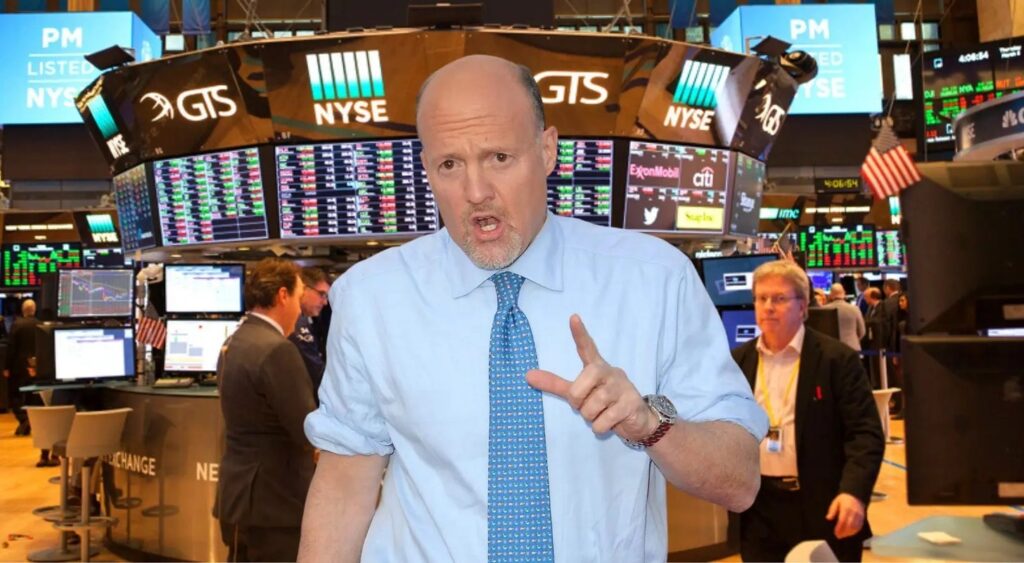

On CNBC’s “Mad Money Lightning Round,” Jim Cramer praised the asset management titan, BlackRock, Inc., encouraging investors to buy shares. Referring to its recent financial performance, he called it “an amazing quarter.”

The Securities and Exchange Commission (SEC) has extended the deadline to pass a judgment on BlackRock’s proposed spot Ethereum exchange-traded fund to March 10.

Cramer expressed hesitancy about Axsome Therapeutics, Inc., indicating a need for further research due to widespread failures in the central nervous system space.

Meanwhile, RBC Capital initiated coverage on Axsome Therapeutics, offering an optimistic outlook and an attractive price target of $126.

Conversely, when asked about SolarEdge Technologies, Inc., Cramer advised against owning it, in a clear contrast to his rave reviews of BlackRock. He likened it to its peer, Enphase Energy, Inc. , as “too hard to own.”

Recently, SolarEdge Technologies announced a reduction of 16% of its workforce in a bid to curtail operating expenses and align its cost structure with market realities. This strategic decision is set to affect approximately 900 employees, with 500 being from the company’s manufacturing sites.

Goldman Sachs analyst Brian Lee maintained SolarEdge Technologies with a Sell rating, and adjusted the price target from $83 to $71.

On the trading front, SolarEdge gained 0.3% to close at $70.44, while Enphase fell 1.2% to $106.83. BlackRock shares observed a 0.6% rise, settling at $790.46, and Axsome Therapeutics faced a 1.3% decline, closing at $90.59.