A Whiff of Success

Williams-Sonoma (WSM) has been simmering in the stock market pot, creating a delightful aroma that has attracted investors far and wide. The Trend Seeker lit a fire under the stock on 2/9, propelling it to sizzle with a 33.35% gain. Like a master chef crafting a perfect dish, the company has ignited the interest of those seeking high-end houseware delights.

Peering into the Pan

The Williams-Sonoma kitchen is stocked with an assortment of products that cater to the desires of the home-oriented consumer. From cookware and electrics to furniture and decorative accessories, the company offers a buffet of choices under various brands like Williams Sonoma, Pottery Barn, West Elm, and more. Since its inception in 1956, Williams-Sonoma, Inc. has established itself as an omni-channel specialty retailer, headquartered in the vibrant city of San Francisco, California.

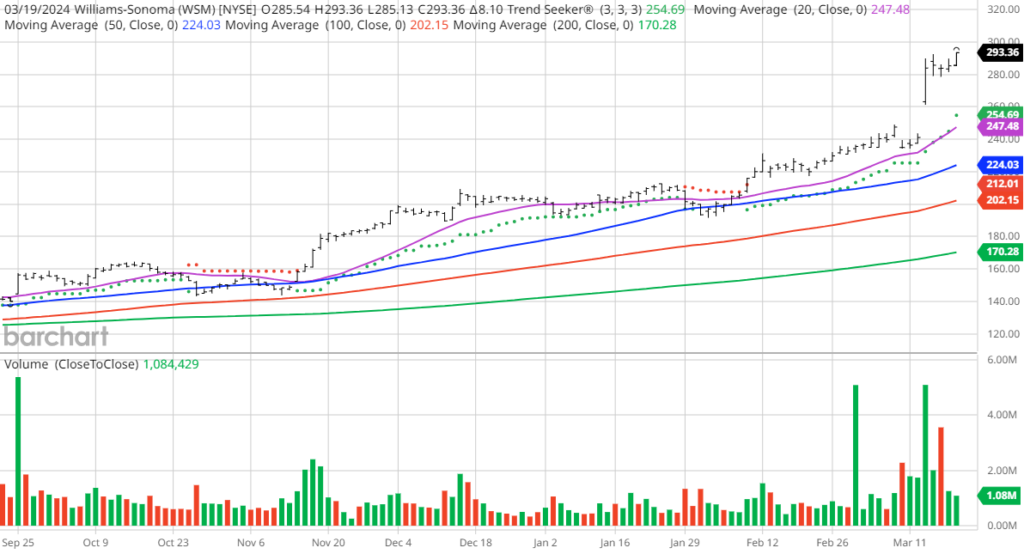

A Taste of Technical Indicators

When we peek into the pot of technical indicators, we find a steaming stew of positive signals for Williams-Sonoma. The stock boasts a perfect 100% technical buy signals, Weighted Alpha of 175.50+, and sits comfortably above its moving averages. With a 151.04% gain in the last year and a Trend Seeker buy signal, investors find themselves salivating at the prospect of continued success.

The Fundamental Recipe

Underneath the glitzy exterior lies a solid foundation for Williams-Sonoma. With a market cap of $18.30 billion, a P/E ratio of 19.10, and a dividend yield of 1.26%, the company flaunts its financial prowess. Revenue projections show a slight dip this year but a promising growth trajectory for the next. Earnings are expected to rise steadily, painting a picture of stability and potential.

Analyst Musings and Investor Sentiment

As we sit at the dining table of analysts and investors, we find a mixed bag of recommendations and sentiments. From strong buys to underperform ratings, the stock stirs up differing opinions. With price targets ranging from $175 to $330, the consensus sits at $272. Individual investors on Motley Fool show confidence in the stock, while seasoned analysts offer varying outlooks. The market’s appetite for Williams-Sonoma seems both fervent and cautious, akin to a diner sampling a new dish with both excitement and restraint.

A Dash of Caution

As we delve into the Williams-Sonoma feast, it’s important to note that the tantalizing aroma of stock market success can quickly turn sour if not carefully managed. The stock’s volatility and speculative nature warrant a cautious approach. Diversification and risk management strategies are recommended to savor the investment journey without getting burnt in the process.