Data released by the European automobile industry paints a grim picture for new battery-electric car sales in the EU, showing a 12% decline in May compared to the previous year. Within this slump, Germany, as the largest electric vehicle (EV) market in the EU, faced a substantial 30% drop. The woes intensified after Germany terminated EV subsidies prematurely in December, leading to a 16% year-to-date decrease in EV sales, according to the European Automobile Manufacturers Association (ACEA).

Insight into the EU Data Trends

While overall new car sales in the EU bloc registered a 3% dip in May, encompassing a 2.6% decline across the wider EU, Britain, and European Free Trade Association (EFTA) zone, a beacon of hope shines through. A briefing by the European advocacy group Transport & Environment (T&E) suggests that EV sales are poised for a rebound next year in anticipation of new EU car emission standards.

The narrative takes a twist with hybrid vehicles gaining ground, increasing their market share to 29.9% in May, while fully electric cars witnessed a dip to 12.5%. Notably, a cumulative of fully electric models, plug-in hybrids, and full hybrids constituted 48.9% of all new passenger car registrations across the EU in May.

EU Tariffs’ Impact on EV Sales

The recent introduction of high tariffs on Chinese EV imports into the EU threatens to undercut EV sales further, particularly given China’s prominent position as the EU’s primary trading partner. Data from Rhodium Group reveals that China exported €10 billion worth of electric cars to the EU last year alone, doubling its market share to 8%.

Following the tariff announcement, Tesla (NASDAQ:TSLA) foresees the necessity to raise prices on its Model 3 units manufactured in China when the tariffs kick in come July. Notably, Tesla’s EU sales took a nosedive of 34.2% in May.

Is Tesla’s Future Electric?

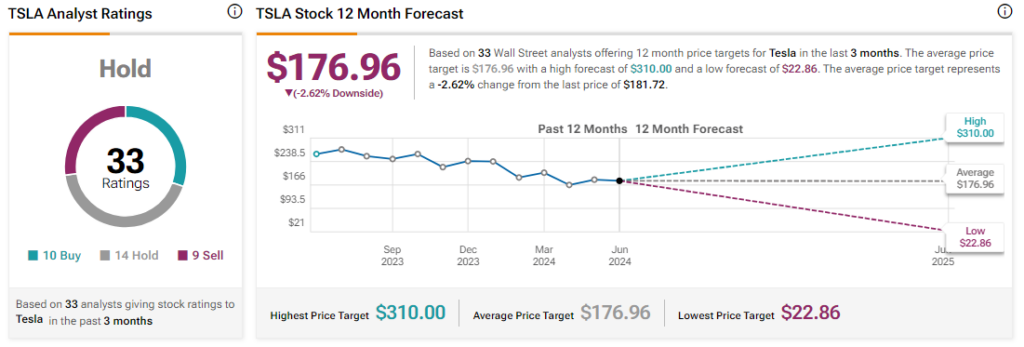

The perplexing question surrounding Tesla’s stock lingers, with analysts largely adopting a cautious stance. Holding a consensus Hold rating premised on 10 Buys, 14 Holds, and nine Sells, Tesla has witnessed a downward spiral of over 30% in the past year. Furthermore, the average price target of $176.96 for TSLA implies a 2.6% downside from current levels.