Deciphering the Recent Norfolk Southern Options Activity

Big-spending investors are making bold moves, striking a bullish chord on Norfolk Southern (NSC).

For retail traders catching wind of this, it’s a noteworthy development.

The signals emerged vividly on our radar as we parsed through the publicly available options history, painting a telling picture of potential future events.

In this realm of high finance, such sizable moves in NSC often imply an insider’s whisper, a hint of things to come.

So, what has this group of investors just set in motion?

Recently, our gaze landed on 11 unusual options trades for Norfolk Southern, captured by Benzinga’s diligent options scanner.

This anomaly is no run-of-the-mill occurrence.

Analysis of these substantial transactions reveals a split sentiment among these investors, with 54% bullish and a modest 18% being bearish.

Among the unique options in question, there are 3 puts amounting to $172,471, and 8 calls totaling $475,765.

Unveiling the Price Target Perspective

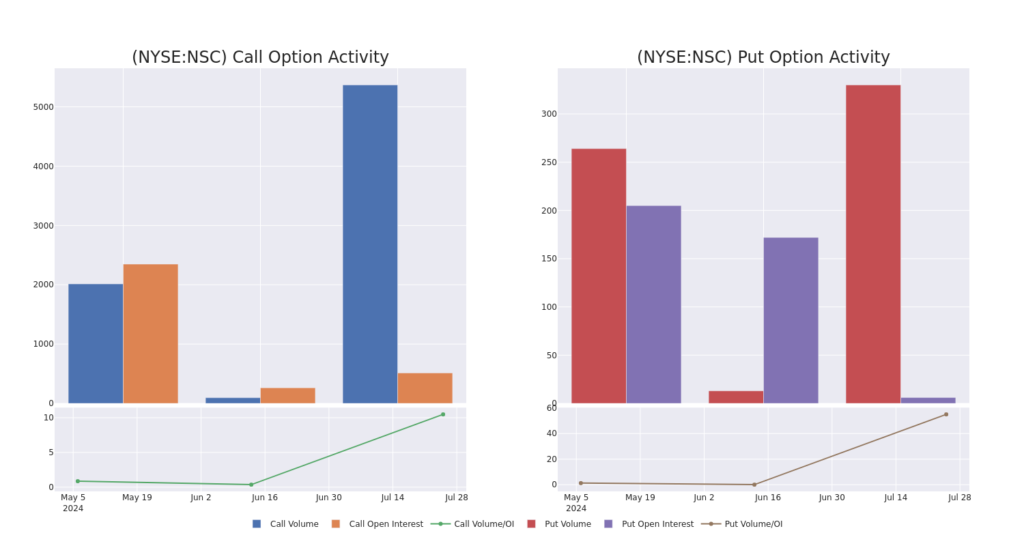

An examination of the recent trading volumes and Open Interest unveils a focal price bandwidth of $225.0 to $240.0 for Norfolk Southern over the past three months.

Insights from Volume & Open Interest Trends

The dynamics of volume and open interest serve as a valuable compass for understanding a stock’s behavior.

This data acts as a mirror, reflecting the ebbs and flows of interest in Norfolk Southern’s options across varying strike prices.

Zeroing in on the past month, we delve into the trajectory of both calls and puts within the $225.0 to $240.0 strike price range, driving insights gleaned from the whale activity on NSC.

Deep Dive into Norfolk Southern’s Option Activity: Last 30 Days

Analyzing the Largest Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NSC | CALL | SWEEP | BULLISH | 08/16/24 | $6.3 | $5.8 | $6.3 | $230.00 | $137.9K | 193 | 220 |

About Norfolk Southern

Engaging in the Eastern United States, Norfolk Southern, a Class-I railroad outfit, navigates over 20,000 miles of terrain, ferrying coal, intermodal traffic, and a mosaic of other goods like automobiles, agriculture produce, metals, chemicals, and forest products.

Evaluating Norfolk Southern’s Current Status

- Amassing a trading volume of 1,002,078, NSC is up by 2.61% at $227.12.

- The RSI indicators throw hints of an approaching overbought state for the underlying stock.

- The eagerly anticipated earnings results are poised for release in the immediate future.

Insights from Analysts on Norfolk Southern

Per recent assessments by three market mavens, the consensus target price for this stock stands at $233.0.

- Stifel’s analyst opts to retain their Hold rating for Norfolk Southern, setting a price target of $239.

- Contrastingly, Morgan Stanley adjusts its rating downward to Underweight, setting a revised price objective of $175.

- Bernstein’s analyst maintains a firm Outperform rating on Norfolk Southern, pegging the target price at $285.

Options trading, like a fierce chess game, places high stakes alongside tantalizing rewards. Skillful players mitigate these risks through continuous learning, adaptation of strategies, vigilant monitoring of various indicators, and a keen eye on market oscillations. Keeping abreast of the latest Norfolk Southern options maneuvers is key via real-time updates from Benzinga Pro.