Transformative Collaboration: Warner Bros. Discovery and Charter Forge Bold Alliance

Warner Bros. Discovery Inc WBD and Charter Communications, Inc CHTR unveiled a groundbreaking multi-year distribution partnership aimed at seamlessly integrating linear video services with streaming offerings. The market responded favorably to the announcement, propelling both entities’ stock prices upwards.

The partnership ushers in an era where Warner Bros. Discovery’s coveted premium Max (Ad Lite) service, encompassing all HBO and Max content alongside Discovery+, will be seamlessly accessible to customers subscribed to Charter Communications’ Spectrum TV Select packages, all without an additional cost.

In a pivot that resonates, Charter Communications will now incur an augmented fee to broadcast Warner Bros. Discovery’s marquee channels such as CNN, Food Network, and TBS; a move underscored in a report by the Wall Street Journal.

Furthermore: In the shifting media landscape, insight into Warner Bros. Discovery Stock Performance and Q2 Results.

Noteworthy in this pact, fees for TNT, set to part ways with NBA broadcasts by the end of the 2024-25 season, will remain unchanged, a strategic triumph attributed to Warner Bros. Discovery by sources familiar with the developments as reported by the WSJ.

Max and Discovery+ represent significant growth drivers for Spectrum’s bouquet offerings, injecting an estimated $60 per month retail direct-to-consumer value when bundled with Disney+, ESPN+, Paramount+, AMC+, BET+, and Vix.

In a symbiotic turn, Charter Communications is poised to play a role in marketing and dispensing Warner Discovery’s Max and Discovery+ streaming services, entitling them to a portion of the revenue from newly acquired subscribers.

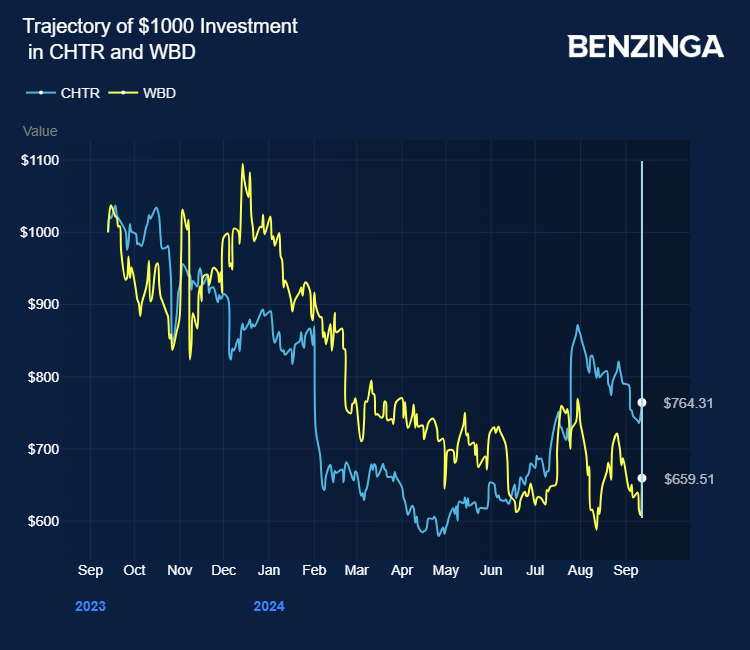

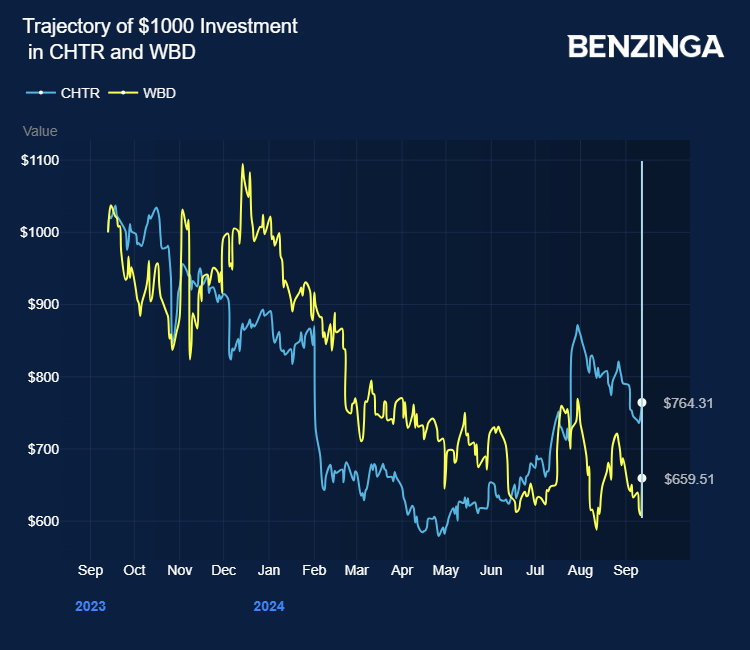

Market Movements: WBD stock is currently soaring by 8.65% at $7.54, with CHTR stock marking a 3.16% uptick, amounting to $337.77 in the latest trading session.

Explore Further: