Fission Uranium FCUUF has concluded the hearing at the Supreme Court of British Columbia to finalize the approval of its acquisition by Paladin Energy Limited. The court proceedings commenced on Sept. 13, 2024, and concluded on Sept. 26. A verdict on the final order is forthcoming in the next few weeks.

Despite Fission’s shareholders consenting to the acquisition during a special meeting on Sept. 9, 2024, CGN Mining Company Limited, a subsidiary of China General Nuclear Power Corp, continues to contest the acquisition, holding an 11.26% stake in Fission.

The acquisition’s completion hinges on the reception of the final order and clearance under the Investment Canada Act, in addition to other standard conditions.

Reviewing the Merger of Fission Uranium and Paladin Energy

In June 2024, Fission Uranium and Australian mining firm, Paladin Energy, struck a deal. Per the terms, Paladin Energy is set to procure FCUUF’s outstanding shares at an implied total equity value of C$1.14 billion ($0.846 billion).

If successful, the acquisition will lead to the establishment of a company with a pro forma market capitalization of $3.5 billion, positioning it among the largest dedicated uranium enterprises globally. The combined entity will boast a mineral resource of 544 million pounds of uranium and ore reserves of 157 million, along with a robust portfolio of exploration, development, and production assets, and significantly amplified exposure to international capital markets.

Shareholders of Fission Uranium will receive 0.1076 fully paid shares of Paladin Energy for each FCUUF share held. Post-merger, existing shareholders of Paladin Energy and Fission Uranium will hold approximately 76% and 24% of the merged entity, respectively.

Paladin Energy has submitted an application to list its shares on the Toronto Stock Exchange following the transaction’s conclusion. Hence, Fission Uranium shareholders are poised to receive TSX-listed Paladin Energy shares.

Implications of FCUUF Acquisition on Paladin Energy’s Uranium Holdings

Paladin Energy, an independent uranium producer, owns 75% of the esteemed Langer Heinrich Mine in Namibia, known for its longevity and top-tier quality. The company also possesses a collection of uranium exploration and development assets in Canada and Australia. Through Langer Heinrich Mine, it supplies uranium to major nuclear utilities worldwide. With an anticipated mine life of 17 years, the facility boasts an annual capacity of 6 million pounds of uranium.

The acquisition of Fission Uranium will confer upon Paladin Energy full ownership of the Patterson Lake South uranium property. This property, located in Canada’s Athabasca Basin region, is slated to become a high-grade uranium mine and mill. The property’s feasibility study projects a decade-long mine life with an annual uranium production of 9.1 million pounds.

This strategic move positions Paladin Energy to leverage the escalating demand for uranium driven by various factors, such as the burgeoning need for electricity generation and the global shift towards decarbonized electrical grids.

In recent years, the global uranium market has transitioned from being inventory-led to production-driven due to underinvestment in uranium mining operations over the past decade. This trend has created a structural deficit between global uranium production and demand. Forecasts predict a shortfall of more than 66 million pounds of uranium in 2024 and 2025, which is expected to escalate to over 400 million pounds by 2034. Consequently, uranium prices are anticipated to remain sturdy due to robust demand and limited supply.

Assessing Fission Uranium’s Stock Performance

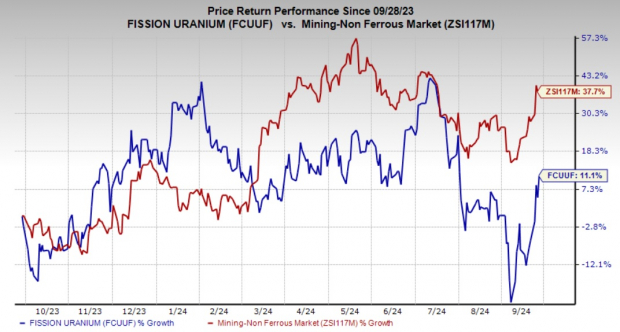

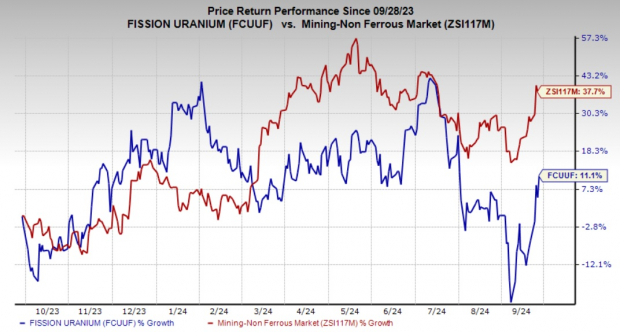

In the last year, Fission Uranium’s shares have appreciated by 11.1%, lagging behind the industry’s growth of 37.7%.

Image Source: Zacks Investment Research

FCUUF’s Zacks Rank & Stock Recommendations

Presently, Fission Uranium holds a Zacks Rank #3 (Hold).

Noteworthy alternatives in the basic materials sector include Carpenter Technology Corporation CRS, Eldorado Gold Corporation EGO, and IAMGOLD Corporation IAG, all currently holding a Zacks Rank #1 (Strong Buy).

The consensus estimate for Carpenter Technology’s fiscal 2025 earnings stands at $6.06 per share, marking a 17% upward revision in the last 60 days. With an average trailing four-quarter earnings surprise of 15.9%, CRS has displayed a 129% increase in share value over the past year.

For Eldorado Gold, the consensus estimate for 2024 earnings is $1.32 per share, reflecting a 16% positive adjustment over the recent 60-day period. Boasting an average trailing four-quarter earnings surprise of 430%, EGO’s share price has surged by 106% in the last year.

Meanwhile, IAMGOLD Corporation is anticipated to achieve 2024 earnings of 39 cents per share as per the consensus forecast, up 44% in the past 60 days. With an average trailing four-quarter earnings surprise of 200%, IAG shares have soared by 160% in the last year.