Digging into the trenches of the financial markets reveals a fascinating story of bullish fervor surrounding Constellation Energy CEG.

This fervor, a tale as old as time in the world of trading, is now pulsating around Constellation Energy’s domain, beckoning retail traders to sit up and take notice.

Today unveiled a glimpse into the possible future when a surge in options activity caught the attention of keen-eyed observers, such as those navigating the waters at Benzinga.

Whether these transactions spring from institutional powerhouses or deep-pocketed individuals remains shrouded in mystery. But when the giants of the trading world shift, it often sets ripples that imply foreknowledge of imminent tectonic shifts.

Today, Benzinga’s radar picked up on 9 significant options trades revolving around Constellation Energy.

This activity, a deviation from the norm, exposed a delicate balance in sentiments – with 55% of the high rollers waving bullish flags while 44% maintain a more somber outlook.

Among the commotion, a lone put, commanding $27,000, stood arm in arm with 8 calls, mustering a hefty $421,165 in defense of convictions.

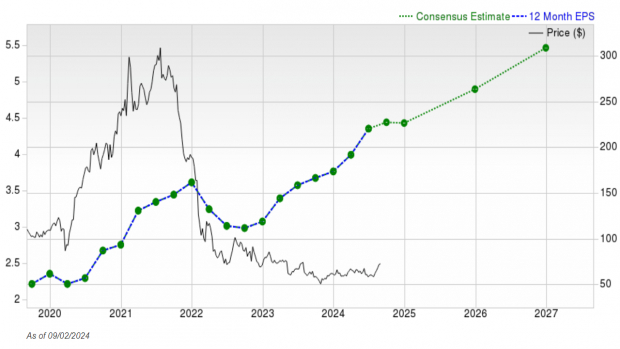

Outlook on Future Price Movements

Navigating the ebbs and flows of Volume and Open Interest across these transactions, it seems the titans of trading have their sights set on a price corridor stretching from $180.0 to $270.0 for Constellation Energy over the past quarter.

Trends in Volume & Open Interest

In the realm of liquidity and interest, the mean open interest for Constellation Energy’s options dances at 231.67, welcoming a total volume of 566.00 revelers.

A visual dive into the fluctuations in volume and open interest of call and put options, particularly within the confines of a strike price spectrum spanning $180.0 to $270.0, over the most recent lunar cycle signals a symphony of activity.

Constellation Energy’s Option Symphony Over the Past 30 Days

Interception of Significant Options Trades:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | SWEEP | BULLISH | 01/17/25 | $7.0 | $6.0 | $7.0 | $270.00 | $119.0K | 16 | 170 |

| CEG | CALL | SWEEP | BULLISH | 07/19/24 | $2.9 | $2.85 | $2.9 | $240.00 | $65.2K | 307 | 4 |

| CEG | CALL | TRADE | NEUTRAL | 05/17/24 | $10.4 | $9.9 | $10.17 | $195.00 | $50.8K | 136 | 90 |

| CEG | CALL | SWEEP | BULLISH | 07/19/24 | $6.0 | $5.8 | $5.9 | $220.00 | $47.7K | 147 | 81 |

| CEG | CALL | TRADE | BEARISH | 04/19/24 | $11.5 | $10.0 | $10.2 | $180.00 | $38.7K | 356 | 2 |

A Glimpse at Constellation Energy

Encompassing a realm of energy solutions, Constellation Energy Corp serves as a beacon, offering sustainable energy solutions to a myriad of entities ranging from homes and businesses to the public sector and community aggregations.

Embracing a comprehensive energy portfolio, the company unfurls a tapestry of pricing options spanning electric, natural gas, and renewable energy products catering to entities of every caliber.

Having delved into the stirring whirlpool of options activity defining Constellation Energy’s narrative, the spotlight now shifts to the company’s intrinsic performance.

Present Market Compass of Constellation Energy

- Trading volume snuggles at 3,130,440, with CEG’s value dipping by -0.33%, perched at $182.5.

- RSI signals portray the stock loitering in a neutral zone meandering between overbought and oversold territories.

- An earnings announcement looms within a 27-day horizon.

Insights from Analysts Regarding Constellation Energy

In a developmental analysis conducted by 4 seasoned analysts over the bygone month, Constellation Energy was bestowed with an average price target of $192.25.

- An oracle from Morgan Stanley clings to an Overweight rating for Constellation Energy, escorting it with a princely target of $193.

- Marching in rhythmic harmony, a sage from Wells Fargo maintains an Overweight stance on Constellation Energy, holding up a target price of $185 like a torch in the dark.

- In sync with a timeless melody, a seer from Morgan Stanley echoes an Overweight refrain for Constellation Energy, swaying to a target price of $193.

- A luminary from Evercore ISI Group preserves an Outperform melody for Constellation Energy, nurturing a target price of $198 like a tender sapling.