Many of the largest American companies are due to release their earnings next week, infusing the market with critical economic data. Despite the relatively small number of reports, the significance of this upcoming earnings period cannot be overstated.

So far, the earnings season paints a rosy picture, with a majority of companies outperforming both earnings and revenue expectations. However, the real spotlight next week will be on the tech and energy sectors.

The Titans of Tech

The technology sector has been the powerhouse driving overall market performance. The ‘Big 7 Tech Players’ – Amazon (AMZN), Alphabet (GOOGL), Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) are all set to unveil their Q4 results in the coming days. The aggregate Q4 earnings for this group are projected to surge by 38.3%, with revenues soaring by 12.5%, compared to the same period last year.

Analysts and market observers have been quick to point out the expanding influence of mega-cap tech stocks in the S&P 500. Yet, the remarkable sales and earnings growth they continue to achieve is indisputable.

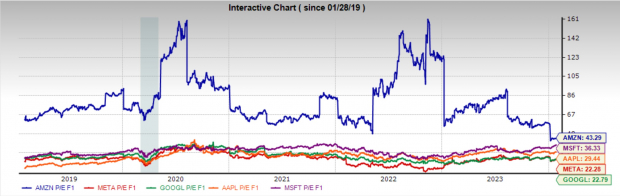

Following the market close on Tuesday, we eagerly await earnings reports from Microsoft (MSFT) and Alphabet (GOOGL), with Apple (AAPL), Amazon (AMZN), and Meta Platforms (META) scheduled to report on Thursday. Despite the recurring chatter about the ‘magnificent seven’ propping up the market, none of these tech giants carry exorbitant valuations, and a couple of them are undeniably attractive.

Valuation Insights

An interesting observation emerges when comparing the valuations of these tech behemoths. Amazon and Microsoft sport the loftiest forward earnings multiples, while Meta Platforms and Alphabet are at the lower end. Meanwhile, Apple falls squarely in the middle. Notably, Meta Platforms and Alphabet are currently trading below their five-year median valuations, and their EPS is expected to grow impressively in the coming years.

Conversely, Microsoft and Apple are trading above their historical valuation averages. Although these premiums are elevated, they remain within reasonable limits. In the case of Amazon, despite its seemingly high valuation, it is actually trading well below its five-year median. The company’s robust earnings growth forecasts further bolster its appeal to investors.

Energy Sector Outlook

Unlike the technology sector, the energy sector presents a sharp contrast in terms of earnings expectations. Struggling with cyclical trends and precipitous declines in oil prices, energy stocks are anticipated to undergo significant YoY earnings drawbacks this quarter.

The prevailing geopolitical turmoil surrounding the Ukraine-Russia conflict has contributed to the fluctuating crude oil prices, which have dipped from the $130 highs to the current $78, occasionally spiking as high as $95. Despite these challenges, the energy sector still offers an intriguing investment proposition, given its resilience in the face of adversity.

As the week draws to a close, all eyes will be on the earnings reports of US oil majors Exxon Mobil (XOM) and Chevron (CVX), set to be disclosed before the market opens on Friday.

Oil and Gas Industry: Valuation and Tailwinds for Exxon Mobil and Chevron

Like the technology stocks, when looking at energy from a historical valuation perspective it is hard to deny the attractiveness. Both Exxon Mobil and Chevron are trading at very reasonable valuations of ~10x forward earnings, easing considerably from the three-year highs near 30x. But they are also below the 10-year medians, which both stand at ~17.7x.

Chevron and Exxon Mobil also both pay hefty dividends of 4% and 3.7% respectively and have structural tailwinds. The structural tailwinds are namely a broad underinvestment in oil and gas infrastructure, which is likely to keep oil supply low for the coming years.

Both Exxon Mobil and Chevron have a Zacks Rank #3 (Hold) rating.

Image Source: Zacks Investment Research

Final Considerations

Final Thoughts

The energy and technology sectors offer two very different outlooks regarding earnings, yet both may be appealing based on valuations. Because they are such critical and leading industries in the country, discerning investors would be wise to hold some mix of the stocks shared.