Understanding analyst recommendations is crucial for investors pondering investment decisions. These recommendations from brokerage firms can sway stock prices, but do they hold true merit? Let’s delve into the significance of brokerage suggestions and how they can be leveraged effectively, particularly in light of the views on Vistra Corp. (VST) by Wall Street analysts.

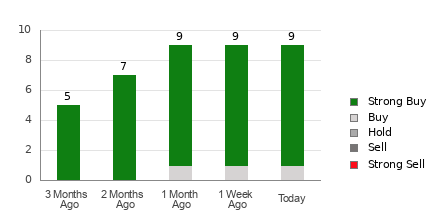

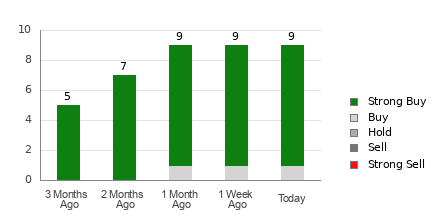

Vistra currently boasts an Average Brokerage Recommendation (ABR) of 1.11, falling between the spectrum of Strong Buy and Buy on a scale ranging from 1 to 5. This metric is the outcome of actual recommendations (Buy, Hold, Sell, etc.) provided by nine brokerage firms, with eight Strong Buy and one Buy recommendation. Notably, Strong Buy and Buy recommendations collectively constitute 88.9% and 11.1% of all endorsements, painting a positive picture for Vistra.

Broker Sentiment Trends Regarding Vistra Corp.

While the ABR view positions Vistra as a buying opportunity, it’s essential not to base investment choices solely on this metric. Research indicates that relying purely on brokerage recommendations may not consistently lead investors to stocks with the highest price appreciation.

Why the skepticism? Analysts at brokerage firms, driven by vested interests, typically exhibit a strong proclivity to rate covered stocks positively. Statistically, for every “Strong Sell” recommendation, there are five “Strong Buy” endorsements. Consequently, their assessments may not always align with retail investors’ interests, offering little insight into a stock’s future price trajectory. Hence, treating this information as a validation tool for personal research or a more reliable price predictor becomes paramount.

Our proprietary tool, Zacks Rank, renowned for its externally validated track record, segments stocks into five categories, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool, rooted in earnings estimate revisions, offers a reliable gauge of a stock’s forthcoming price performance. Thus, juxtaposing the ABR against the Zacks Rank could pave the way for astute investment decisions.

Demystifying Zacks Rank vs. ABR

It’s imperative to discern between Zacks Rank and ABR despite their similar 1-5 scale display.

The ABR emanates solely from brokerage recommendations, depicted with decimals (e.g., 1.28). Conversely, the Zacks Rank operates as a quantitative model predicated on earnings estimate revisions, utilizing whole-number displays from 1 to 5.

Where brokerage analysts’ recommendations tend to exhibit unwarranted optimism owing to inherent biases, Zacks Rank pivots on earnings estimate trends. Empirical evidence strongly correlates short-term stock price movements with earnings estimate alterations, underscoring the reliability of the Zacks Rank.

An essential distinction between ABR and Zacks Rank lies in their currency. While ABR may lack real-time updates, Zacks Rank swiftly assimilates analysts’ earnings estimate revisions, ensuring timeliness in anticipating future stock valuations amidst changing market dynamics.

Is Vistra Corp.(VST) a Lucrative Bet?

The Zacks Consensus Estimate reflects a 1% upsurge to $4.99 for Vistra in the current year, underlining analysts’ burgeoning confidence in the company’s earnings outlook. This optimism, mirrored through consensus EPS estimate upgrades, propels Vistra to a Zacks Rank #1 (Strong Buy).

Given this backdrop, the ABR equivalent for Vistra could serve as a valuable compass for discerning investors.

Infrastructure Stock Boom to Sweep America

A seismic initiative to revamp U.S. infrastructure looms large, promising bipartisan support and massive infrastructural refurbishments. Ride this wave of transformation with precision investments to harness immense wealth creation brought forth by this inevitable tidal wave of infrastructural rejuvenation.

Don’t sit on the sidelines while fortunes are being minted, claim your slice of the pie now by identifying key stocks poised to capitalize on the impending infrastructure overhaul.

Download FREE: How To Profit From Trillions On Spending For Infrastructure

Stay ahead of the curve. Download your copy today.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days and seize the moment!