Vacasa, Inc. VCSA has been facing a tumultuous period recently, marked by significant downward movement driven by intense selling pressure. With a substantial 48.8% decrease in the past four weeks, the stock is currently in a prime position for a potential reversal of this trend. Analysts on Wall Street are increasingly optimistic about Vacasa’s upcoming earnings, further bolstering the case for a turnaround.

Deciphering Oversold Stocks

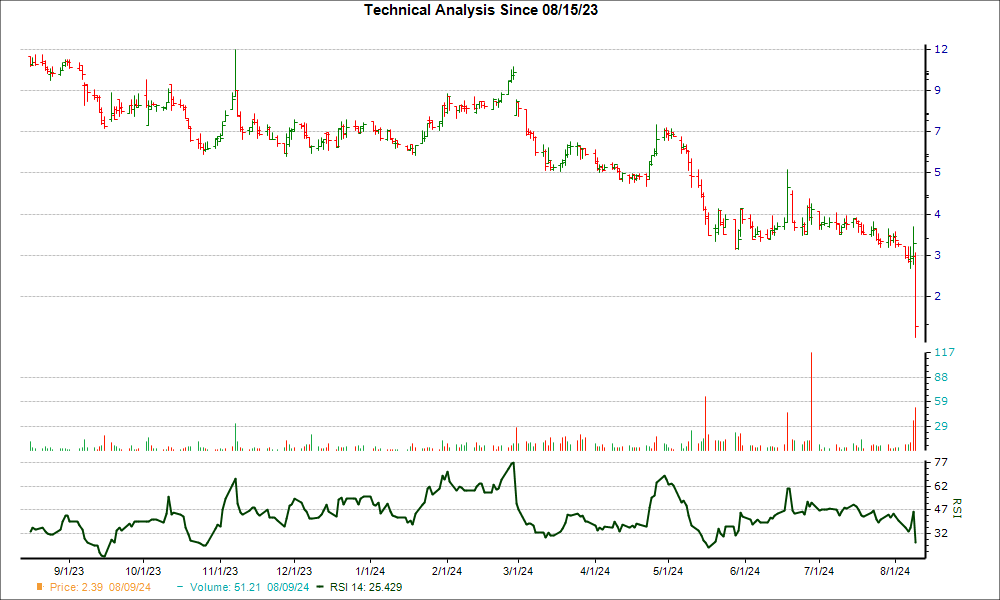

Using the Relative Strength Index (RSI), a widely employed technical indicator, investors can identify instances where a stock may be oversold. The RSI serves as a momentum oscillator, gauging the velocity and magnitude of price changes.

With RSI values oscillating between zero and 100, a stock generally enters oversold territory when its RSI reading drops below 30.

Regardless of a company’s underlying fundamentals, all stocks fluctuate between overbought and oversold conditions. The RSI offers a quick and efficient method to assess whether a stock’s price is nearing a reversal point.

Therefore, when a stock’s price has fallen significantly below its intrinsic value due to unwarranted selling pressure, investors may seek entry points in anticipation of an imminent rebound.

Nevertheless, it is essential to recognize that while RSI provides valuable insights, it should not be the sole factor driving investment decisions.

Potential for a Turnaround in VCSA

With an RSI reading of 28.87, Vacasa’s stock indicates that the intense selling pressure may be waning, potentially paving the way for a resurgence as it aims to re-establish a balance between supply and demand.

Moreover, beyond the technical aspect, there is a consensus among analysts covering VCSA that the company’s earnings estimates for the current fiscal year are poised to outperform initial predictions. In the past month, the projected EPS for Vacasa has surged by 13.4%. Historically, an uptrend in earnings forecasts often translates into near-term price appreciation.

Furthermore, with a Zacks Rank of #2 (Buy), Vacasa falls within the top 20% of over 4,000 ranked stocks based on earnings estimate revisions and EPS surprises. This ranking serves as a stronger endorsement of the stock’s potential for a turnaround in the imminent future.