Once upon a recent past, Ford, alongside its companions in the veteran automaker realm, braved strikes orchestrated by the United Auto Workers – a skirmish eventually settled. However, emerging reports hint at a potential resurgence of turbulence, with the UAW poised to stage a comeback, a mere year after the initial uproar. Ford investors, though, seemed unperturbed by the news, pushing shares up modestly during the Thursday afternoon trades.

The genesis of this latest strife can be traced back to a tool and die plant pivotal to the Rouge Complex near Detroit. Given that the said plant is a bastion for the production of the F-150 pickup, and is one of a measly two such establishments, any disruption in its operations could deal Ford a significant financial blow.

A strike ultimatum has been set for the stroke of midnight on September 25, 2024. This deadline coincided with UAW President Shawn Fain’s proclamation of imminent strike authorization ballots. The crux of the matter seems local, with reports indicating that the union is advocating for, “…job security, wage parity for Skilled Trades, as well as work rules.”

New In-Car Entertainment Option on the Horizon?

In a bid to lighten the mood, Ford is introducing a novel feature to spice up long journeys – in-car karaoke. The upcoming Stingray Karaoke app will seamlessly integrate into the in-dash infotainment system, displaying song lyrics on the screen. With songs spanning a kaleidoscope of genres and lyrics available in 38 languages, the chances of crooning along to your favorite tunes are high.

However, drivers flying solo will have to park to enjoy the sing-along experience, as the system restricts lyric display to park mode. Nonetheless, any passenger can activate the system by scanning a QR code and take the wheel, quite literally, by controlling the karaoke system via their smartphone. This upgrade is undoubtedly going to make self-driving cars even more enticing for those itching to join the musical revelry.

Is Ford a Viable Stock Investment?

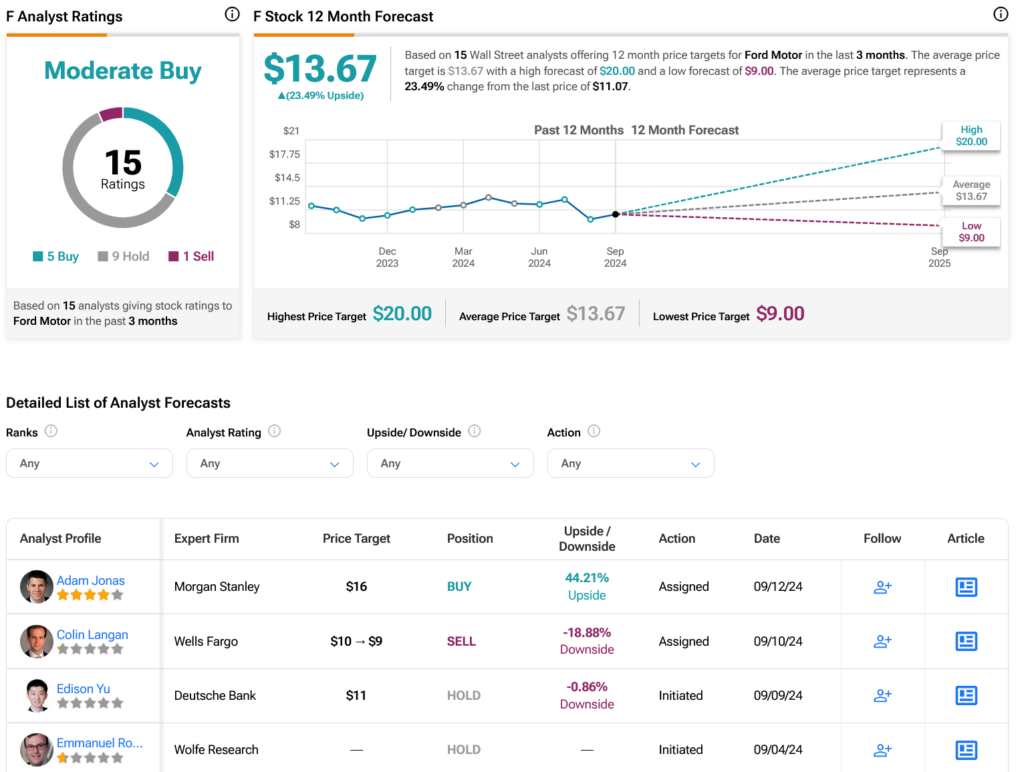

Shifting gears to Wall Street, market analysts harbor a Moderate Buy consensus on F stock, premised on a collage of five Buys, nine Holds, and an isolated Sell rating issued in the trailing three months. Despite a 3.77% dip in its share price over the past year, the mean price target for Ford is pinned at $13.67 per share, implying a lucrative 23.49% upward potential.