Tech stocks have dominated the stock market over the last decade and are poised to do so for another decade.

The emergence of generative artificial intelligence has opened a new frontier in technology, and cloud infrastructure companies are ramping up spending in the process.

One steady winner in the tech sector has been digital advertising. Alphabet and Meta Platforms, the two leading ad platforms, have been big winners, and advertising has also become a major profit driver at Amazon.

Another winner that’s not as well known as those “Magnificent Seven” stocks above is The Trade Desk (NASDAQ: TTD), the leading independent demand-side platform (DSP). The Trade Desk provides a self-serve, automated, cloud-based platform, enhanced by artificial intelligence (AI), that helps advertisers and agencies manage their ad campaigns. The company has asserted its leadership of the industry through superior technology and a wide network of relationships with advertisers and platforms.

It’s also introduced Unified ID 2.0 (UID2), which has become the leading cookieless tracking program, providing an alternative for companies that want to protect user privacy.

So will The Trade Desk set you up for life? Let’s take a look at what the company has to offer.

Image source: Getty Images.

An impeccable track record

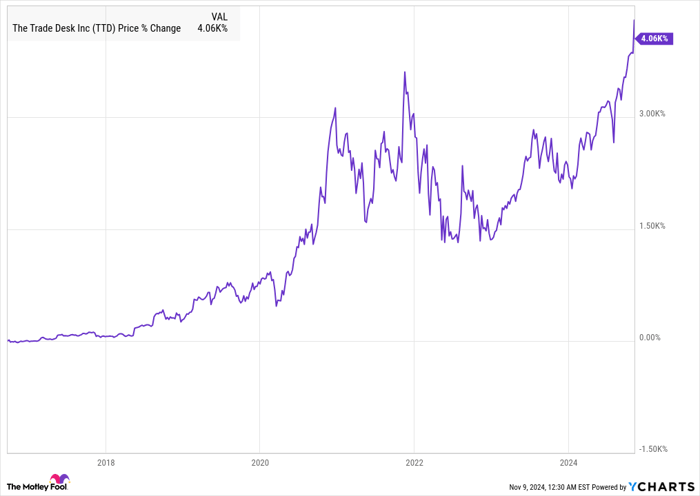

On the stock market, winners tend to keep winning, and The Trade Desk is no exception, as you can see from the chart below.

The Trade Desk is up more than 4,000% in less than a decade, and with the exception of volatility during the pandemic, its gains have been pretty steady.

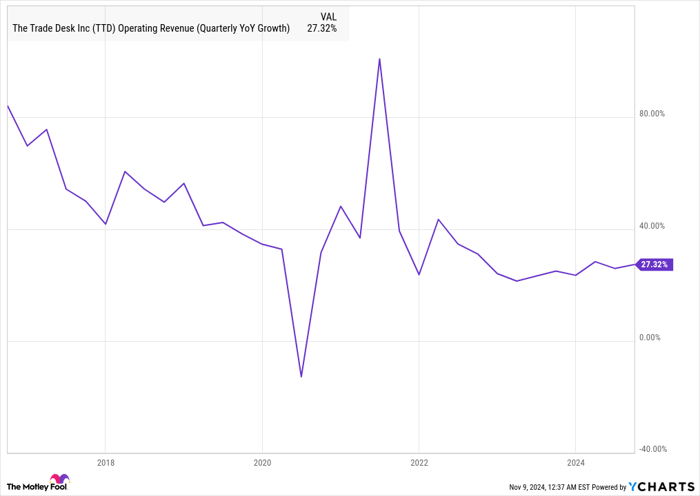

Additionally, its revenue growth has been strong throughout its history as a public company, as you can see from the chart below.

TTD Operating Revenue (Quarterly YoY Growth) data by YCharts

With the exception of the pandemic again, The Trade Desk’s revenue has grown by 20% or more every quarter since its IPO, and the company shows little signs of slowing, especially as the digital advertising market has bounced back from a lull in 2022 and 2023.

The company just reported 27% growth in the third quarter, and CEO Jeff Green talked up the opportunity in connected TV (CTV), also known as ad-based streaming. That market continues to expand as major platforms sign up new users, and the company just forged a new partnership with Netflix earlier this year as the leading streamer added The Trade Desk to the handful of DSPs it’s working with.

On the bottom line, The Trade Desk also reported adjusted net income of $207 million on $628 million in revenue in the third quarter. It continues to see strong customer retention with a retention rate of 95% or better every quarter for 10 years in a row.

Can The Trade Desk help set you up for life?

If there’s a knock on The Trade Desk, it would be the company’s valuation. It trades at a price-to-earnings ratio of around 200, but even at that price, the stock has a lot of upside potential, especially with its Kokai AI platform unlocking new growth.

The Trade Desk is well ahead of the competition in adtech and should continue to capitalize on growth in CTV, retail media, and other opportunities in digital media as they arise.

Given its valuation, investors may want to buy the stock strategically on dips, but its profitable business model and exposure to a consistently growing corner of the sector should make the stock a long-term winner. With those tailwinds and a track record of standout execution, The Trade Desk has what it takes to set you up for life.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $23,295!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,465!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $434,367!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon, Meta Platforms, Netflix, and The Trade Desk. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Netflix, and The Trade Desk. The Motley Fool has a disclosure policy.