Let’s take a look at the three Magnificent Seven companies to report earnings so far this week…

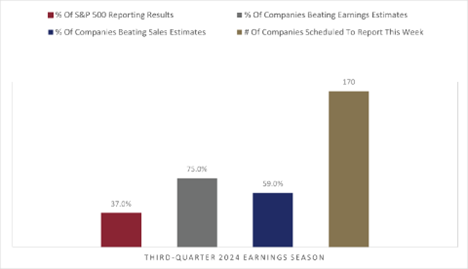

So far, the third-quarter earnings season has been full of treats. According to FactSet, 37% of S&P 500 companies have reported. Of those, 75% have beaten earnings estimates and 59% have beaten sales estimates.

But with 170 S&P 500 companies releasing earnings this week, we’re seeing more tricks than treats. This includes reports from five of the Magnificent Seven: Alphabet Inc. (GOOGL), Amazon.com, Inc. (AMZN), Apple, Inc. (AAPL), Meta Platforms, Inc. (META) and Microsoft Corporation (MSFT).

Now, one member, AI chip leader NVIDIA Corporation (NVDA), reports on November 21. And the other Magnificent Seven stock, Tesla, Inc. (TSLA), reported last week. (We reviewed TSLA’s earnings in last Thursday’s Market 360.)

Wall Street pays close attention to their earnings because the Magnificent Seven stocks aren’t your average tech stocks – they were huge benefactors at the beginning of the artificial intelligence craze. Not to mention that they make up a significant percentage of the S&P 500’s market capitalization.

The big question on Wall Street’s mind is: Are their investments in AI paying off in profits?

So, in today’s Market 360, we’ll dig into Alphabet’s, Meta Platforms’ and Microsoft’s earnings reports. I’ll also share if they are good buys following their results. (We will review Amazon and Apple during your Saturday Market 360, so be on the lookout for that.)

On Tuesday, after the market closed, Alphabet announced results that topped Wall Street’s expectations.

For its third quarter, the company reported earnings of $2.12 per share and sales of $88.3 billion, up from earnings of $1.55 per share and revenue of $76.7 billion. That translates to a 36.8% year-over-year earnings gain and a 15.1% year-over-year revenue boost. Analysts were calling for earnings per share of $1.85 and revenue of $86.22 billion, so the company posted a 14.7% earnings surprise and a 2.4% revenue surprise.

You can see how Alphabet’s third-quarter revenue stacks up against previous quarters in the chart below.

Digging a little deeper into the report… Google’s all-important advertising revenue rose 10.4% to $65.85 billion, topping expectations of $65.5 billion. Meanwhile, YouTube ad revenue rose 12.2% to $8.9 billion. But the shining star comes from Google Cloud revenue, which increased 34.97% year-over-year to $11.4 billion, besting analysts’ estimates.

During Alphabet’s earnings call, CEO Sundar Pichai, stated:

Our commitment to innovation, as well as our long-term focus and investment in AI, are paying off with consumers and partners benefiting from our AI tools.

In Search, our new AI features are expanding what people can search for and how they search for it. In Cloud, our AI solutions are helping drive deeper product adoption with existing customers, attract new customers and win larger deals.

Now, I would be remiss if I didn’t note the issues Alphabet has been facing lately with the Department of Justice (DOJ). Recently, the DOJ won a court case related to Alphabet’s dominance of the search engine market. This essentially ended up with Alphabet being declared an unlawful monopoly. The DOJ is now struggling to figure out whether to break up the company – and if so, how to do it.

In my opinion, the DOJ is now a bit like “the dog that caught the car.” DOJ lawyers have proposed a number of “remedies” to the presiding judge, and it reportedly wants to “futureproof” Alphabet from using AI to maintain its dominance.

The problem, though, is that Alphabet’s search engine remains superior to its competitors. So, I think its monopoly status will persist unless the court does something really drastic. Ultimately, I predict that the DOJ will not be able to successfully break up Alphabet since advertising from Alphabet accounts for the vast majority of its business.

Regardless, none of this impacted its earnings report, and investors still cheered the results, sending GOOGL as high as 7.4% on Wednesday.

I should add that GOOGL has a Total Grade of “C” in Stock Grader right now (subscription required). That makes it a “Hold.” So, if you own GOOGL, I wouldn’t sell it – but I would also look for other opportunities if you are looking to buy.

Meta’s Jump Scare

Meta Platforms released its third-quarter results yesterday afternoon. Revenue increased 19% year-over-year to $40.59 billion, beating Wall Street estimates for revenue of $40.31 billion.

Meanwhile, earnings per share jumped 37% year-over-year to $6.03 per share, up from earnings of $4.39 per share in the same quarter of last year. Analysts were calling for earnings of $5.29 per share.

Facebook’s daily active users rose 5% year-over-year to 3.29 billion, which came in just lower than expectations of 3.31 billion.

Unfortunately, in Meta’s earnings release, CFO Susan Li shared that the company “continues to expect significant capital expenditures growth in 2025,” which spooked investors. Then, during the company’s earnings call, CEO Mark Zuckerberg stated that AI is the big theme for the company right now:

Across Facebook and Instagram, advances in AI continue to improve the quality of recommendations and drive engagement… AI is also going to significantly evolve our services for advertisers in some exciting ways.

Looking ahead to the fourth quarter, Meta now expects revenue to be between $45 billion and $48 billion. That would equate to about a 21.6% improvement from 2023’s fourth-quarter revenue, which was $36.5 billion to $40 billion.

Unfortunately, investors weren’t pleased with this report – especially after Meta raised its capital expenditure estimates for the year to between $38 billion and $40 billion, up from $37 billion to $40 billion previously. As a result, shares of META dropped 4.1% today.

Meanwhile, META has a Total Grade of “A” in Stock Grader, making it a “Strong Buy.” So, if you want to buy on the dip, now may be a good time.

Microsoft’s Tricky Outlook

Microsoft released its earnings report for its first quarter in fiscal year 2025 after the closing bell yesterday.

The company reported earnings of $3.30 per share on revenue of $65.6 billion. That’s up from $2.99 per share and $56.5 billion in the previous year. This translates to 10.4% year-over-year earnings growth and 16.1% year-over-year revenue growth. Analysts anticipated $3.10 per share earnings on revenue of $64.56 billion.

Now, one of Microsoft’s most closely watched divisions is its Intelligent Cloud platform. And the strength in this division was a key driver in the company’s results. Cloud revenue increased 21% year-over-year to $24.1 billion. Microsoft highlighted that Azure and other cloud services revenue was up 33% which came in just above estimates for 32.8%.

In the earnings release, Microsoft CEO Satya Nadella noted:

AI-driven transformation is changing work, work artifacts, and workflow across every role, function, and business purpose. We are expanding our opportunity and winning new customers as we help them apply our AI platforms and tools to drive new growth and operating leverage.

The company also provided forward-looking guidance for the second quarter. Company management anticipates revenue between $68.1 billion to $69.1 billion. The big sticking point here is that Intelligent Cloud revenue is only expected to see revenue of $25.55 to $25.85 billion.

So, even though Microsoft bested expectations and gave good insight into its AI investments, this “light” guidance disappointed Wall Street, and the stock dropped by 6.1% today.

Right now, MSFT earns a Total Grade of “C” in Stock Grader, making it a “Hold.” In fact, that has been the case for much of this year.

More Market Scares Ahead?

Microsoft’s and Meta’s mixed earnings spooked the broader market today; the Dow slipped 0.9%, while the S&P 500 declined 1.9% and the tech-heavy NASDAQ dropped 2.8%. And unfortunately, I don’t think the volatility is done with the market just yet.

The presidential election is now five days away, and we could see some big swings in the market after election day.

However, as investors, that doesn’t mean we can’t use the chaos to our benefit. That’s why I hosted my “Day-After Summit” with The Freeport Society’s Chief Investment Strategist, Charles Sizemore this past week… because my friend Charles believes he has the solution.

By tracking the moves of deep-pocketed Wall Street investors, he can help investors turn the coming volatility into profits.

Charles even gave away a free post-election trade that’s designed to pay off no matter who wins the election. But with election day right around the corner, time is running out to properly prepare your portfolio for the potential post-election chaos.

If you haven’t already, click here now and a replay of our “Day-After Summit.”

Sincerely,

Louis Navellier

Editor, Market360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Microsoft Corporation (MSFT) and NVIDIA Corporation (NVDA)