Back in 2023, a remarkable revelation unfolded as Ford’s CEO, Jim Farley, and CFO John Lawler embarked on a test drive in a Chinese-made electric SUV. Lawler’s candid exclamation, “Jim, this is like nothing before. These guys are ahead of us,” struck a chord, unveiling a shocking truth. While this revelation didn’t dent Ford’s share price significantly, the stock managed to edge up slightly in the final moments of Tuesday’s trading session.

Behind the wheel of a Changan Automobile electric SUV, both Ford executives were left awestruck by the experience. Changan, in partnership with Ford, showcased a ride that exuded both smoothness and an uncanny silence. However, the plot thickened as Farley’s trip to China in May prompted him to dub the country’s electric vehicle market as an “existential threat.”

Despite Farley’s ominous declaration, one might wonder if he missed the accounts of Chinese electric vehicles painted in snow, resembling useless ice sculptures. Reports also surfaced of electric cars enduring only “half-range” during harsh Chinese winters, potentially prompting Farley to reevaluate his stance.

An Impressive Innovation: The Mustang GTD

While the specter of Chinese electric advancements looms large, Ford’s traditional prowess in gas-powered vehicles remains robust. Enter the latest addition to their lineup, the Mustang GTD, hailed as a monumental leap in capability. Described as “the fastest Mustang ever,” this new entrant boasts Ford’s revolutionary “dry-sump oil system,” a feature unprecedented in any Ford vehicle. With the engine’s capability to rev up to 7,650 RPM, the 5.2-liter V8 engine churns out a staggering 815 horsepower and 664 foot-pounds of torque, outperforming even a Porsche 911 GT3 RS in horsepower per liter.

Investor Outlook: Is Ford a Promising Pick?

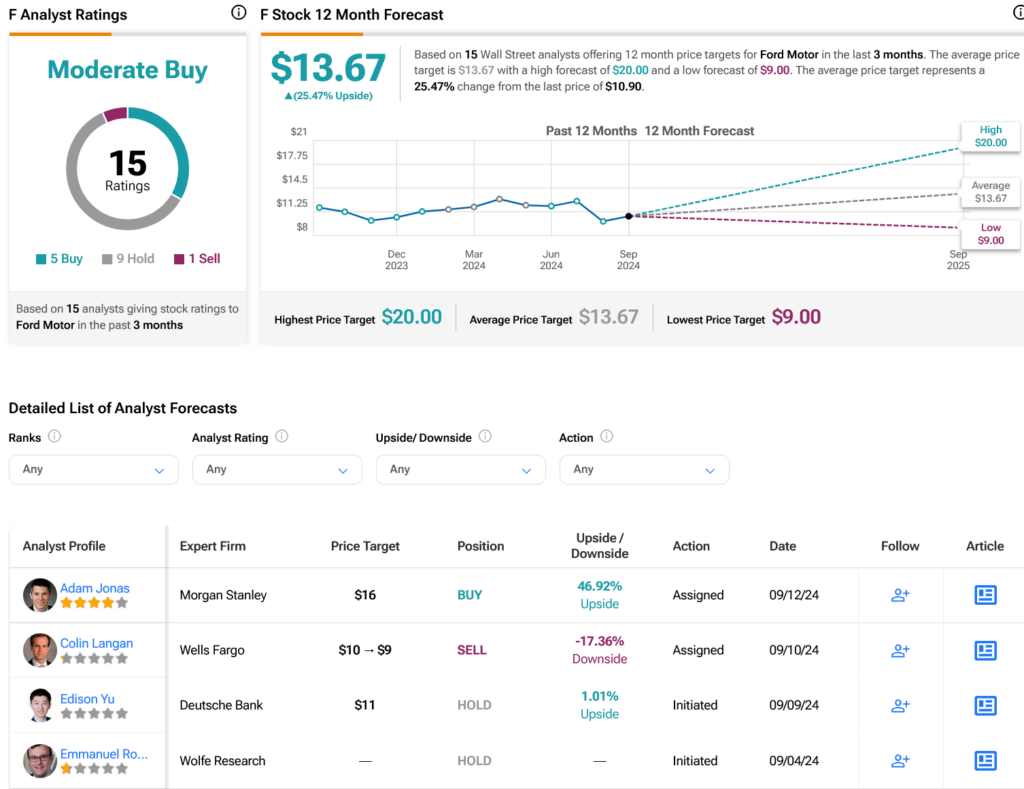

Shifting focus to Wall Street sentiments, analysts maintain a Moderate Buy consensus on F stock, comprising five Buy ratings, nine Holds, and a lone Sell over the past quarter, as depicted in the graphic below. Despite a 5.39% dip in share price over the past year, with an average price target of $13.67 per share, there’s a promising upside potential of 25.47% to be gleaned.

Explore more F analyst ratings here.