphic processing units (GPUs) to function proficiently.

Nvidia predominantly supplies these high-performance AI chips and GPUs, emerging as a primary beneficiary of the burgeoning AI realm. TSMC makes a grand entrance here—fabricating the advanced chips fuelling companies like Nvidia to construct and energize their AI hardware. Some reports estimate TSMC’s contribution to approximately 90% of all AI chip production.

Devoid of TSMC’s chip prowess, the AI conduit would suffer a debilitating blow, particularly given its current expanse.

An Impending Revenue Upsurge for TSMC

TSMC predominantly garners revenue from two primary sources: smartphones (comprising 38% of Q1 revenue) and high-power computing (amassing 46% of revenue).

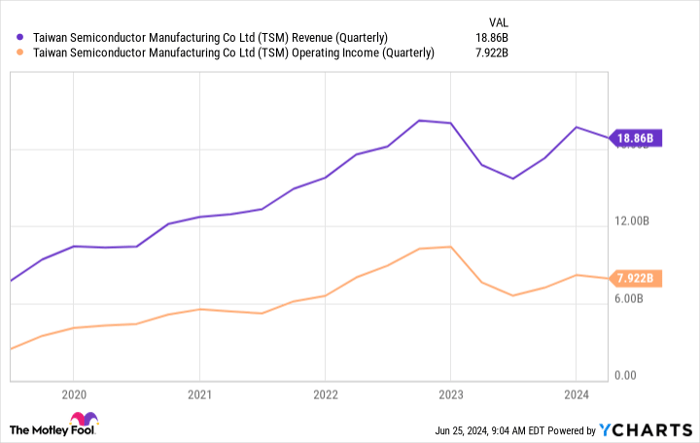

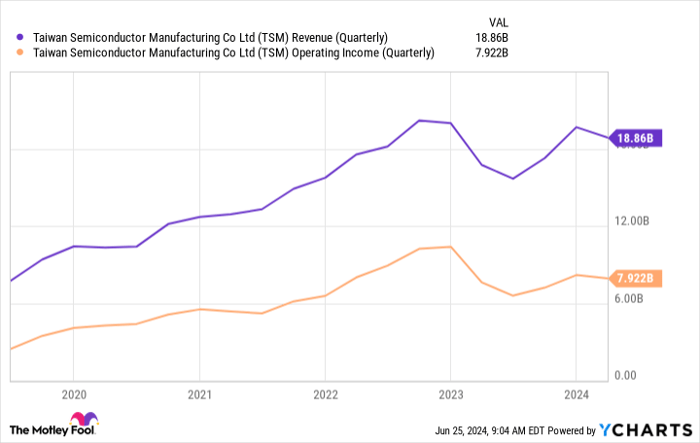

A recent downturn in the global smartphone sphere directly impacted TSMC’s revenue, precipitating a decline in the first half of 2023. Though finishing the year on a high note, TSMC is yet to reclaim the momentum preceding the slump.

TSM Revenue (Quarterly) data by YCharts

Anticipate no longer, for aid approaches on swift wings. In a recent earnings address, TSMC’s CEO prophesied AI-focused revenue doubling this year, constituting a “low-teens percentage” of 2024’s revenue. Of greater intrigue was the bold forecast of a 50% compound annual growth rate (CAGR) for AI-related revenue over the ensuing five years, potentially representing 20% of its total revenue.

While smartphones shall remain a behemoth revenue source for TSMC (with Apple alone forming a substantial revenue chunk), AI chips could present a dual bonanza for the chip giant. Resilient demand arms TSMC with leverage, enabling strategic employment of its market dominance to wield pricing power. This ability to hike prices sans incremental costs could fortify its margins and augment free cash flow.

Treading the Notoriously Pricy Path

Undeniably, TSMC stands undervalued as a corporate entity, yet its stock stands tall amidst pricey metrics. Commanding a price-to-earnings (P/E) ratio nearing 32, the figure looms notably above its five-year historical average.

TSM PE Ratio data by YCharts

Although TSMC’s stock commands a premium, its growth prospects validate the premium paid. The equation transcends AI and its pivotal function within the expanding ecosystem.

Envisage a resurgence in smartphone and PC markets fortifying TSMC’s financial fortitude down the line. Coupled with an above-average dividend yield, investors are handed another compelling rationale to clutch onto TSMC shares long-term.

Contemplating a $1,000 Investment in Taiwan Semiconductor Manufacturing

Before delving into Taiwan Semiconductor Manufacturing shares, deliberate on this:

The Motley Fool Stock Advisor analyst cohort recently pinpointed what they believe holds the utmost.promise.

The Hidden Gems: Unearthed Potential in Stock Markets

Unveiling the Underdogs

When investors search for the promised land of stocks, they often overlook the hidden gems. Emerging from obscurity, lesser-known stocks are frequently passed over in favor of the flashy contenders. But as history has taught us, the underdogs can sometimes surprise us all.

A Glimpse Into the Past

Reflecting back to April 15, 2005, we witness the rise of Nvidia—a stock that soared to unforeseen heights. An initial investment of $1,000 at the time of recommendation blossomed into an astounding $774,526. This historical backdrop serves as a stark reminder of the potential lying dormant within the market.

The Beacon of Stock Advisor

Guiding investors through the turbulent waters of the stock market, Stock Advisor offers a beacon of hope. With a blueprint for success in hand, investors are equipped with the necessary tools to navigate the unpredictable terrain of investment. Providing insightful updates, analysts dissect the market, offering two new stock picks monthly. This invaluable service has outpaced the S&P 500 by more than quadruple since its inception in 2002.

Unearthing Potential

As investors peer into the depths of the market, they are often drawn to familiar giants, overshadowing the hidden gems awaiting discovery. The allure of popular stocks can blindside even the most seasoned investors, but it is in the uncharted territories that true potential lies.