In a bid to bolster its streaming service, Disney (DIS) is set to implement stricter measures against password sharing. The crackdown will commence in June in select regions, expanding broadly by September. This strategic move mirrors the steps taken by competitors like Netflix and Warner Bros. Discovery to regulate password sharing, aiming to drive both subscriptions and revenues.

Following the precedent set by Netflix, which observed a surge in sign-ups post the enforcement of password sharing rules in May 2023, Warner Bros. Discovery announced similar restrictions on its streaming platform, Max, earlier this year. Hulu, another streaming service under the Disney umbrella, initiated restrictions on password sharing across households in March 2024, anticipating a boost in subscriber numbers. Hulu concluded the first quarter of 2023 with 49.7 million paid subscribers, up from 48.5 million in the preceding quarter.

The limitation on password sharing is poised to catalyze subscriber growth for Disney in the forthcoming quarters. Analysts estimate that Disney+ is set to reach 157.13 million paid subscribers in fiscal year 2024, marking a 4.61% increase year-over-year. Earnings are also projected to grow by 22.87% to $4.62 per share.

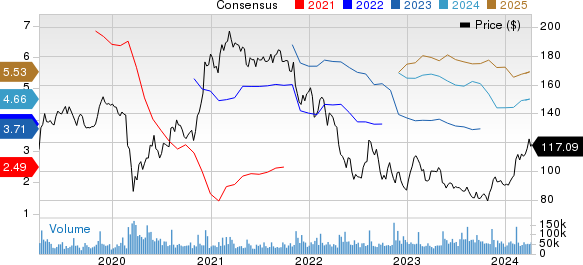

The Walt Disney Company Price and Consensus

Zacks Consensus Estimate for DIS’ fiscal year 2024 paid subscribers on Disney+ stands at 157.13 million, reflecting a year-over-year growth of 4.61%. The consensus earnings estimate is pegged at $4.62 per share, indicating a significant 22.87% increase.

Disney+ Content Lineup Spurs Exciting Growth Prospects

Disney+ has unveiled an array of compelling shows in its lineup, poised to captivate audiences and drive platform engagement. Notable titles such as Doctor Who, The Acolyte, and Ironheart are expected to pose stiff competition to industry giants like Warner Bros. Discovery, Netflix, and Amazon Prime.

The ongoing success of Disney is evident as shares of this Zacks Rank #3 (Hold) company have surged by 29.7% year-to-date, outpacing the modest 3.9% growth of the Consumer Discretionary sector. The strategic introduction of advertisements into its platform is likely to sustain this momentum, fueled by the compelling content lineup.

Disney Branded Television and BBC recently announced the upcoming season premiere of Doctor Who on May 10, exclusively on Disney+. This season promises thrilling adventures through time and space, featuring the Fifteenth Doctor and Ruby Sunday.

The Acolyte, an upcoming sci-fi series on Disney+ set in the Star Wars universe during the High Republic era, is slated for release on June 4. The show portrays Jedi unraveling a series of crimes before the events depicted in the main films.

Ironheart, a new miniseries on Disney+ inspired by the Marvel Comics character and situated within the Marvel Cinematic Universe, entails collaboration with Marvel Studios and Proximity Media. Chinaka Hodge leads as the head writer, promising an immersive viewer experience.

As Netflix maintains its dominance in the streaming sphere with a rich library of original content, upcoming releases such as SCOOP, City Hunter, and What Jennifer Did are set to solidify its market position and attract a wider subscriber base.

Warner Bros. Discovery has unveiled an exciting lineup of blockbuster movies, including Venom 3 and Red One, poised to intensify competition with Disney and drive significant revenue growth.

Amazon Prime, a robust contender in the streaming landscape, is gearing up to launch a series of captivating projects like Música, Fallout, and How to Date Billy Walsh. These shows are expected to resonate with audiences and strengthen Amazon Prime’s foothold in the market.