Zacks Rank #1 (Strong Buy) stock PayPal (PYPL) is a payment platform that enables individuals and businesses to send and receive money securely over the internet. PayPal functions as a middleman, connecting users’ bank accounts or credit cards with merchants or recipients to facilitate transactions without disclosing sensitive financial details. PayPal is commonly used for e-commerce purchases, sending money to loved ones, and conducting business transactions conveniently and securely.

The Rise of Venmo Offers a Bright Future for PayPal

Venmo, a digital wallet service under PayPal, has captured the attention of the younger American demographic. It also doubles as a social platform, allowing users to peek into each other’s transactions and add comments or emojis.

In the first quarter of 2024, Venmo witnessed an 8% surge in total payment volume (TPV) compared to the previous year. In 2022, Venmo managed approximately $250 billion in TPV and experienced a 6% year-over-year growth.

Strategic Partnerships Fuel PayPal’s Earnings Per Share Growth

By collaborating with credit card industry giants like Visa (V) and Mastercard (MA), PayPal has significantly expanded its global footprint, roping in millions of merchants and consumers.

Furthermore, partnerships with Alphabet’s (GOOGL) Google Pay and YouTube, along with a collaboration with Chinese e-commerce behemoth Alibaba (BABA), have facilitated seamless payment solutions across various platforms and tapped into the lucrative Asian market.

PayPal Emerges as a Value Investment Opportunity

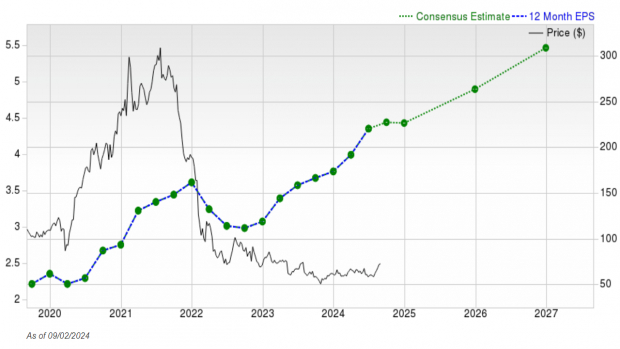

Once a darling during the pandemic, PYPL’s stock price has plummeted from around $300 to under $100 presently. Yet, unlike some pandemic winners, PayPal boasts a sturdy financial foundation. PYPL’s earnings have surpassed pre-drop levels and are anticipated to continue climbing through 2027.

Image Source: Zacks Investment Research

Moreover, PYPL’s forward price-to-sales (P/S) ratio is flirting with 5-year lows, presently standing at just 1.98x compared to its peak of 13.63x. The stock holds a more attractive valuation as opposed to its sub-industry, sector, and the S&P 500 Index.

Image Source: Zacks Investment Research

PYPL Surges Ahead

PYPL shares broke free from a prolonged consolidation phase late the previous month. Even more encouraging are two positive signals evident from the charts:

1) Golden Cross: The quicker 50-day moving average crossed over the longer-term 200-day moving average, signaling bullish sentiments.

2) Support/Resistance Flip: Past resistance levels have transformed into support, and the stock is displaying resilience despite market volatility.

Image Source: TradingView

In Conclusion

The growth of Venmo, robust partnerships, and an attractive valuation make PayPal an appealing investment prospect for the next 6-12 months.