-

As the fourth-quarter earnings reports flood in, the wave of positive dividend change announcements is catching the attention of investors.

-

Walmart’s announcement of a 3:1 stock split is raising questions about a potential revival of split activities in the market.

-

Overall sentiment appears to be on an upward trend, despite prevailing macroeconomic uncertainties.

Following a substantial chunk of Q4 earnings reports, the aggregate profits of companies seem to have roughly held steady compared to 2022, according to the latest FactSet data. Against the backdrop of rising interest rates, looming inflation fears, and pessimistic projections of a US recession, 2023 was a challenging year in the macroeconomic arena. Additionally, sluggish growth in Europe and various soft indicators in China cast a shadow over the global economy. Nevertheless, corporations have managed to persevere and reward their shareholders.

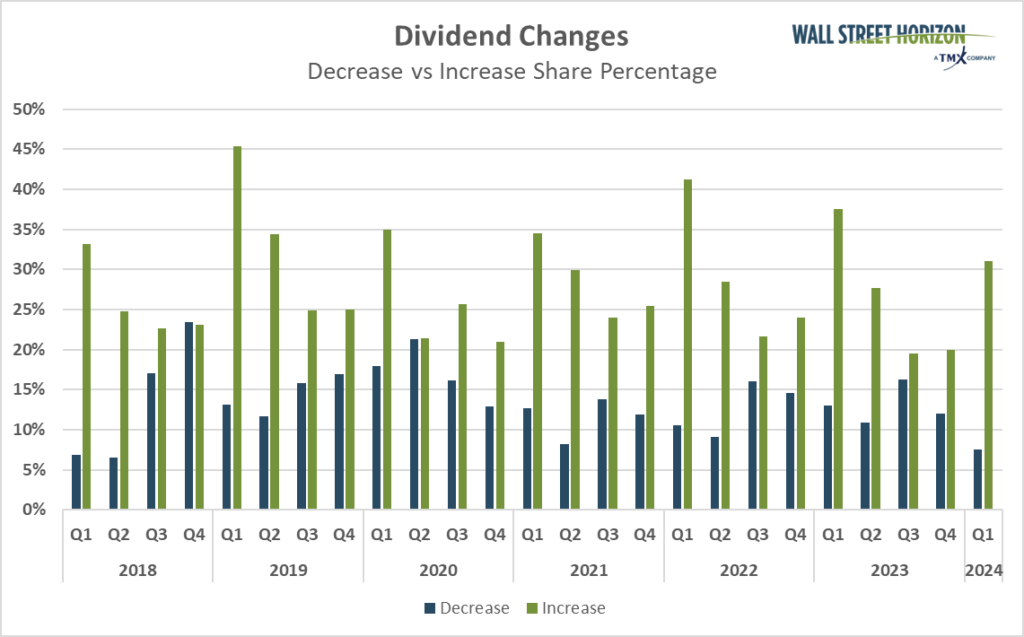

Our observations have indicated a positive trend in the sphere of dividends. Wall Street Horizon has been diligently tracking dividend change announcements from thousands of companies globally for over six years. Although it is early days, Q1 of 2024 seems poised to exhibit the highest ratio of dividend increases to decreases since the first quarter of 2018. Usually, the beginning of the year witnesses the highest number of dividend hikes relative to cuts, aligning with the narrative that companies want to commence the new year on an optimistic note.

A Bullish Dividend Increase-to-Decrease Ratio

As of January, among all companies in the Wall Street Horizon universe of 10,000 companies worldwide, 31% have announced a dividend increase while only 8% have slashed their payout. The ratio of increases to decreases stands at better than 4:1, and if the percentage of decreases falls below 7%, it would represent the lowest quarterly ratio of companies announcing a dividend decrease in over 6 years.

However, it is crucial to note that the latter part of earnings season tends to center more on non-US companies and smaller firms. Given the tighter financial conditions last year, ongoing strength of the US dollar, and overseas volatility, there is a possibility that the ratio of dividend hikes to cuts may decline in the coming weeks. This is a trend that warrants close monitoring.

Dividend Change Announcements Since 2018: A 4:1 Increase to Decrease Ratio

Source: Wall Street Horizon

Nonetheless, this early positive development should hearten the bulls. It further reinforces the narrative of robust US real GDP growth exceeding expectations last quarter, while inflation, by certain measures, has receded to the Fed’s 2% target. Our indicator also serves as a reminder that while the macroeconomic landscape is critical, many of the world’s leading companies are adept at generating profits and cash flow as they reward shareholders through dividends and buybacks.

A Brighter Consumer Sentiment

The more optimistic dividend outlook coincides with an improved consumer sentiment. Recent University of Michigan Surveys of Consumers and the Consumer Confidence survey from The Conference Board have both indicated a noticeable shift in consumer attitudes.

Even during periods of a gloomy economic outlook in 2023, consumer spending remained robust, as evidenced by the Census Bureau’s strong Retail Sales reports throughout the last year, particularly in the latter two quarters. While household budgets might feel tight when settling bills across the country, real wage growth remains positive, and the unemployment rate is hovering not far from multi-decade lows.

Stock Splits: A Fading Trend?

Another trend being closely monitored is how 2024 shapes up in terms of stock splits. From 2021 through mid-2022, stock splits were all the rage, led by prominent entities such as Alphabet (NASDAQ:) (GOOG), Amazon (NASDAQ:), NVIDIA (NASDAQ:), and Tesla (NASDAQ:) following substantial gains from the March 2020 stock market low.

Management teams may opt for a stock split to enhance the perceived affordability for individual investors, improve liquidity to attract a wider investor base, bolster the psychological appeal of their stock, or even augment options trading related to the underlying shares.

A Significant Moment for a Major Retailer

While a resurgence of traditional stock splits among the current market leaders is not readily apparent, Walmart (NYSE:) announced a 3:1 split on January 30, 2024. The split, payable on February 23 to shareholders of record on the 22nd, will commence trading ex the split on Monday, February 26.

Prior to this event, the world’s largest retailer by revenue will be reporting its Q4 figures on Tuesday, February 20, with a subsequent conference call following the release. The retail earnings season is of utmost importance as it spans the crucial holiday shopping period.

Strong Spending, Strong Profits, Higher Dividends?

Last month, the National Retail Federation (NRF) reported a robust influx of consumer spending ahead of and during the holiday season. Total holiday spending surged to a record $964.4 billion, meeting the NRF’s projections despite the aforementioned challenging macro conditions. A robust labor market contributed to the vigorous spending, and this trend appears to be bolstering companies’ bottom lines across various sectors. It is reasonable to infer a correlation with the encouraging dividend landscape reflected in our data.

Investors must remain vigilant for potential disruptors to this positive trajectory. Uncertainties persist regarding the Federal Reserve’s future actions, while geopolitical tensions are casting shadows over crucial segments of the global economy. Moreover, following the substantial upsurge from the stock market lows in October, the bar has likely been raised significantly.

In Conclusion

As we advance into 2024, numerous moving pieces are at play. Earnings reports continue to pour in, and there are encouraging developments on the dividend front. The near-record high ratio of dividend increases to decreases is heartening news, perhaps indicating that CEOs and CFOs feel sufficiently confident to reward shareholders. Moreover, the question remains: Will Walmart kick off a fresh wave of stock splits? This is something we will remain attentive to.