Citigroup recently unveiled its annual report, a hefty 313-page document reminiscent of a voluminous college textbook. As we delve into the landscape surrounding Q1 ’24 earnings, the banking and financial services sector appears robust from a credit standpoint. While regional banks and commercial real estate sectors face challenges, there’s optimism around stable to higher net interest income, contained loan losses, and a regulatory environment tempered by the prospect of Basel III reforms taking a backseat, possibly due to the election year.

Monitoring metrics like credit card losses, particularly for unsecured credit, reveals a promising outlook. In March ’24, major players like Citi, JPMorgan, and Bank of America reported diminished losses for February ’24 credit card portfolios, hinting at resilience in the face of economic fluctuations.

Despite the promising credit card metrics, red flags are far from raised at this juncture.

Citigroup’s Earnings Trajectory:

A notable aspect of Citigroup is the prospect of increasingly favorable comparisons as we progress through 2024. Comparing actual EPS figures for Citi from Q1 ’23 to Q4 ’23:

- Q1 ’23: $2.19

- Q2 ’23: $1.33

- Q3 ’23: $1.53

- Q4 ’23: $0.84

Estimated quarterly EPS for Citi in 2024 stands as follows:

- Q1 ’24: $1.20

- Q2 ’24: $1.49

- Q3 ’24: $1.56

- Q4 ’24: $1.40

While Q1 ’24 poses a tough comparison, the full-year earnings for 2024 are expected to reach $5.70 in EPS, slightly lower than the $5.88 recorded in 2023.

Concerns arise due to consumer banking divestitures in regions like India, Taiwan, the Philippines, and Korea, which may complicate direct year-over-year comparisons for 2023 and 2024 due to lingering “legacy businesses” on Citi’s financial statements.

Analysts anticipate Citi’s upcoming earnings report on April 12th to reveal $1.20 in EPS on $20.4 billion in revenue, signifying a -45% and -5% year-on-year growth expectation, respectively, with a challenging Q1 ’23 comparison for the banking behemoth.

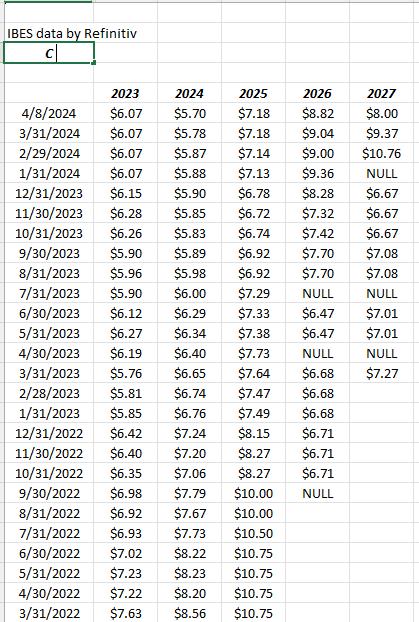

EPS Estimate Adjustments:

Concerns linger as the 2024 EPS estimate experiences a slight decline since December 31, 2023, although projections for 2025 and 2026 showcase upward trends.

Revenue Projections amendments:

Encouragingly, revenue forecasts for 2024 to 2026 exhibit a gradual rise, indicating positive momentum for the banking giant.

Technical Examination:![CitiGroup-Weekly Chart]()

An intriguing observation from a weekly chart perspective reveals Citi’s recurring pattern of surging to $80 levels between 2018 and 2021, only to retreat and stabilize around $40 subsequently. Although currently overbought, a slight pullback to the $50–$55 range could be beneficial.

Relative to the S&P 500 index, Citi’s performance from the mid-2000s has fluctuated, with varying returns year by year.

- 2005: -8% vs +10.19%

- 2010: 5.86% vs 13.49%

- 2015: 5.12% vs 12.85%

- 2020: -1.44% vs 13.77%

- 2024 Q1: 24.11% vs 10.56%

- Performance returns sourced from YCharts

Valuation Insights:

Long-touted by value investors, Citi’s appeal lies in its price-to-book value and price-to-tangible book value metrics, currently standing at 0.65x and 0.75x, respectively – notably economical for a banking giant like Citi.

Citi grapples with a 7% ROE, significantly lower than JP Morgan and Bank of America. Jane Fraser tackles this issue by divesting underperforming segments.

Trading at 9x average EPS per share, Citi anticipates a 15% growth in EPS (3-year average) and 2% revenue growth ahead, boasting a significant multiple discount relative to the expected growth rate. However, the looming concern pertains to the unfolding of 2024.

Conclusion:

Citi’s strong performance in Q1 ’24 compared to the S&P 500 index signals a promising start. While Jane Fraser has taken steps to streamline the business, the spotlight now shifts to generating sustainable returns across Citi’s diverse portfolio of businesses.

The banking sector, particularly investment banking, now constitutes 5% of Citi’s revenue, with Wealth and US Personal Banking commanding a 38% share. The TSS division (Treasury and Securities Services) has consistently contributed 25% to revenue over the past 5 quarters, emerging as a key segment for Citi.

Despite the complexity induced by divestitures and portfolio reshuffling, one can hope for clearer reporting going into the end of 2024.

Clients maintain a 1.2% stake in Citi’s stock, with plans for additional acquisitions at a favorable price point. Positioned as a value play complementing JP Morgan’s momentum, Citi embarks on a transformation journey under Jane Fraser’s leadership, striving to evolve from being merely “cheap on a book value basis” to a bank offering value on a PEG (PE to growth) basis.

As we await what lies ahead, let’s remember – investment decisions carry risks, and past performance does not guarantee future outcomes. Data provided from LSEG and previous IBES data by Refinitiv.

Thank you for your attention.