Editas Medicine, Inc. EDIT registered a loss of 82 cents per share in the second quarter of 2024, which was wider than the Zacks Consensus Estimate of a loss of 69 cents. This marked a significant contrast from the loss of 56 cents per share reported in the year-ago quarter.

The linchpin of the company’s financials, Collaboration and other research and development (R&D) revenues, plummeted to $0.5 million in the second quarter, down from $2.9 million reported in the year-ago quarter. Shockingly, this figure fell short of the Zacks Consensus Estimate of $7 million. The deceleration in revenues was primarily due to reduced drug supply activity with collaborators.

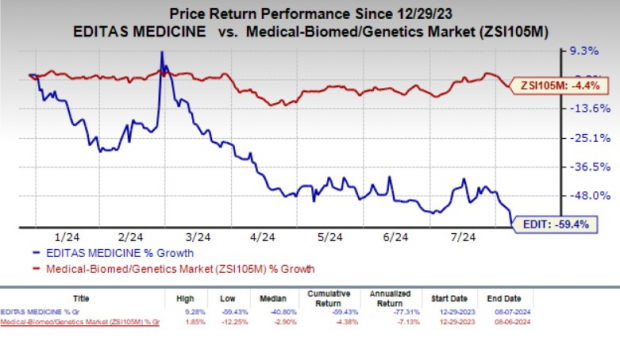

In response to the disappointing results, shares of Editas experienced a 12.2% decline on August 7th immediately following the release of the financials.

Quarter in Detail

Diving into the specifics, R&D expenses soared by a staggering 82% to $54.2 million in the second quarter of 2024 compared to $29.8 million reported in the same period last year. The surge in R&D costs can be explained by elevated clinical and manufacturing expenses attributed to the accelerated progression of Editas’ reni-cel program, alongside costs related to other research endeavors.

General and administrative expenses reached $18.2 million in the reported quarter, marking a 6% increase year over year, primarily due to heightened intellectual property and patent-related fees arising from escalated legal activities.

As of June 30, 2024, Editas held cash, cash equivalents, and investments amounting to $318.3 million, a slight dip from the $376.8 million recorded as of March 31, 2024. The company anticipates that its current cash reserves, combined with the near-term annual license fees and the contingent upfront payment from Vertex Pharmaceuticals, will suffice to finance operating expenses and capital expenditure through 2026.

Notably, in late 2023, Vertex acquired rights to Editas’ Cas9 gene editing tool to develop the approved sickle cell disease gene therapy, Casgevy.

Year to date, Editas’ shares have witnessed a significant downturn of 59.4%, substantially outpacing the industry’s decline of 4.4%.

Pipeline Updates

Notably, Editas does not currently possess any approved products in its repertoire, thus placing primary emphasis on pipeline development.

The ongoing evaluation of the investigational gene-editing medicine, reni-cel (renizgamglogene autogedtemcel, previously EDIT-301), in the phase I/II/III RUBY study for treating Sickle Cell Disease (SCD) remains a cornerstone of Editas’ endeavors.

The company has successfully completed enrollment and continues to administer doses to SCD patients in the adult group of the RUBY study. Similarly, enrollment for the adolescent cohort within the RUBY study has also been wrapped up. Editas remains steadfast in its commitment to divulge substantial data from the RUBY study by the end of 2024.

Additionally, Editas is exploring the utility of reni-cel in the treatment of transfusion-dependent beta thalassemia (TDT). The company has concluded enrollment in the adult cohort and continues to dose patients in the EdiTHAL study for TDT, with plans to release additional clinical data from the study by the end of 2024.

It’s worth noting that Editas disclosed new positive data from both the RUBY and EdiTHAL studies during the reported quarter, showcasing promise in 18 SCD patients and 7 TDT patients respectively. The anticipated data readout from these pivotal studies at year-end is expected to shed further light on the efficacy of Editas’ initiatives.

Zacks Rank & Stocks to Consider

Presently, Editas holds a Zacks Rank #3 (Hold).

Among the more promising stocks in the biotech sector are Annovis Bio and Akero Therapeutics, each flaunting a Zacks Rank #2 (Buy) at present.

Over the past 60 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share remained steady at $2.46. Meanwhile, the estimate for 2025 reflects a slight narrowing from $1.95 to $1.91. Year to date, ANVS shares have endured a 57.1% plunge.

Having surpassed estimates in three of the previous four quarters, Annovis Bio has delivered an average negative surprise of 1.39%.

Recent alterations in Akero Therapeutics’ earnings predictions show a narrowing in the 2024 loss per share from $3.87 to $3.82 over the past 60 days. The 2025 loss per share estimate has remained constant at $4.29 during the same timeframe. In contrast to ANVS, AKRO shares have gained 1.4% year to date.

Akero’s earnings have surpassed estimates once in the last four quarters while falling short twice, yielding an average negative surprise of 5.10%.