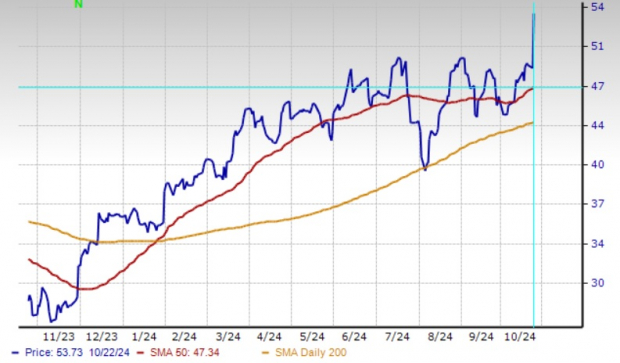

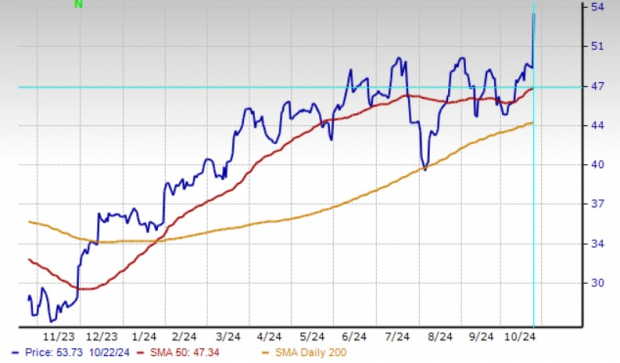

U.S. legacy automaker General Motors GM delivered stellar third-quarter results yesterday, which drove its shares to a 52-week high. The stock rose nearly 10%, marking its biggest daily percentage gain since 2020, as the company outpaced Wall Street’s expectations and raised its full-year 2024 guidance for the third time this year. GM stock is currently trading above its 50 and 200-day moving averages, indicating bullishness. This technical strength reflects positive market perception and confidence in General Motors’ financial health and prospects.

GM Stock Above 50 & 200-Day SMA

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

With the stock at its one-year peak at around $54 now, it’s a good time to dive deeper into the company’s fundamentals to evaluate whether it’s worth holding onto the stock or seizing the opportunity to book profits. Before discussing that, let’s take a closer look at the highlights of GM’s latest quarterly results.

6 Big Takeaways From General Motors’ Q3 Results

EPS & Sales Beat: General Motors posted third-quarter adjusted earnings of $2.96 per share, which topped the Zacks Consensus Estimate of $2.49, marking the ninth consecutive quarterly beat. Revenues of $48.75 billion beat the Zacks Consensus Estimate of $44.29 billion, again marking the ninth straight quarterly beat. The company’s third-quarter earnings and revenues were up 30% and 10.5%, respectively, on a yearly basis.

Stay up-to-date with the quarterly releases: See Zacks Earnings Calendar.

Upbeat 2024 outlook: Buoyed by strong results in the first three quarters of 2024, continued strength in its vehicle demand and disciplined cost management, General Motors lifted its full- year outlook. GM now expects adjusted EBIT in the range of $14-$15 billion, up from $13-$15 billion guided earlier. Adjusted EPS is anticipated in the range of $10-$10.5, up from $9.50-$10, guided earlier. Adjusted automotive free cash flow is expected in the band of $12.5-$13.5 billion, higher than the prior forecast of $9.5-$11.5 billion.

GMNA Strength: GM’s North America division (GMNA), the company’s largest and most profitable segment, continues to shine. Pretax earnings in the region jumped roughly 14% to $4 billion, while revenues climbed 14% to a record $41.2 billion. This success is largely attributed to strong demand for GM’s full-size and midsize pickups, as well as strategic pricing. Notably, pricing was up $900 million compared to the previous year quarter. GM maintains its leadership as the top-selling automaker in the United States, with well-managed inventories and below-average incentives.

China Struggles: GM’s operations in China remain a concern, as the company reported a $137 million equity loss in the region during the September quarter against a $192 million profit in the same period last year. Sales by GM’s joint ventures with SAIC Motor Corp. and Wuling fell 21% to around 426,000 vehicles in the quarter under review, reflecting increased competition from domestic automakers offering lower-priced EVs. While CEO Mary Barra reaffirmed that the company is actively working on restructuring its Chinese operations to reduce inventories and improve sales, the details of its recovery strategy remain limited. The operating environment in China is tough and the automaker has been facing significant challenges in regaining market share amid fierce local competition.

