- Google has recently emerged from a drawn-out consolidation period, indicating a remarkable shift in stock performance following its successful IPO in 2004.

- This recent market upswing hints at a potential milestone of $200 on the horizon.

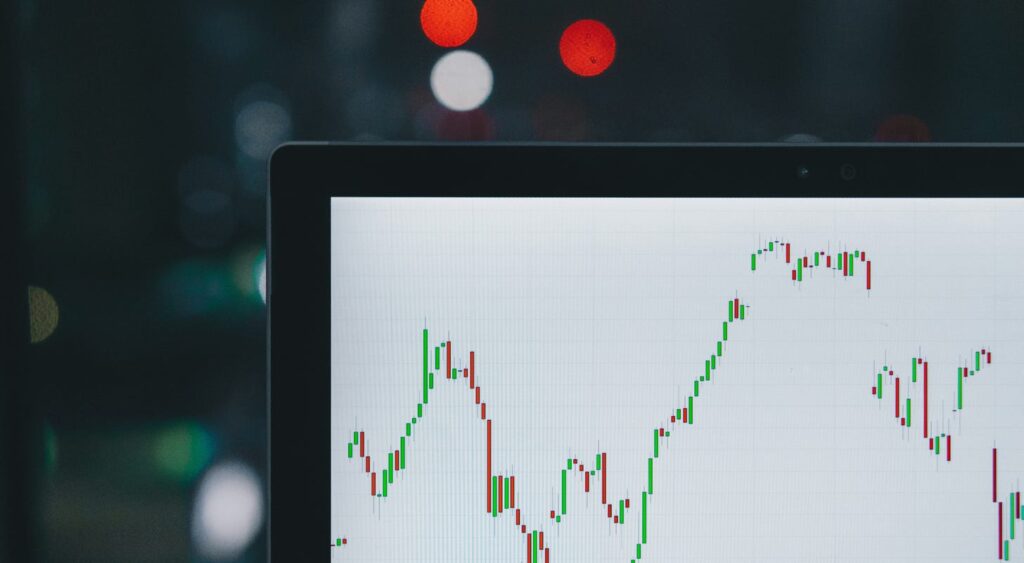

Alphabet Inc Class A GOOGL has surged by 83%, breaking free from an extended phase of consolidation to achieve its second breakout in over two years. This development is particularly noteworthy given its consistent upward trajectory since the landmark IPO in 2004, which saw the stock skyrocket by over 6000%, reaching a pinnacle of $150 in November 2021.

This ascent underscores Google’s enduring innovation and market dominance. However, akin to many premier stocks, Google experienced a slowdown in momentum, leading to a period of consolidation.

Over the past couple of years, the stock meandered between $83 and $150, a phase rife with investor speculation and anticipation. A brief breakout occurred in January 2024, only to see the stock swiftly retreat back into its prior range.

The subsequent decline brought the stock close to its 200-day simple moving average at around $133, a pivotal support level that reignited buying interest and propelled the stock out of inertia.

The current market breakout warrants tempered optimism. Given the inherent capriciousness of the market, dismissing the prospect of a false breakout would be imprudent. Nonetheless, if Google manages to maintain its stock price above recent lows and continues to establish higher lows, it could signal an exit from its protracted consolidation phase.

This could potentially herald the onset of a sustained bullish trend. Looking ahead, should this breakout sustain and a new trend firmly take hold, investors may set their sights on the significant milestone of $200. Not only does this figure pose a considerable psychological barrier, but surpassing it could further solidify Google’s supremacy in the market.

The notion of embarking on another protracted bullish cycle akin to the 17-year stretch prior to the recent consolidation period presents an alluring prospect to investors. Those who steadfastly weathered the recent bouts of volatility and uncertainty could be strategically positioned to capitalize on this emerging trend.

Following the market close on Wednesday, April 3, the stock concluded at $154.92, reflecting a modest 0.23% uptick.