Costco is set to unveil its fiscal fourth-quarter results on Thursday, September 5. Over the past year, Costco’s stock has surged by an impressive 35% to $879, eclipsing the S&P index growth of 18%. In comparison to its retail counterpart Walmart, Costco has soared while Walmart’s stock has risen nearly 50% during the same period.

Costco’s strategic focus on enhancing customer experience and consistent revenue growth has been a key driver behind its success in navigating the volatile retail landscape. The company’s expansion into new markets, including China, positions it for sustained growth in the future. However, with a current P/E ratio of 54, significantly higher than the pre-pandemic levels of 25 to 30, the stock may face challenges in achieving further gains.

Remarkably, Costco has outperformed the broader market for the past three years, with varying returns. While the Trefis High Quality Portfolio, consisting of 30 stocks, has consistently surpassed the S&P 500 annually, Costco’s resilience in generating superior returns has been notable.

With uncertainties surrounding macroeconomic conditions, such as rate fluctuations and geopolitical tensions, there is anticipation about Costco’s potential for robust growth. The company’s revenue forecast for fiscal year 2024 is approximately $255 billion, representing a 5% year-over-year increase.

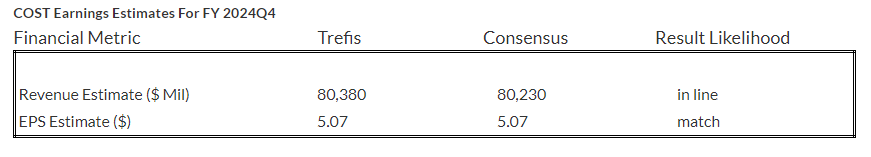

Revenues set to meet Expectations

Trefis projects Costco’s fourth-quarter 2024 revenues to reach $80.4 billion, aligning with consensus estimates. In the previous quarter, the company reported a 9% year-over-year revenue growth, driven by a surge in comparable sales and eCommerce expansion. With a robust 93% renewal rate in the U.S. and Canada, and 90.5% globally, Costco’s membership base continues to be a vital revenue source, enhancing its overall profitability.

EPS on Track with Estimates

In the upcoming quarter, Costco’s earnings per share (EPS) is estimated at $5.07, in line with consensus expectations. The third quarter showcased a 29% increase in EPS, underscored by improved gross margins and substantial growth in membership fees. Moreover, Costco boasts a healthy balance sheet with significant cash reserves compared to its long-term debt.

Valuation Insight

Costco’s projected EPS of $16.32 and a P/E multiple of 52.1x for fiscal 2024 indicate a share price estimate of $850, reflecting current market valuation levels.

Comparing Costco against its industry peers can offer valuable insights into its competitive positioning and growth potential, providing investors with a comprehensive view of the market landscape.

| Returns | Sep 2024 MTD | 2024 YTD | 2017-24 Total |

| Costco Return | -1% | 34% | 542% |

| S&P 500 Return | 0% | 18% | 152% |

| Trefis Reinforced Value Portfolio | -3% | 9% | 714% |

[1] Returns as of 9/3/2024 [2] Cumulative total returns since the end of 2016

Investing insights from Trefis Market-Beating Portfolios can offer further guidance on optimizing investment strategies.