Apple stands as the largest investment within Berkshire Hathaway’s portfolio, comprising a staggering 47% of the conglomerate’s investments. Yet, possibilities abound when considering stocks like Amazon (NASDAQ: AMZN) and Visa (NYSE: V) as superior alternatives in the year 2024.

Why Visa and Amazon Outshine Apple

While all three companies are household names and significant players in their respective industries, Visa with its $532 billion market cap, Amazon across various sectors such as e-commerce, cloud computing, and advertising, and Apple in consumer electronics, the resilience of Visa and Amazon’s businesses outshines that of Apple’s.

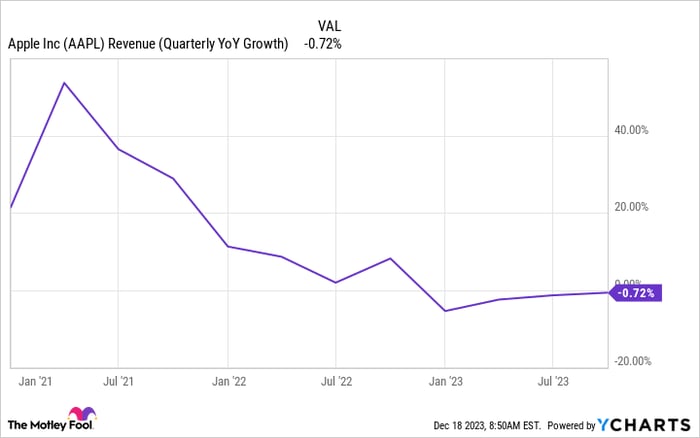

Apple’s turnover largely hinges on consumer disposable income and its recent negative revenue growth is indicative of this, a trajectory unlikely to be reversed soon. In stark contrast, Amazon’s growth is rebounding, particularly in its lucrative Amazon Web Services segment. Visa, enjoying a robust operating margin and net profit margins, continues to grow its profits and earnings, a feat Apple struggles to match in the current economic climate.

The Momentum of Amazon

Amazon has seen a resurgence in its growth as 2023 drew to a close, particularly in its North America, international, and Amazon Web Services divisions. Moreover, the company has witnessed significant improvements in its margins and is poised for a year of consistent profits and unprecedented growth in 2024. As Amazon continues to expand its business beyond e-commerce, investors are presented with unparalleled investment potential.

Visa’s Resilience and Profitability

With operating and net profit margins of 66% and 54%, respectively, Visa’s profuse cash conversion from revenue and impressive growth rates are a remarkable contrast to Apple’s trajectory. Furthermore, Visa’s aggressive share repurchasing program fuels its earnings per share, offering investors an enticing prospect amidst a valuation that is relatively favorable compared to Apple.

When analyzing their forward price-to-earnings (P/Es) ratios based on analyst projections, Visa offers a compelling case for investment given the company’s consistent growth and promising valuation. Its appeal in comparison to Apple’s valuation presents an opportune moment for investors.

Amidst these considerations, one might wonder about Amazon and Visa’s meteoric rise as top investment prospects. The buoyancy of their businesses and the potential they hold make them prime targets for investment in 2024, overshadowing the prospects of an investment in Apple.