Emerging Trends

During the Q2 earnings season, a stable and improving earnings outlook has surfaced, offering a comforting depiction of economic realities. However, estimates for the present period are succumbing to weakening momentum at a quicker pace than observed in previous quarters.

Q2 Insights

Total earnings for the index in Q2 are poised to surge by +9.4% compared to the previous year, with a remarkable +5.4% uptick in revenues. This marks the swiftest earnings growth escalation since the robust +10% surge in Q1 2022.

2024 Outlook

Projections for Q3 of 2024 foresee a +4.3% rise in total S&P 500 earnings from the corresponding period last year, accompanied by a +4.6% increase in revenues. Although the quarter commenced with a +6.9% earnings growth forecast, estimates have dwindled significantly since then.

The negative trajectory in Q3 revisions accentuates a more substantial decline compared to the preceding two quarters. Notably, 14 out of the 16 Zacks sectors have witnessed downward revisions, with Energy, Medical, Transportation, and Business Services grappling with the most substantial adjustments.

On the contrasting end, Tech and Finance sectors have observed an uplift in their estimated earnings.

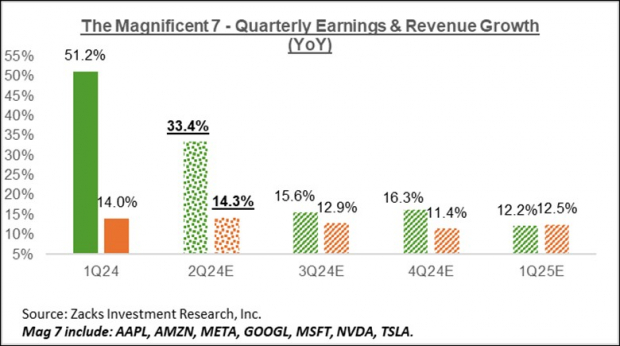

The recent market commotion cast a spotlight on the ‘Magnificent 7’ stocks. Despite most of these companies – Microsoft, Alphabet, Amazon, Apple, Meta Platforms, Tesla, and Nvidia – failing to dazzle investors with their Q2 earnings performances, the escalating capital expenditure directed towards AI projects has raised concerns among market participants.

Market sentiment yearns for a clearer revenue generation path from these AI investments, a clarity that management teams have struggled to furnish.

However, the strategic allocation of capital towards pioneering AI endeavors by major tech giants like Alphabet, Microsoft, and Amazon underscores a visionary commitment towards leveraging untapped business potentials.

Tech Sector Projections

On a broader scale, Q2 earnings for the Tech sector are anticipated to soar by +20.6% from the previous year. The sector’s positive revision streak bodes well, especially since it is forecasted to drive nearly 30% of all S&P 500 earnings in the upcoming four-quarter period.

Moreover, the Tech sector’s optimistic earnings trajectory signals a +17.6% surge for 2024, with a robust momentum anticipated for the subsequent year.

Margin Expectations

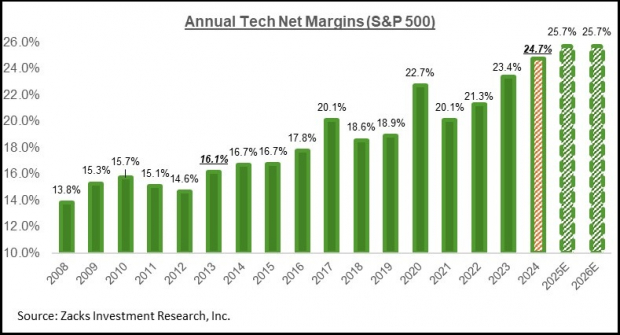

The record-breaking margins in the Tech sector forecasted for 2024 surpass the benchmarks set in the prior year. This uptrend is further expected to continue over the coming years, driven by a growing proportion of high-margin software and services in the sector’s earnings landscape and the palpable benefits arising from AI’s integration into operational frameworks.

The optimistic frontier of tech sector earnings hinges significantly on the margin horizons, as portrayed in the chart below:

Image Source: Zacks Investment Research

Transitioning towards the broader earnings landscape, Q3 of 2024 envisions a +4.3% surge in S&P 500 earnings, accompanied by a +4.6% revenue hike compared to the same period the previous year. As depicted in the chart below, estimates have undergone a modest deceleration amidst a more pronounced downward revision pattern across various sectors.

Image Source: Zacks Investment Research

The convolution of negative revisions infiltrating 14 out of the 16 Zacks sectors accentuates a pervasive deceleration in projections. Noteworthy is the Tech and Finance sectors, which stand out amidst a sea of contracting estimates.

For a comprehensive portrayal of the annual earnings landscape, refer to the charts below:

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Unveiling the Dynamics of Revenue Growth and Margin Gains

Revenue growth, combined with margin gains, serves as the driving force behind financial ascension in the investment realm. It’s akin to a synchronized dance between profitability and expansion. With margin gains being instrumental, different sectors showcase varying degrees of promising outlooks.

Significant Sectoral Shifts Towards Margin Gains

Strategic insights unveil that among the 16 Zacks sectors under scrutiny, 11 are poised for an upsurge in margins by 2024 when juxtaposed with the preceding year. Sectors like Technology, Finance, and Consumer Discretionary emerge as stalwarts, illustrating remarkable margin escalations. This sectoral metamorphosis suggests a landscape primed for profitability and potential investor appeal.