Microsoft (NASDAQ: MSFT) stock has made fortunes for numerous shareholders over the last few decades. The company’s ascent toward a remarkable $3 trillion market capitalization has been nothing short of awe-inspiring, culminating in its recent overtaking of Apple as the world’s most valuable business. Undoubtedly, riding this wave has reaped substantial rewards, even for those who joined the growth trajectory comparatively later.

The landscape of Microsoft’s business today bears little resemblance to its state 25 years ago, and the ever-evolving tech sphere is certain to undergo further metamorphoses over the next several decades. Nonetheless, the pressing question for investors is whether the stock can continue to yield above-market returns, given Microsoft’s current lofty valuation. Let’s delve into the factors that could position this stock as a positive force in the long-term management of your retirement portfolio.

Market Presence and Diversification

While predicting the dominance of specific tech trends in the industry several years from now remains an enigma, investors can reasonably believe that Microsoft will persist as a leading player amid these future dynamics. The company currently boasts robust exposure across various growth domains, spanning cloud enterprise services, video games, cybersecurity, and artificial intelligence. This diversification significantly augments its appeal to large clientele, who increasingly seek comprehensive software solutions providers.

Sure, investing in a specialist such as cybersecurity expert Palo Alto Networks, which is still in the early stages of its growth narrative, may yield considerably faster growth. The company, known for its potent firewalls and cloud security products, envisages several years of above-average sales surges as more businesses strive to safeguard their digital assets and workflows. However, Microsoft already enjoys a valuable rapport with a majority of the world’s largest enterprises. It is entirely plausible that the software juggernaut can extend its formidable market share in the years and decades ahead.

Financial Strength and Flexibility

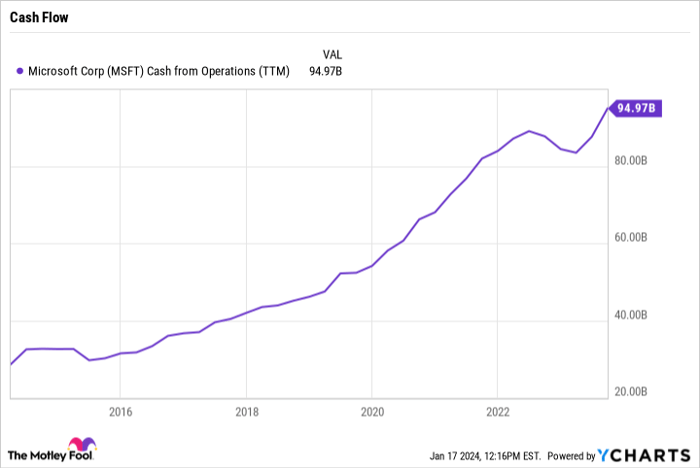

Microsoft’s robust financial position offers a significant competitive edge. With a cash reserve exceeding $140 billion as of late September, and a staggering $30 billion in operating cash flow in the last quarter alone – signifying a robust 26% surge in operating profit year-over-year – the company stands poised for enduring success.

These substantial financial resources bode well for Microsoft. They not only bolster its resilience to withstand market downturns better than its smaller counterparts but also facilitate aggressive investments in technological innovations, particularly within the realm of artificial intelligence. Furthermore, in the event of missed opportunities, Microsoft can judiciously utilize its cash reserves to fund acquisitions or partnerships, thereby sustaining its leadership position in the impending computing era. Such a high level of flexibility is a rarity among most tech companies.

Valuation and Potential

Unsurprisingly, Microsoft’s stock commands a premium valuation, reflective of the aforementioned key advantages. Investors must shell out over 13 times the annual sales for its shares, a figure not far from the pandemic-driven peak witnessed in early 2022. In comparison, Amazon stands as a relative bargain, with an equivalent pricing of approximately 3 times revenue, albeit with less lucrative profit margins compared to Microsoft.

Undoubtedly, Microsoft’s lofty valuation and market capitalization will inevitably constrain future returns for investors. Nevertheless, the stock still has the potential to play a pivotal role in a retirement portfolio aiming to surpass the $1 million milestone. Microsoft investors can anticipate the company steering the imminent technological shifts while leveraging its entrenched position within the vast global software industry. In essence, the tech behemoth stands a strong chance of minting additional millionaire shareholders in the forthcoming decades.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors.