Artificial intelligence (AI) has been hailed as a transformative force with the potential to reshape society and the global economy. Firms like PwC project that AI could contribute a staggering $15.7 trillion to the global economy by 2030, underlining the immense impact this technology could have.

Leading the charge in AI innovation is Nvidia (NASDAQ: NVDA), whose chips are considered vital components in the industry. Without Nvidia’s technology, AI models would lack the necessary processing power to operate effectively. Nvidia’s dominance in power and efficiency has yet to be rivaled, making it a key player in the AI sector.

Nvidia’s latest offering, Grace Blackwell, has generated significant buzz, with CEO Jensen Huang describing demand for the chips as “insane.” This sentiment was echoed by Foxconn’s CEO, highlighting the immense anticipation surrounding the chip’s upcoming launch.

Nvidia Overcomes Setbacks and Forges Ahead

To maintain its competitive edge, Nvidia has committed to an aggressive yearly update cycle for its chip architecture. Each iteration offers substantial performance improvements, with Blackwell expected to be at least 400% more powerful than its predecessor, Hopper. This rapid pace of innovation creates a formidable barrier for competitors like AMD to overcome, given Nvidia’s significant research and development budget advantage.

Although Nvidia faced a setback with Blackwell’s delayed release due to a manufacturing flaw, the company swiftly addressed the issue. The chip is now set to hit the market in the near future, demonstrating Nvidia’s ability to navigate challenges effectively. While sustaining this aggressive update cadence poses long-term sustainability questions, Nvidia’s proactive handling of the situation inspires confidence in its future trajectory.

Anticipating Blackwell’s Impact and Evaluating Valuation

Nvidia’s collaboration with Foxconn to establish a state-of-the-art production facility for Blackwell chips in Mexico signals a strategic move to enhance manufacturing capabilities and mitigate geopolitical risks. With Blackwell chips already sold out for a year ahead of production, Nvidia’s position in the market appears robust.

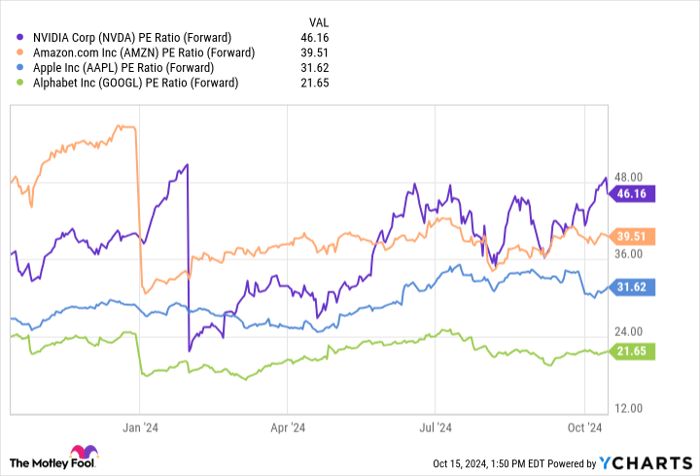

Despite the positive outlook, investors should exercise caution regarding Nvidia’s valuation. While the stock has surged to record highs, the forward price-to-earnings ratio (P/E) of 46 raises valuation concerns, particularly in the tech sector.

Considering Investment Opportunities

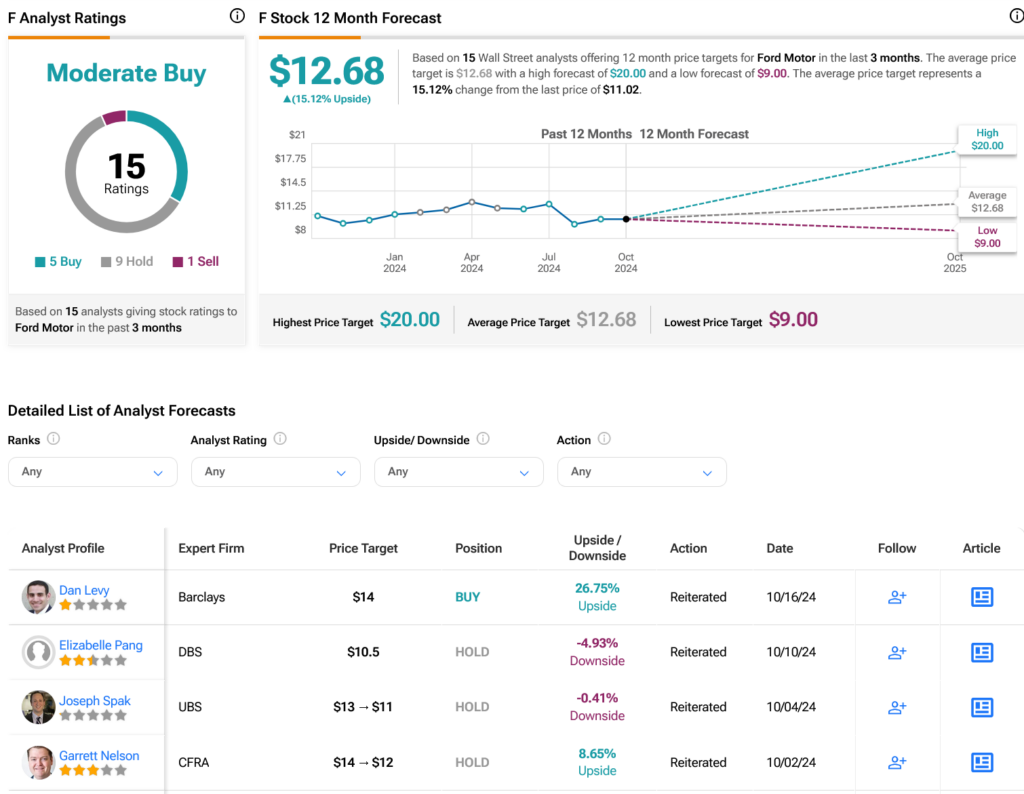

Investors contemplating Nvidia should weigh the company’s growth potential against its current valuation. While the demand for Blackwell chips is promising, prudent investors with shorter investment horizons may opt to observe market dynamics before committing capital. Nvidia’s trajectory post-Blackwell deliveries could offer further insights into the company’s performance and market sentiment.

Reflecting on past investment successes, Nvidia’s exclusion from the recent list of top stock picks by the Motley Fool Stock Advisor team underscores the evolving nature of market opportunities. However, historical data showcases remarkable returns for early Nvidia investors, exemplifying the potential for substantial gains in the tech sector.

Stay informed and vigilant in monitoring Nvidia’s developments, weighing business fundamentals against market trends to make well-informed investment decisions.