A wave of wealthy investors, akin to mighty whales navigating choppy waters, have recently embraced a distinctly bearish stance on the telecommunications giant, Comcast

Upon delving into the annals of options trading history for Comcast, with the ticker symbol CMCSA adorning its mast on the NASDAQ exchange, a total of 10 trades were flagged.

A nuanced examination of each trade unveiled that a mere 10% of investors set sail with bullish expectations, while a staggering 70% cast their bearish nets into the speculative sea.

Among the trove of trades uncovered, 2 takes the form of puts, boasting a cumulative worth of $63,354, while 8 sets of calls floated higher, amassing a total of $606,337. An intriguing spectacle, to say the least.

Peering into the Crystal Ball: Projections & Predilections

By meticulously dissecting the Volume and Open Interest of these contracts, a discernible pattern emerges, indicating that the behemoths of the trading realm have set their sights on a price corridor stretching from $35.0 to $47.5 for Comcast during the most recent quarter—a veritable battleground for market forces.

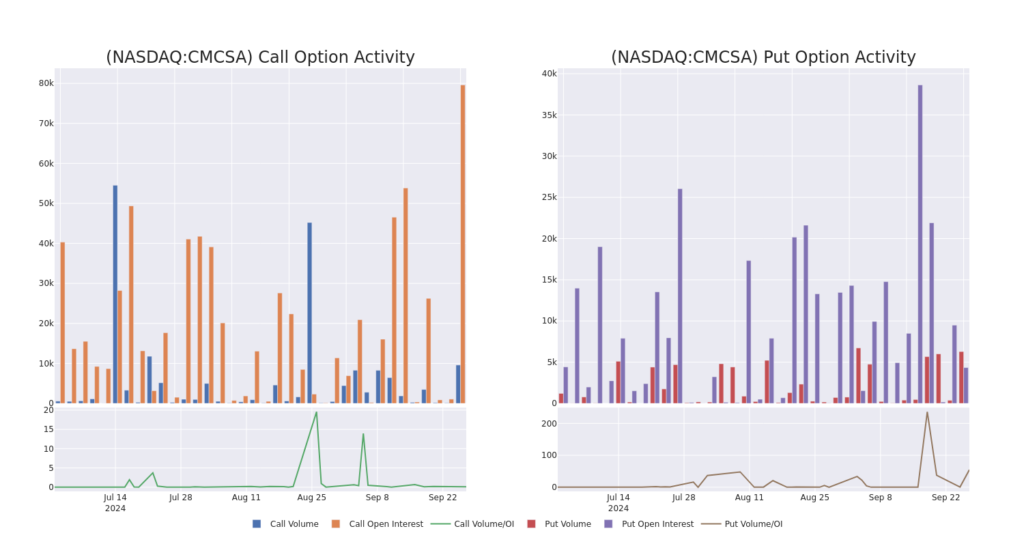

Unveiling Insights Through Volume & Open Interest

An astute investigation into the volume and open interest opens a window into the mystique shrouding stock research, offering a trove of valuable insights. This data is a cornerstone in gauging the liquidity and levels of interest revolving around Comcast’s options at specific strike prices. Below lies a snapshot of the trends in volume and open interest for calls and puts, within the price range of $35.0 to $47.5, spanning the past month.

A Close Look at Comcast’s Call and Put Volume: A 30-Day Glimpse

Spotting the Gems: Major Options Trades Discovered

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMCSA | CALL | SWEEP | BEARISH | 09/19/25 | $8.35 | $8.25 | $8.25 | $35.00 | $171.6K | 4 | 223 |

| CMCSA | CALL | SWEEP | NEUTRAL | 10/18/24 | $2.0 | $1.91 | $1.98 | $40.00 | $103.5K | 7.2K | 2.8K |

| CMCSA | CALL | SWEEP | BEARISH | 01/17/25 | $1.96 | $1.92 | $1.94 | $42.50 | $101.4K | 28.3K | 2.8K |

| CMCSA | CALL | TRADE | BEARISH | 04/17/25 | $1.24 | $1.14 | $1.16 | $47.50 | $58.0K | 1.0K | 1.0K |

| CMCSA | CALL | TRADE | BEARISH | 04/17/25 | $1.24 | $1.15 | $1.16 | $47.50 | $58.0K | 1.0K | 501 |

Decoding the Essence of Comcast

Comcast, much like a multifaceted gemstone, encompasses three distinct facets. The core cable business stands tall, owning networks capable of delivering television, internet, and phone services to a staggering 63 million homes and businesses across the US—an empire that blankets nearly half the nation. Delving into this terrain, it becomes evident that roughly 50% of these locales have tethered themselves to at least one Comcast service. The acquisition of NBCUniversal from General Electric in 2011 further expanded Comcast’s domain, bestowing ownership of coveted cable networks such as CNBC, MSNBC, USA, the illustrious NBC network, the Peacock streaming platform, an array of local NBC affiliates, Universal Studios, and a constellation of theme parks. The acquisition of Sky in 2018 further bolstered Comcast’s portfolio, propelling it into the echelons of a prominent television provider in the UK. Sky’s reach extends to Italy, Germany, and Austria, underpinned by substantial investments in proprietary content, fortifying its market position.

Navigating the Currents: Comcast’s Standing Today

- With a trading volume of 6,485,734, Comcast, signified by the symbol CMCSA, has seen its price surge by 2.0%, anchoring itself at $41.84.

- RSI evaluations hint at a potential bout of overbuying in the stock’s trajectory.

- An earnings release looms tantalizingly close, poised to grace the scene in 34 days.

Can $1000 transmute into $1270 within a mere 20 days?

An options trading veteran, with two decades of experience tethered to their mast, unveils a one-line chart technique that serves as a lodestar, guiding traders on the opportune moments to unfurl their sails and chart a course. Mirroring the trades of this seasoned mariner, which have historically yielded a handsome 27% profit every 20 days, beckons as an enticing prospect. Discover more here for access to this treasure trove of insights.

Options trading remains a realm beset with elevated risks and boundless potential rewards. Adroit traders, akin to seasoned captains of the high seas, deftly navigate these vicissitudes by orchestrating a delicate dance of continual education, adaptive strategies, vigilant monitoring of myriad indicators, and a keen awareness of the undulating tides of market movements. Stay abreast of the latest Comcast options trades through real-time alerts, courtesy of Benzinga Pro.

Market News and Data brought to you by Benzinga APIs