The Q2 earnings season is hitting full throttle, with a slew of prominent corporations lined up for their quarterly disclosures. The prevailing sentiment points towards another period of robust growth, primarily anticipated in the Tech sector.

Of particular interest in the upcoming week are the financial reports from three major players – Home Depot HD, Walmart WMT, and Deere & Co. DE. Let’s delve into the expectations surrounding these impending releases.

Home Depot: A Mixed Bag of Expectations

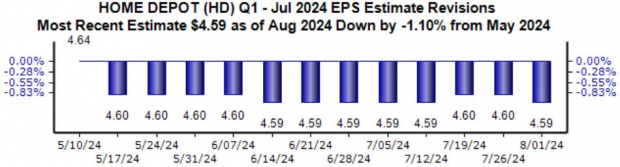

Home Depot’s stock performance in 2024 has been akin to a rollercoaster ride – displaying a 2% increase overall but lagging behind the S&P 500. Analysts have revised downward their projections for the upcoming quarter, with an estimated $4.59 per share, indicating a 1.3% dip from the same period last year.

The company witnessed a 2.8% decline in comparable sales recently, leading to a somewhat subdued market response post-results. However, Home Depot remains optimistic about meeting its yearly targets, relying on its diverse product range to drive sales.

Notably, the persisting weakness in high-ticket discretionary products continues to be a recurring trend, attributed to pre-pandemic demand spikes. Revenue forecasts have remained steady, with a minor 0.8% sales decrease expected. The stock’s current forward 12-month earnings multiple of 22.8X sits above the five-year median.

Walmart: Navigating Growth Amidst Challenges

Walmart’s shares have showcased a commendable performance in 2024, propelled by favorable financial outcomes. The retail giant witnessed a substantial 22% year-on-year surge in earnings in the previous quarter, coupled with a 6% rise in sales.

Market analysts exhibit a positive outlook for the upcoming quarter, with a Zacks Consensus EPS estimate of $0.65 – up by 1.6% over recent months, indicating a projected 6.5% profit growth compared to the previous year. Revenue expectations stand at a solid $168.4 billion.

Walmart’s success story in the eCommerce sector remains a highlight, with a remarkable 21% year-over-year surge in global online sales last quarter. The forthcoming results are expected to further validate the company’s digital prowess.

Deere & Co: Weathering the Storm

Deere’s stock has faced significant headwinds in 2024, plummeting by approximately 11% and notably falling short against the S&P 500. Recent financial disclosures have exerted downward pressure on the shares, reflecting a challenging period for the company.

The last earnings report highlighted a 12% decline in sales, primarily attributed to a softening global demand in the agricultural and turf sector. On a positive note, Deere emphasizes the stability in the construction industry, offering some respite amidst the turmoil.

Analysts have taken a cautious stance for the upcoming release, with the estimated $5.85 per share marking a more than 15% decrease since mid-May. The CEO, however, remains steadfast in the company’s resilience, anchored by consistent performance levels.

Wrapping Up

The Q2 earnings season unfolds with an air of optimism, showcasing predominantly positive outcomes thus far. As we gear up for the upcoming reports from key players like Home Depot HD, Walmart WMT, and Deere & Co DE, the market remains poised for further insights into the financial landscape.