The AI Chip Battle Heats Up

As the AI race intensifies, fueled by the booming generative AI sector, the demand for cutting-edge chips capable of handling massive AI workloads continues to soar. These chips boast robust computing power, enabling seamless training of large language models.

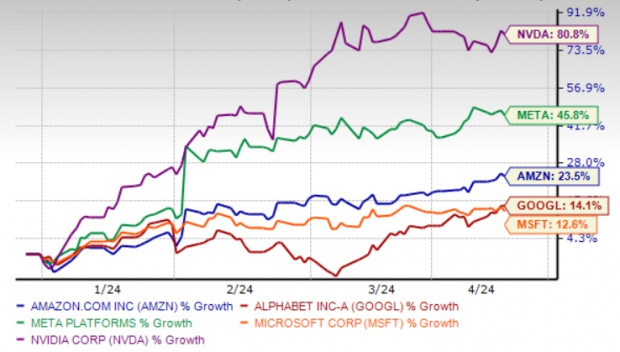

In this landscape, prominent players in the tech industry such as Amazon, Microsoft, Alphabet, and Meta Platforms are venturing into developing AI-specific customized chips in a bid to bolster their position in the competitive AI arena. This move underscores the importance of self-sufficiency in accelerating AI model development, paving the way for advancements in the realm of artificial intelligence.

The Threat to NVIDIA

NVIDIA, currently holding a Zacks Rank #1 (Strong Buy), enjoys strong demand for its cutting-edge AI chips. With a reported market share of over 90% in the AI chips market, NVIDIA’s dominance is clear. However, the foray of tech giants into developing in-house chips to reduce reliance on external chip providers poses a significant threat to NVIDIA, escalating the chip competition in the industry.

If major customers of NVIDIA start producing their chips, the company stands to lose market share, presenting a critical challenge. This concern is compounded by the extended waiting time for NVIDIA’s flagship AI chip, leading to a scarcity in the market. NVIDIA’s production capacity is limited as it depends on Taiwan Semiconductor for chip assembly.

Consequently, AI giants such as Google, Microsoft, Meta, and Amazon are stepping into the arena with their own chips, albeit not as potent as NVIDIA’s offerings. The ability to customize these chips not only helps save costs but also accelerates time-to-market, posing a formidable challenge to NVIDIA’s incumbent position.

AI Chip Showdown: GOOGL, META, MSFT & AMZN

Alphabet’s Google recently upped the ante in the AI race by introducing its Axion central processing unit (CPU) designed to support AI operations in data centers. Axion processors mark Google’s first venture into tailored Arm-based CPUs, delivering superior performance and energy efficiency. These CPUs outperform general-purpose Arm-based instances by up to 30%, showcasing Google’s commitment to driving AI innovation.

Building on this momentum, Meta revealed its next-gen Meta Training and Inference Accelerator (MTIA), a family of customized chips tailored to power Meta’s AI workloads. Boasting enhanced compute and memory bandwidth, MTIA amplifies Meta’s capabilities in generative AI, recommendation systems, and advanced AI research.

Microsoft unveiled Maia 100 and Cobalt 100 chips catering to AI and general computing tasks, respectively. Maia 100, a 5-nanometer TSMC-powered AI accelerator, partners with OpenAI to drive cloud AI workloads. On the other hand, Amazon introduced AWS Trainium2 chips for training and running AI models, offering superior performance and energy efficiency compared to its predecessor.

The Race Continues

Despite the strong foothold NVIDIA holds in the AI chips market, the emergence of in-house chips from tech giants like Google, Microsoft, Meta, and Amazon poses a credible challenge to its market dominance. While NVIDIA’s chips may outshine those of competitors in terms of raw power, the customization and agility offered by these new entrants threaten to reshape the AI chip landscape.

As the battle for AI supremacy unfolds, investors must closely monitor how NVIDIA navigates this evolving competitive landscape while keeping an eye on the innovative strides made by its formidable rivals in the AI chip domain.