General Motors and Ford are facing a bumpy road ahead this quarter. Both automotive giants are expected to announce reduced profits due to a drop in electric vehicle (EV) demand and the recent fallout from a cyberattack on a critical dealer software system.

Impact on Profits and Cyberattack Ramifications

General Motors anticipates a 7.7% decline in second-quarter net income, while Ford forecasts a 10% reduction, according to LSEG data. The cyberattack targeting CDK Global, a crucial software provider for over 15,000 U.S. car dealerships, struck at a critical sales period. The outage during June, a traditionally strong sales month, resulted in an estimated industry-wide loss of $1 billion, as per Anderson Economic Group.

Hurdles in the Maturing EV Market

Despite heavy investments in EVs, GM and Ford are yet to reap the expected rewards. Sam Fiorani, Vice President at AutoForecast Solutions, noted that established car manufacturers can’t expect instantaneous profits in the EV space. Intense competition from Chinese EV manufacturers and Tesla has sparked a global price war, adding another layer of complexity to the situation.

Revised EV Strategies

In response to these challenges, both GM and Ford are making adjustments to their EV plans. GM recently scaled back its ambitious target of manufacturing one million EVs in North America by 2025. Similarly, Ford has postponed the launch of its new three-row EVs from 2025 to 2027 and redirected its Canadian plant’s focus from EVs to larger gasoline-powered F-Series trucks.

Looking Forward

Despite these setbacks, Evercore ISI analysts maintain optimism regarding GM, expecting the company to meet the upper end of its full-year forecast. Investors eagerly await further details on the automakers’ revised EV strategies and the repercussions of the CDK outage as the companies disclose their results this week.

Investor Sentiment on Ford and General Motors

Analysts have a cautiously optimistic outlook on both Ford and GM stocks, assigning a Moderate Buy consensus rating to both.

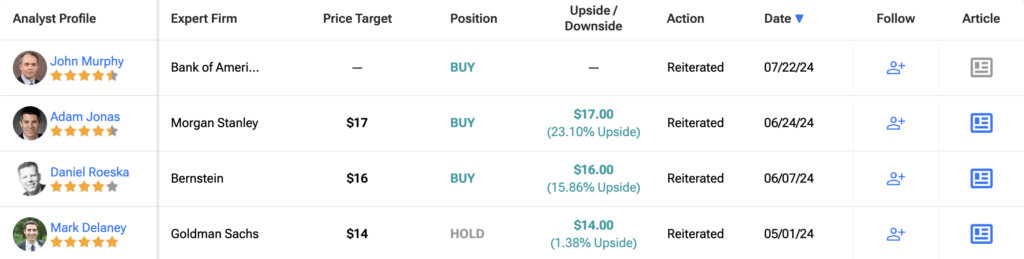

Explore more analyst ratings for Ford here

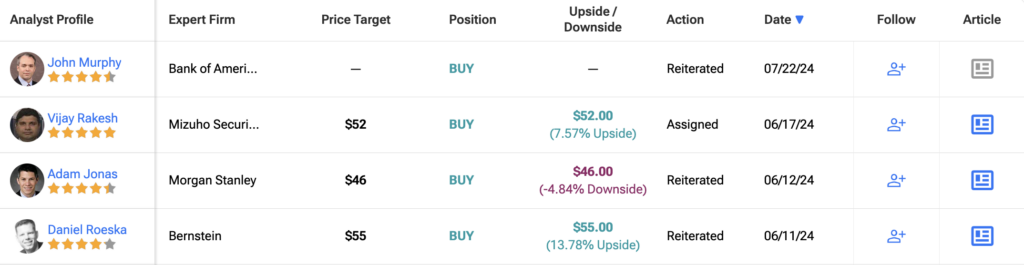

Explore more analyst ratings for General Motors here