The stock of Butterfly Network, under the ticker BFLY, closed a whopping 26.9% higher on Sept. 4, riding the waves of excitement following the announcement of the commercial release of its cutting-edge handheld ultrasound system, Butterfly iQ3, in Europe. This surge comes on the heels of the remarkable reception the device received in the U.S. market post its introduction in February.

European Expansion and Technical Advancements

In March, the Butterfly iQ3 gained its EU MDR certification, ensuring full compliance with the Restriction of Hazardous Substances Directive. Currently available in all European countries including the United Kingdom, the device was successfully launched in Canada during the second quarter. Plans are also underway to seek regulatory approval for iQ3 in additional global regions.

Embodying the apex of the company’s ultrasound technology, the Butterfly iQ3 takes the crown as the most advanced portable ultrasound device in Butterfly Network’s arsenal, surpassing its predecessor, the iQ+. Powered by BFLY’s state-of-the-art P4.3 chip, exhibiting double the processing prowess of the iQ+, the iQ3 boasts unrivaled image quality, novel 3D imaging tools enhancing usability, and a sleeker, more ergonomic design. Moreover, the iQ3’s premium pricing compared to the iQ+ promises to rev up revenue growth.

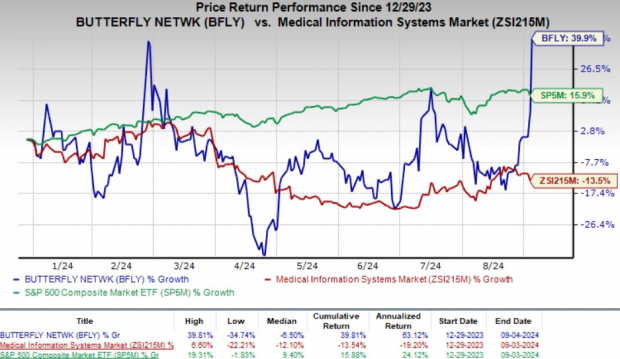

Year-to-date, BFLY’s shares have skyrocketed by 39.9%, dwarfing the industry’s decline of 13.5%, propelled by the escalating adoption of Butterfly iQ3 in the U.S. market. By comparison, the S&P 500 Index has advanced by 15.9% over the same period.

Proliferation in the U.S. Market

During the second quarter, Butterfly Network witnessed a robust 16% surge in top-line growth, predominantly fueled by the robust reception of the Butterfly iQ3 in the U.S. market and additional sales stemming from the Canadian launch. Notably, a staggering 74% of the company’s online orders in the quarter were for iQ3. The iQ3 accounted for 89% of sales across all channels in Canada. Expanding its horizons further, the company initiated a competitive device upgrade in the second quarter, enabling customers to exchange their outdated non-Butterfly products for the cutting-edge iQ3, providing an additional avenue for growth.

Enhanced Patient Care Through Innovative Features

The incorporation of advanced 3D capabilities, namely iQ Slice and iQ Fan, in the Butterfly iQ3 is set to revolutionize image capturing, making the process more seamless. iQ Slice facilitates the capture of up to 46 ultrasound slices concurrently across a wide angle, streamlining and expediting image acquisition without the need for intricate maneuvering. On the other hand, iQ Fan, a dedicated lung tool, minimizes the movements required to gather information critical for informed clinical decisions.

These new features complement Butterfly’s extensive feature suite comprising over 20 anatomical presets, six imaging modes, an array of artificial intelligence, cutting-edge imaging tools, and a comprehensive set of calculation tools.

Aside from its rich feature set, the Butterfly iQ3’s compact and ergonomic design is propelling its rapid adoption in the U.S. and Canada, with the same favor expected in the European markets moving forward. Sporting a 17% smaller probe face and a 7% reduction in size compared to the iQ+, the new device boasts an amped-up battery with up to 2 hours of thermal runtime for uninterrupted scanning and a charging speed that is 2.5 times faster.

These features collectively gear the Butterfly iQ3 to significantly amplify echo image quality and the biplane mode for cannulation, proving immensely beneficial in managing patients with challenging IV access.

Zacks Rank, Market Performance, and Other Medical Stock Picks

At present, Butterfly Network holds a commendable Zacks Rank #2 (Buy).

Other top-rated stocks in the broader medical domain include Boston Scientific (BSX), Apyx Medical (APYX), and Universal Health Services (UHS), each earning a Zacks Rank #2 presently.

Boston Scientific boasts a long-term estimated growth rate of 12.6%, having surpassed earnings estimates in each of the last four quarters, with an average surprise of 7.2%. The company’s shares have appreciated by 41.4% year to date, eclipsing the industry’s 12.3% growth.

Apyx Medical projects a growth rate of 20% for 2025. Although it missed earnings estimates in the trailing four quarters, registering a negative average surprise of 25.98%, the company’s shares have dipped by 49.3% since the beginning of the year, in contrast to the industry’s growth of 12.3%.

Universal Health Services anticipates a long-term estimated growth rate of 19%, with its earnings surpassing estimates in each of the prior four quarters, boasting an average surprise of 14.58%. The company’s shares have surged by 56.1% year to date, outshining the industry’s growth of 48%.