Finance Sector Earnings Projections

As earnings season kicks off, all eyes are on the Finance sector. Expectations are high with forecasts indicating a robust +8.3% earnings growth from the same period last year. Revenue is also expected to climb by +5.6%, following a strong performance in the preceding quarter of 2024 Q1.

Positive Signs in Banking Industry

The finance sector is displaying signs of improvement as underlying business trends stabilize. Analysts’ estimates are on the rise, particularly noticeable for Q2, as actual trends in deposits, trading volumes, and investment banking fees have outperformed earlier expectations.

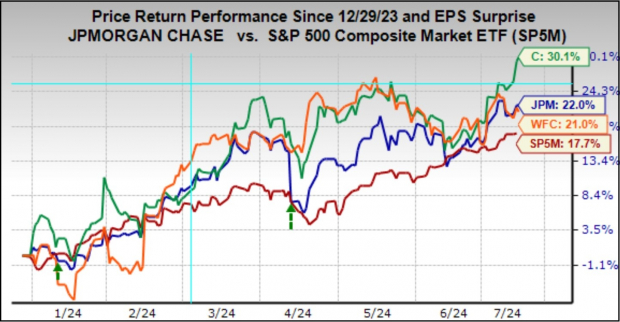

Market Performance of Major Banks

JPMorgan, Wells Fargo, and Citigroup have all showcased positive stock market performance, which reflects the market’s optimism towards these institutions. This surge also signals confidence in management’s efforts.

Market Confidence and Earnings Outlook

Market optimism is further fueled by expectations of the Fed easing monetary policy. These anticipated changes are projected to enhance financial conditions, triggering increased activity in capital markets and credit demands. Management commentary will be closely watched for insights into economic indicators and investment banking trends.

Tech Sector’s Earnings Momentum

The Tech sector continues to impress with its strong earnings projections. Forecasts indicate a solid earnings growth of +15.7% in 2024 Q2, with promising expectations for the full year. Margins in the sector are also on an upward trajectory, further enhancing the positive outlook.

Overall Earnings Landscape

The earnings landscape reveals steady growth, with sectors like Tech, Finance, and Consumer Discretionary leading the way. Earnings growth is attributed to a combination of revenue gains and margin improvements, showcasing a balanced growth trajectory.

Exploring the Next Raging Bull in the Chemical Industry

From the vast expanse of the stock market, 5 seasoned experts at Zacks have each unveiled their top picks projected to surge by over 100% in the upcoming months. Amidst these choices, the Director of Research, Sheraz Mian, singles out a gem bearing the promise of unparalleled growth.

In the limelight stands a discreet chemical company whose stocks have soared by a commendable 65% in the past year, yet languish at a bargain price. Fueled by unyielding demand, estimations point towards a meteoric rise in earnings for 2022. Furthermore, the allocation of $1.5 billion towards stock buybacks adds an enticing allure, inviting retail investors to enter the fray without delay.

This underdog enterprise threatens to outshine or even outstrip recent Zacks’ champions such as the Boston Beer Company, which ascended by a remarkable 143.0% in slightly over 9 months, or NVIDIA, which witnessed a staggering 175.9% surge in the span of just one year.