The Transformative Journey of Roku

Despite a tumultuous journey in the bear market of 2022, streaming giant Roku has emerged as a resilient force in the tech landscape. With its dual business model encompassing Platform and Devices segments, Roku has captured the essence of the evolving digital era. The company’s relentless pursuit of innovation and adaptability has led to significant milestones, propelling Roku’s market presence forward.

Roku: Riding the Wave of Streaming Revolution

As the wave of cord-cutting sweeps across households worldwide, Roku stands at the forefront of the streaming revolution. The paradigm shift towards online streaming has created a fertile ground for Roku’s growth, with an increasing number of households embracing streaming services as part of their daily entertainment consumption. With its unique blend of platform services and ad capabilities, Roku is well-poised to capitalize on the expanding market dynamics.

Roku’s astute positioning in the streaming domain, with a focus on personalized ads and aggregated content offerings, sets it apart in a competitive landscape dominated by tech behemoths. As the convergence of video streaming and online ads gains momentum, Roku’s strategic initiatives position it favorably to harness the market’s potential.

Roku’s Financial Fortitude and Valuation Dynamics

While Roku’s recent financial performance showcased a slight dip in gross margins attributed to its Devices business, the company’s resilience shone through its ability to optimize operational expenses and generate positive free cash flow. This financial stability not only underscores Roku’s commitment to sustainable growth but also highlights its prudent strategic direction towards profitability.

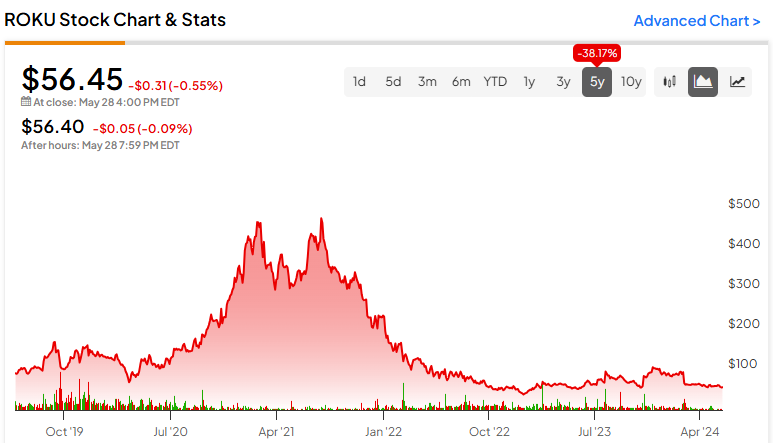

With its stock trading at an appealing valuation of 19.2 times trailing cash flows, Roku emerges as an attractive prospect for investors keen on the streaming industry’s growth trajectory. A comparative analysis with industry peers like Netflix underscores Roku’s competitive positioning and potential for future value appreciation.

Analyst Insights and Market Outlook

The consensus among analysts reflects a positive sentiment towards Roku, with a moderate buy rating supported by predictions of upward trajectory in stock price. The average price target signifies substantial upside potential, hinting at a favorable outlook for investors considering Roku as part of their portfolio.

Unlocking Roku’s Potential: A Forward-Looking Approach

While the prospect of Roku reaching its all-time highs this year may seem far-fetched, the company’s strategic initiatives and market positioning offer a beacon of hope amidst prevailing market turbulence. Roku’s journey towards sustained growth, bolstered by its expanding free cash flow and strategic imperatives, sets the stage for a compelling narrative of resurgence and robust shareholder returns.