Recent Earnings Trends

Total earnings for the 440 S&P 500 members that reported Q1 results saw a 5.0% increase from the same period last year. This rise in earnings was accompanied by a 4.2% increase in revenues. A substantial number of companies, 78.0%, exceeded EPS estimates, while 60.9% surpassed revenue estimates.

Looking Towards the Future

Projections for 2024 Q2 indicate a predicted 9.2% growth in S&P 500 earnings compared to the same period in the previous year. This increase in earnings is expected to accompany a 4.5% rise in revenues. Estimates have shown a positive trend since the beginning of April, with the current earnings growth forecast of 9.2% exceeding the early April projection of 8.7%.

Yearly Outlook

The full-year 2024 outlook predicts an 8.9% growth in total S&P 500 earnings, following a decline in the previous year. Excluding the influential Tech sector with anticipated earnings growth of 15.9%, the rest of the index is projected to experience a more moderate 6.3% increase in earnings.

The recent weeks have heralded an encouraging trend in overall estimate revisions. The positive momentum is evident both in the Q2 2024 estimates and the annual 2024 projections. Sectors like Tech and Retail have enjoyed positive estimate revisions for some time now, with half of the Zacks sectors showing higher aggregate earnings estimates than predicted at the beginning of the year.

Focus on Energy Sector and ‘Magnificent 7’ Stocks

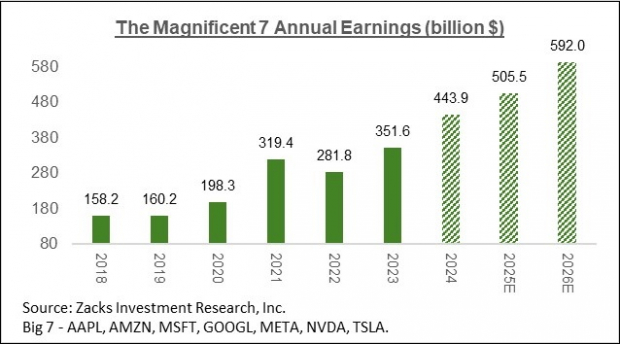

Noteworthy attention has been paid to the Energy sector’s favorable revisions trend. This week’s discussions are set to focus on the evolving earnings outlook for the ‘Magnificent 7’ stocks.

The broader view encapsulates the aggregate annual earnings figures for this distinguished group.

The landscape for earnings revisions has seen contrasting trends for prominent companies such as Tesla (TSLA) and Apple (AAPL). While Tesla has faced consistent negative revisions, the negative impact on Apple’s estimates has been less severe. However, the positive revisions for the other five members are significant enough to counterbalance the effects of Tesla and Apple, with Nvidia (NVDA) notably standing out among them.

An analysis of the sector’s aggregate full-year earnings estimate evolution over the last year showcases a dynamic picture.

Additionally, examining how the S&P 500’s aggregate earnings estimates for full-year 2024 have evolved offers valuable insights.

The holistic earnings panorama for the S&P 500 on an annual basis is depicted below.

Anticipated earnings growth for the current year is expected to be driven by a reversal of last year’s margin declines, with a projected resurgence in net margins to 2022 levels. Notably, the Tech sector is expected to be a primary driver of these gains.

A significant portion of the earnings boost is forecasted to stem from margin improvements, with the Tech sector set to play a leading role in this resurgence.