Caution for Q4 Earnings: GM CFO Paul Jacobson advised caution for the fourth quarter. He cited several factors that could weigh on earnings, including seasonality, reduced wholesale volumes for ICE vehicles, and the company’s ongoing shift toward electric vehicles (EVs). Production rates for GM’s highly profitable full-size SUVs are expected to be impacted by downtime due to supply chain disruptions and the transition to refreshed models. Additionally, the holiday season typically reduces production days, further contributing to lower-than-anticipated fourth-quarter results. Higher EV volumes and increased seasonal incentives also pose a challenge to profitability.

Robust Buyback Program: GM continues to prioritize shareholder returns through its stock buyback program. During the third quarter, the company repurchased $1 billion shares, retiring 23 million shares in the process. GM anticipates retiring an additional 25 million shares (associated with its $10 billion accelerated share buyback program) in the fourth quarter of 2024, bringing the total number of shares retired under this program to nearly 250 million. This reflects GM’s ongoing commitment to enhancing shareholder value while maintaining a solid balance sheet. The company ended the third quarter with $40.2 billion in automotive liquidity.

Assessing GM’s Path Forward

GM is strategically positioning itself for long-term growth through a disciplined focus on inventory management, cost control and profitability across both gasoline and EVs. The automaker has maintained strong pricing by keeping inventory levels low and rolling out frequent vehicle redesigns. This approach has bolstered margins of its ICE vehicles. GM aims to make its EVs profitable on an EBIT basis by the end of 2024, with plans to produce approximately 200,000 electric vehicles this year.

On its investor day held earlier this month, the company revealed plans to narrow EV losses by $2 billion to $4 billion next year, highlighting progress in reducing costs and ramping up production efficiency. The company is also on track to meet its $2 billion net cost reduction goal by the end of 2024. Meanwhile, GM’s goal to reduce its outstanding shares below 1 billion by early 2025 reinforces its commitment to driving shareholder value alongside operational growth.

What Should Investors Do With GM Shares?

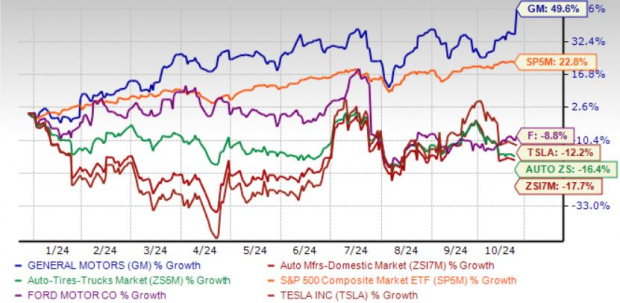

So far in 2024, shares of General Motors have rallied nearly 50%, outperforming the industry, sector and S&P 500. Meanwhile, GM’s closest peer Ford F declined 9% during the same time period. EV giant Tesla TSLA, set to report results today after the closing bell, has lost 12.2% year to date.

YTD Price Performance Comparison

Image Source: Zacks Investment Research

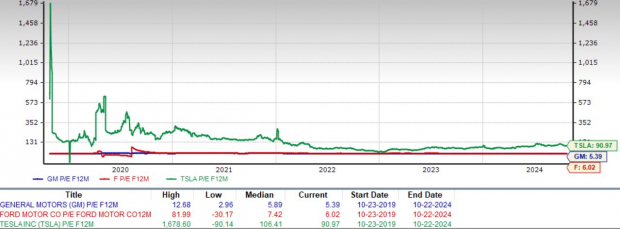

Despite General Motors’ impressive run on the bourses, the stock still trades at just 5.39X forward earnings, lower than its closest peer, F’s 6.02X. Of course, TSLA is trading very expensive at a P/E ratio of 90.97X.

GM is Undervalued

Image Source: Zacks Investment Research

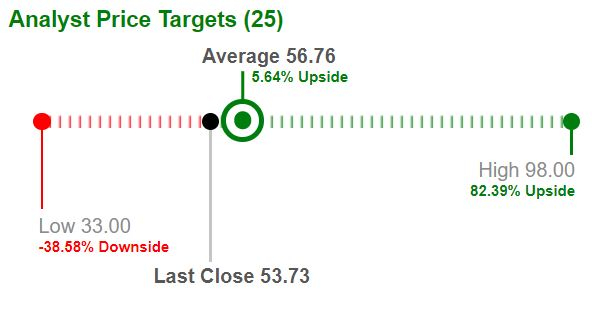

Given General Motors’ value and strong fundamentals, the post-earnings rally in its shares could very well extend further. With Wall Street’s average price target of $56.76, there’s still room for upside. Investors should hold onto their shares to capitalize on the company’s growth drivers rather than cashing out now.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for GM’s 2024 EPS and sales implies a 29% and 3% uptick, respectively, on a year-over-year basis. The stock currently has a Zacks Rank #3 (Hold) and a VGM Score of A. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report