Investor interest in artificial intelligence (AI) stocks surged over the past 18 months, triggered by the groundbreaking release of a vastly improved version of OpenAI’s ChatGPT in November 2022. This event reshaped the landscape and propelled certain stocks to soaring heights while leaving others struggling to keep pace. Amidst perceived setbacks and undervaluations, three AI stocks stand out as enticing opportunities for investors working with a modest $1,000 budget. Let’s delve into the rationale behind the potential profitability of these stocks.

Alphabet: Weathering the Storm

Alphabet, the parent company of Google, has a storied history in the AI realm, dating back to pioneering machine learning for spellcheck in 2001. Despite being recognized as an “AI-first” entity since 2016, recent developments, such as Microsoft’s integration of ChatGPT into Bing search, have raised concerns about Alphabet’s competitive edge in search functions. Additionally, the lukewarm reception of Google Gemini added fuel to the fire of doubt.

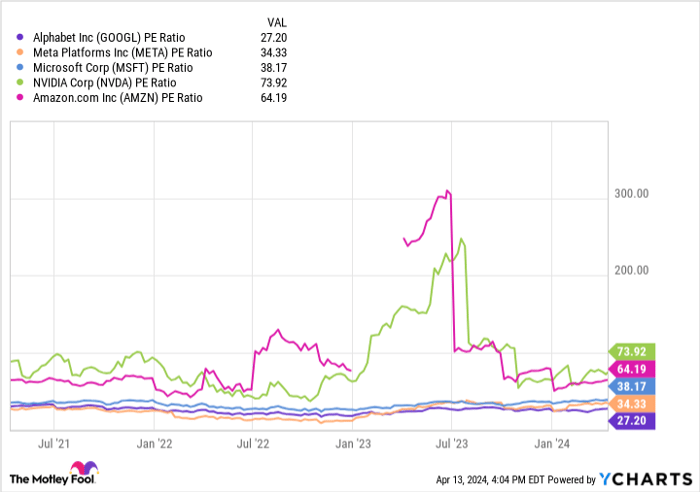

Nonetheless, Alphabet’s strategic consolidation of AI research entities, including Google DeepMind, demonstrates a commitment to maintaining relevance in the AI space. With approximately $111 billion in liquidity, the company possesses ample resources to drive innovation internally or via strategic acquisitions. Currently trading at nearly $160 per share, a modest 50% increase over the past year, Alphabet’s comparatively low price-to-earnings (P/E) ratio of 27 presents a compelling entry point for investors seeking long-term growth amidst temporary uncertainties.

Apple: Unveiling the AI Potential

While Apple may not immediately register as an AI powerhouse, its substantial investments in AI research underpin popular consumer features like Siri, FaceID, and AI-driven functionalities across its product portfolio. Despite a relative lull in groundbreaking product releases, Apple’s focus on growing its Services segment and the upcoming launch of generative AI tools in June hint at forthcoming AI innovations.

With a formidable liquidity reserve of around $173 billion and a P/E ratio of 28, Apple’s shares, priced at approximately $175 each, offer an attractive proposition. Adapting to evolving market dynamics and consumer trends, Apple seeks to leverage AI capabilities for sustained growth, positioning itself as a viable choice for investors eyeing lucrative returns in the AI market.

Alibaba: Navigating Turbulent Waters

Amidst the realm of cost-effective AI stocks, Alibaba emerges as a compelling option with a valuation at just 13 times earnings. Functioning as China’s premier e-commerce behemoth and managing a robust cloud-infrastructure platform akin to Amazon, Alibaba’s value proposition appears enticing. However, concerns surrounding its status as an American depositary receipt (ADR) and the implications of strained U.S.-China relations have dampened investor sentiment.

Trading at approximately $70 per share, a stark decline from its IPO price a decade ago, Alibaba’s perceived risks have led to substantial devaluations. Yet, this downtrend may have overshot fair valuation, potentially setting the stage for a significant rebound should geopolitical factors stabilize. While acknowledging the inherent risks, investors could find Alibaba’s current price point as an opportunistic entry into a stock poised for resurgence.

Conclusion: Unlocking AI Investment Potential

As the AI landscape continues to evolve, discerning investors may find value in overlooked gems within the market. Alphabet’s resilience, Apple’s AI resurgence, and Alibaba’s recalibration present unique investment prospects for those keen on AI-driven growth stories. With prudent analysis and a strategic outlook, allocating $1,000 towards these AI stocks could pave the way for substantial returns in the ever-dynamic world of artificial intelligence investments.

Insightful Stock Recommendations Shake Market Sentiments

The Motley Fool Stock Advisor analyst team has sparked a ripple through the financial world with their latest revelation. In a bold move, they have unearthed what they confidently assert to be the crème de la crème of investment opportunities. However, surprisingly missing from this select group is none other than Alphabet. The 10 chosen stocks are being hailed as the potential architects of monumental returns in the imminent future.

Stock Advisor stands as a lighthouse for investors amidst the turbulent waters of the stock market. It offers a straightforward roadmap to financial triumph, complete with expert advice on constructing a winning portfolio, regular insights from seasoned analysts, and the unveiling of two fresh stock picks every month. Remarkably, the Stock Advisor service has soared past the S&P 500’s performance by a staggering threefold margin since its inception in 2002.

Explore the 10 recommended stocks

*Stock Advisor returns accurate as of April 15, 2024